The Limitations of Max Pain Theory For Options Traders (into Op-ex)

The Max Pain theory suggests that stock and commodity prices will often move towards specific prices on specific option expiration dates. “Max pain” is the price...

Using Stock Options To Gain Exposure to Real Estate

Not everyone had enough cash or borrowing capacity to buy an investment property.

Those that do have issues with collecting rent, broken toilets, damaged properties...

How To Trade A Poor Man’s Covered Call

Most traders worth their salt have used, or at least heard of covered calls.

Covered calls are really easy to implement and are a proven...

Using Cash Secured Puts To Pick Up Stocks For Less

Getting paid while you wait, I like the sound of that.

A cash secured put is a conservative options strategy that can be used to...

How To Trade An Iron Condor

An Iron Condor is an options trading strategy where the seller of the Iron condor is looking for the price of the underlying security...

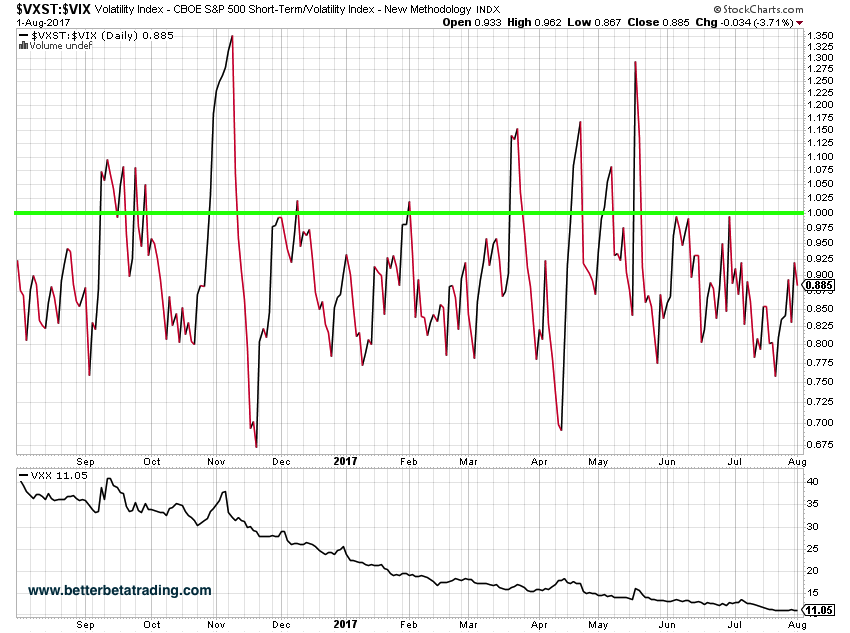

Using The $VXST To $VIX Ratio For Shorting $VXX

Recap:In our first article we examined the ratio of the CBOE VXST Short-term Volatility Index (INDEXCBOE:VXST) to the CBOE VIX Volatility Index (INDEXCBOE:VIX) as a...

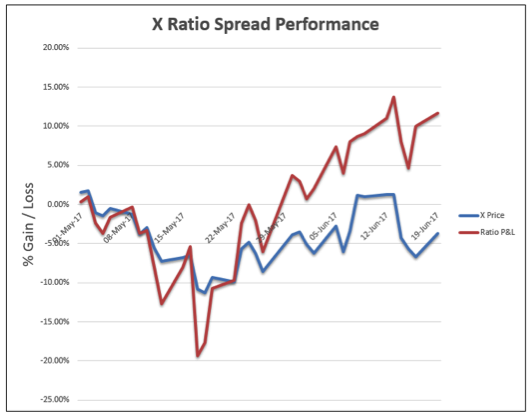

Options Education: How To Trade Put Ratio Spreads

The put ratio spread is generally considered a neutral options trading strategy, although it has the ability to make a profit in up, down...

Options Trading: Using Covered Calls To Increase Yield

When starting out with options, a natural place to begin is with covered calls. It’s a very easy to understand strategy for those that...

Here Comes The Netflix (NFLX) Post Earnings Volatility Crush

Have you ever wondered why puts don’t rise in value and sometimes even fall in value after a poor earnings release? How can that...

How To Increase Your Probability of Success Trading Options

Put 75%+ Odds In Your Favor – How To Increase Your Probability of Success Trading Options

One of the biggest challenges newer traders face is...