Have you ever wondered why puts don’t rise in value and sometimes even fall in value after a poor earnings release? How can that be? If the stock declined, surely the puts would get a significant bump up in price, right?

Not necessarily, and the reason for this is the volatility premium (or uncertainty) coming out of the option prices.

During the lead up to an earnings announcement, there is a huge “excitement factor” and anticipation about how the numbers will come out. As a result implied volatility goes through the roof resulting in inflated options prices.

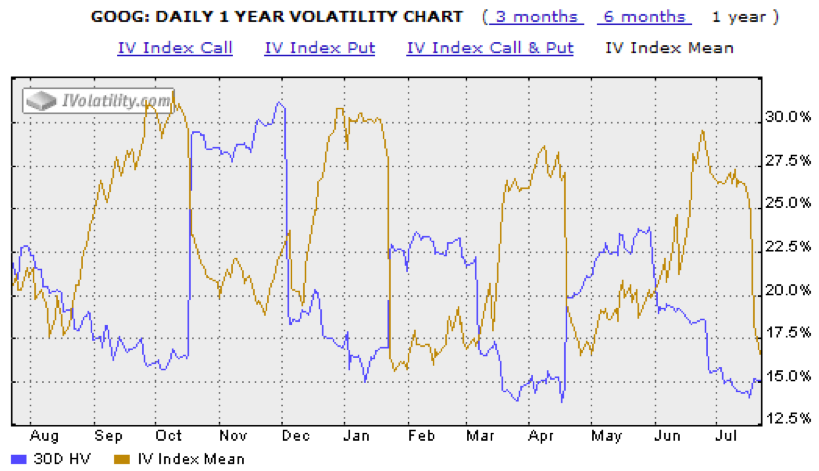

Generally implied volatility will gradually rise into earnings and then investors will see a post earnings volatility crush after the announcement as the uncertainty is taken out of the market. You can see a great example of this below with Google/Alphabet (GOOG). The gold line shows implied volatility gradually rising into each earnings announcement and then getting crushed after the announcement. At the same time, if there is a big move in the stock, the historical volatility goes through the roof.

Each earnings cycle there is a battle between market makers who have to price options and traders looking to profit from the post earnings volatility crush by selling strangles and straddles. Let’s use a simple example and assume you have a stock trading at $100. The $100 calls are trading at $5 and the puts are trading at $5. This tells us that the market makers are expecting a 10% range in the stock post earnings.

Here is a great example with Netflix (NASDAQ:NFLX) from back in 2013. Notice that the stock dropped $11.52 or -4.40% to $250.44. They July 260 put actually fell in value by 32%!

Yesterday, Netflix stock price (NFLX) closed at around $100. The at-the-money put was trading at $5.45 and the call at $5.60.

In the after-hours market, NFLX traded up almost $20, so this round goes to the straddle buyers in a resounding fashion.

The lesson here, is to make sure you understand what you are getting yourself into if you’re trading options around an earnings announcement.

Check out more of my options strategies and trading education at Options Trading IQ. Thanks for reading.

Twitter: @OptiontradinIQ

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.