How To Focus On Investment Performance… Without “Chasing”

“Past performance is no guarantee of future results,” or a similar iteration, is likely the most common phrase found among investment disclaimers.

To say...

5 Practices of Mindful Investors

I started a mindfulness routine a couple years ago, during a particularly stressful period in my life. A daily meditation practice was a life...

5 Behavioral Biases That Infect An Investor’s P&L

While the word certainly carries a negative connotation, it is essentially a preconceived opinion or feeling. Sometimes these opinions are based on accurate, objective...

Identifying and Countering Investor Biases

In an ideal world, any important decision we make in life would go through a rigorous and disciplined process, designed to lead us to...

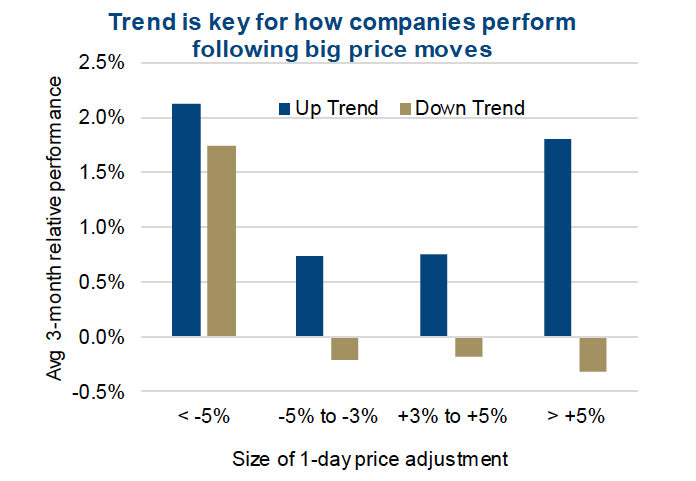

When Markets Overreact: How To Trade Major News and Earnings

Anecdotally, most market practitioners and investors likely believe that the market often overreacts to news.

This happens often around earnings announcements, when a company surprises...

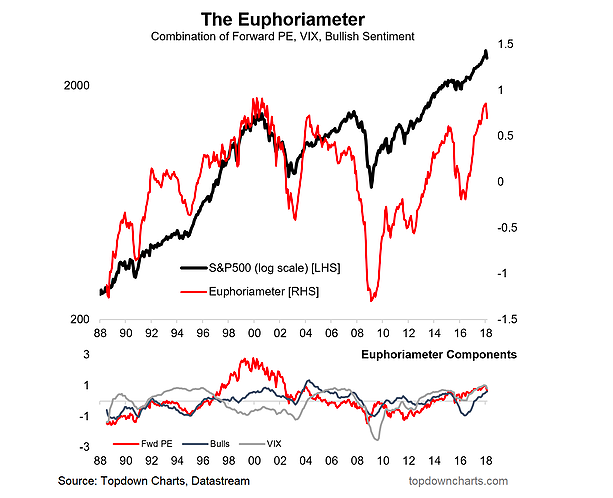

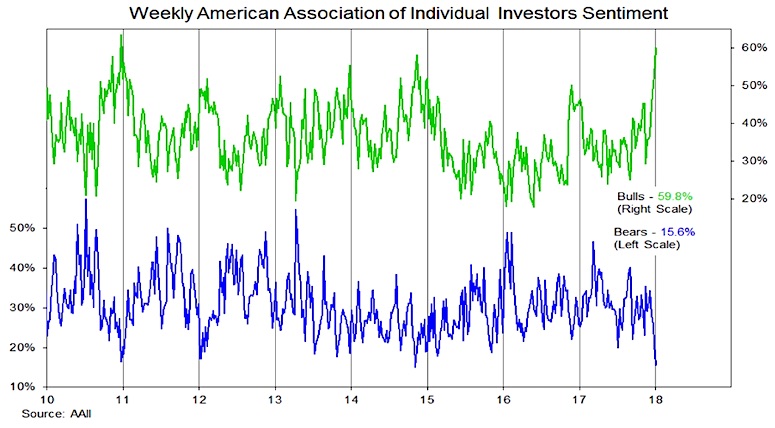

Investor Sentiment Update and Outlook: 5 Charts

The much awaited and widely predicted correction (that no one really ended up predicting) has turned 2 weeks old now, and driven the S&P...

4 Prevalent Investor Biases And How To Manage Them

If you had to analyze every decision you make on a given day, you probably wouldn’t get much done. You might not even make...

S&P 500 Market Outlook: Investors In Celebratory Mood

In this week’s investing research outlook, we discuss current trends and indicators for the S&P 500 Index (INDEXSP:.INX), while checking in on investor sentiment and market...

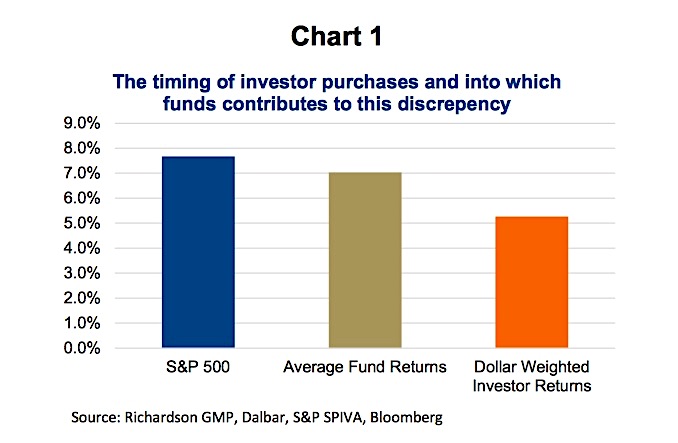

Investors: The Dangers Of Performance Chasing

The most prevalent disclaimer in the investments world goes something like this – “past performance may not be repeated”. If you don’t believe us,...

Behavioral Bias: How Investors Can Profit From It

All investors make errors that can often be traced back to a behavioral bias or emotional mistake.

If under certain circumstances these mistakes are systematic,...