Elliott Wave: Expect Euro Currency to Continue Downward Trend

We believe the Euro is poised to continue the downward trajectory it began at the start of the year. For traders who work a...

Important Gold Ratio Testing Breakout Resistance!

Precious Metals have been strong this month and have metal heads excited for next year.

One gauge that I use to highlight the strength of...

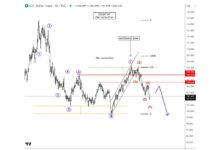

US Dollar Index Elliot Wave Forecast: Targeting 98.00 in 2024

The US Dollar Index has been heading lower as the Federal Reserve hinted that they may be done with hawkish policy and that they...

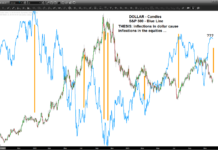

US Dollar Nearing Critical Inflection Point For Equities

I’ve put a rudimentary “count” of the US Dollar below because we need to develop a gameplan for the coming Santa Claus rally or...

Japanese Yen (FXY) Trading At Important Elliott Wave Crossroads

If the Dollar Index makes a significant low near its present area, it would create a favorable environment for bearish trades in paired currencies...

US Dollar Deja Vu? Repeating Bearish Pattern In Play!

Recent weakness in the US Dollar has helped to propel commodities such as Gold and Silver higher.

Today's analysis showing a potential repeating pattern that...

Market Trading Update: A Foray into Currency Pairs

Teaching an old dog new tricks means that the tricks might be new, but the notion of doing tricks is familiar.

Case in point-currencies and...

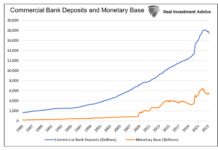

Central Bank Digital Currency (CBDC): Navigating The Pros and Cons

Before you read our thoughts on Central Bank Digital Currencies (CBDC), pull out your wallet and count the cash in it. Then, add any...

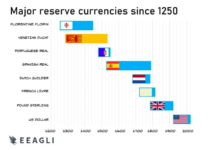

The Dollar’s Death, Not So Fast (Part 1)

Headlines like the ones below lead some to believe that the U.S. dollar’s death may be coming soon.

China, Brazil Strike Deal to Ditch Dollar...

Market Update (April6): Bonds, Euro-Dollar, Metals, Oil and a Stock Pick

In the last few Daily blogs, we have covered a lot!

From the silver to gold ratio, to long bonds to the Euro versus the...