In an ideal world, any important decision we make in life would go through a rigorous and disciplined process, designed to lead us to the answer most likely to be correct or of greatest probability weighted benefit.

This would include assessing all potential options available, the potential outcomes of each option, analyze the consequences including the probability of uncertain events occurring, then make the best decision based on the information available.

Sadly, this type of rigorous decision-making process is rarely used because it takes a lot of time, energy and resources. Instead we tend to be lazy and more often rely on mental short cuts or our ‘gut’ to make decisions. This saves us tons of time and fortunately often leads us to the correct decision, at least most of the time. However, these short cuts can sometimes lead us to make sub-optimal decisions.

Behavioral finance is the study of how we make decisions. It has a special focus on how and when our shortcuts, labeled behavioral biases, are likely to mislead us. This research discipline is gaining more and more attention outside academia, with notable traction in the world of investing.

Investing is really all about making important decisions, with imperfect information, in an uncertain world. In this environment, we would expect the rise of behavioral finance to continue for some time.

Understanding many of the behavioral biases and how they can mislead our decision making process can help avoid, or at least mitigate the risk of making a bad mistake.

Behavioral Biases

There are many behavioral biases that have been identified and researched over the years. Behavioral Economics Guide 2018 identifies roughly 100. Don’t worry, we are not going through them all. However there are some that are more important than others when it comes to investing.

We believe the most important biases are those that have the biggest potential of leading an investor to an incorrect decision and also have the biggest potential negative impact. Some of the more important biases are listed around the brain to the right.

Behavioral biases are evident in all of us. They impacts how we think, process information and make decisions. However the influence of these biases varies from person to person and from situation to situation. When emotions are elevated, many biases tend to become more evident or elicit a stronger influence on decision making. Who you are is also a key determinant of which biases you may be most at risk.

Investors tend to suffer from some, while advisors or financial professionals tend to suffer from others. In the following section we will dive into a few that are common for investment advisors, how they can cause poor investment decisions and some technicques to mitigate or correct the mistakes.

Behavioral Biases Most Evident in Advisors

It should not come as a surprise that behavioural biases differ between investors and those providing professional investment advice. Most investors are only involved in investment decisions on a sporadic basis, potentially when changes are being made to their portfolios.

Most other times they are more focused on other aspects of everyday life. Meanwhile those providing professional investment advice are involved in making financial decisions, research, analysis and monitoring just about everyday given this is their profession. In a later Market Ethos we will dive into the behavioural biases that most impact individual investors such as herd behaviour, performance chasing, status quo bias and loss aversion. Today’s ethos is all about biases most evident in advisors, including Overconfidence, Anchoring and Confirmation biases.

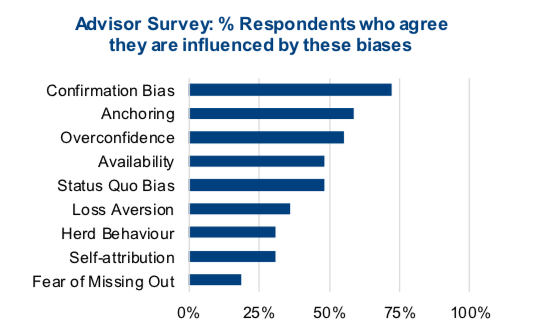

The chart above is a survey of financial professions asked whether they are influenced by certain biases. While survey results should always be taken with a grain of salt as respondents will often answer as they would like to see themselves or how they believe the surveyer would like them to respond, the survey findings actually line up with other research. Those biases near the top of the list are most evident in people actively involved in the investment decision process (advisors) and those near the bottom are more evident in those less involved in the investment decision process (investors).

Confirmation Bias

What it is: This is our tendency to seek out information or views that are aligned with our pre-existing opinion or thinking on a topic. This bias also causes us to ignore or discount contrary views. We do this because it actually makes us happier reading or listening to views that reinforce ours, gives us greater confidence in our beliefs.

Investment Process Risk: Confirmation bias is a serious risk to the investment

decision making process from a few perspectives. Focusing mainly on research or ideas that aligned with our views can lead to increased portfolio concentration, becoming so emboldened that we are right that we continue to add to a theme, industry, stock, etc. It can also cause us to miss a change in market as you often discredit contrary information. As an example: today many believe Amazon will dominate the world. Not questioning the great company, but many thought the same of Xerox in the 1970s, IBM in the 1980s and the four horsemen of the internet in the 1990s.

How to Defend against this bias: The good news is confirmation bias is often easy to spot and we can catch ourselves just by knowing about it. Other tools include considering why or how we may be wrong in our pre-existing views. What could go wrong with a specific investment or strategy and are we able to put a probability on it? Just by doing this excercise actually opens up our minds to contrary opinions.

Another technique it to force ourselves, or someone on your team to make the counter argument. As an example: our asset management team is bullish on the U.S. dollar but we will often task some members to make the opposite argument. This results in a more balanced view and reduces the chance of being materially surprised.

Overconfidence Bias

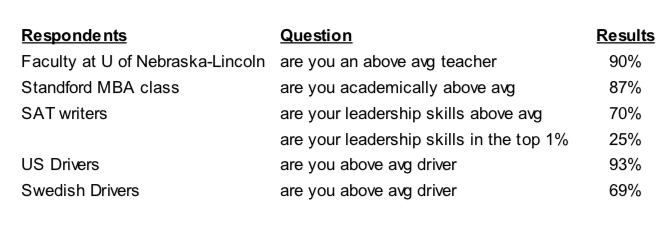

What it is: This a very common bias where people believe their own abilities are greater than their actual abilities. Do you believe you are an above average driver? Not surprising that the vast majority of respondents believe so. This is evident in everything from how people view their work abilities, leadership, their relationships, etc (see table below – survey results source: Wikipedia).

Overconfidence is evident in advisors/portfolio managers in the professional finance industry. They often believe their skills will enable them to pick stocks or funds that will outperform. Most of the evidence refutes this belief.

Charts are sourced to Bloomberg unless otherwise noted.

Twitter: @sobata416 @ConnectedWealth

Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.