How Low Can Natural Gas Prices Go?

I did this research using AI when I asked the question:

Can natural gas producers afford to extract gas if price is below 4?

Whether natural...

Shareholder Meetings Hot Topics: Tariffs, AI, and Farmland

The Q4 reporting period is largely in the books, and results were strong

New macro challenges have emerged that could disrupt bullish trends

Apple (NASDAQ: AAPL),...

Sugar Futures Near Major Price Breakout

On November 7, 2024, I wrote a Daily called Food Commodities Comeback-1st Sugar, Now Soybeans.

Back then I wrote,

It should come as no surprise that I...

Brazil ETF (EWZ): Will Price Dictate Current Narrative?

“Brazilian analysts say the tariffs announced by U.S. President Donald Trump against Canada, Mexico and China could cause a currency-related inflation surge in Latin America's largest...

Are German Government Bond Yields Changing 44 Year Trend?

Interest rates continue to dominate our recent research. And rightfully so. Big swings in interest rates have ramifications for the domestic and global economy.

Whether...

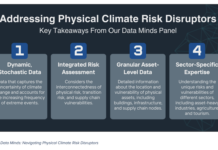

How Climate Change Risks Could Impact Investments in 2025

This year is on track to be the warmest on record. Extreme weather that accompanies a warming planet has also become the new norm,...

German DAX Stock Market Signals Bullish Phase

The DAX is a stock market index consisting of the 40 major German blue-chip companies trading on the Frankfurt Stock Exchange.

The German economy, hit...

Semiconductors (SMH) Bullish Trend Nears Pivotal Crossroads

For much of the past two years, the Semiconductors sector has lead the Nasdaq and S&P 500 higher. Lead by Nvidia, the Semiconductors have...

Nikkei Trading Near 1989 Stock Peak; Double Top?

If you have been investing for 35 years, you likely remember the fervor heading into the Japanese Nikkei stock market index peak. And most...

US Dollar Rally Near Critical Inflection Point!

In a world where the US Dollar still makes the world go round, it's vitally important that investors pay attention to potential pivot points...