Enduring Investment Rules (Part II): What Would Bob Farrell Do?

In Part 1 of What Would Bob Farrell Do? we reviewed the first five of Bob Farrell’s legendary rules of investing. We now continue with rules...

How to Validate a Trade Setup Using Multiple Time Frames

Looking at multiple time frames is a helpful way to verify support or resistance before placing a trade.

When looking at an intraday setup,...

Understanding Investor Behavior During Era of 24/7 News Cycle

There is an evolution for individuals learning to play poker that is often captured in the adage ‘Play the player, not your cards’.

Beginning...

5 Practices of Mindful Investors

I started a mindfulness routine a couple years ago, during a particularly stressful period in my life. A daily meditation practice was a life...

6 Interesting Similarities Between Golf and Trading

With another Golf season winding down here in the North East, I decided to put together my thoughts on what I've come to realize...

5 Behavioral Biases That Infect An Investor’s P&L

While the word certainly carries a negative connotation, it is essentially a preconceived opinion or feeling. Sometimes these opinions are based on accurate, objective...

Identifying and Countering Investor Biases

In an ideal world, any important decision we make in life would go through a rigorous and disciplined process, designed to lead us to...

What It Takes To Become A Great Trader

Have you ever noticed that becoming great at anything takes a big commitment of time and focused energy?

You can observe a lot of similarities...

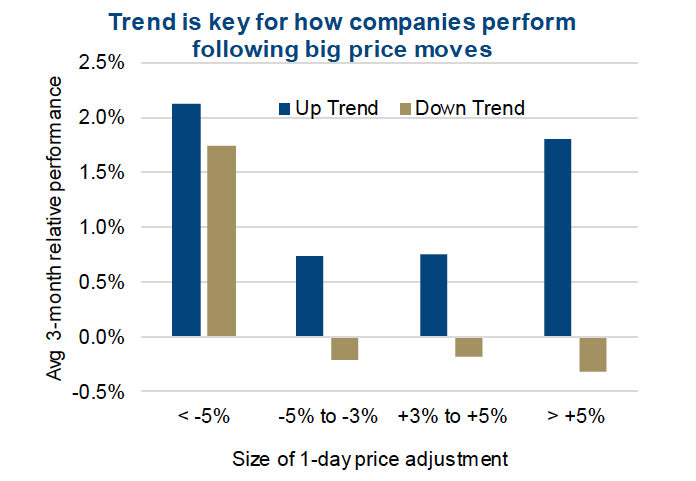

When Markets Overreact: How To Trade Major News and Earnings

Anecdotally, most market practitioners and investors likely believe that the market often overreacts to news.

This happens often around earnings announcements, when a company surprises...

Investing Insights: Mental Accounting & Mind Games

There was a time when a cattle rancher in need of new shoes had to find a shoemaker who wanted a cow. This was...