In Part 1 of What Would Bob Farrell Do? we reviewed the first five of Bob Farrell’s legendary rules of investing. We now continue with rules six through ten.

Rule #6: Fear and greed are stronger than long-term resolve.

This rule extends rule #5- the public buys the most at the top and the least at the bottom. Our investment rules and inherent conservatism often yield to the yearning to make more money at market tops. Similarly, fear at market bottoms frequently inhibits our ability to buy assets at cheap levels.

To counteract our emotions and maintain resolve, we should have a plan for different scenarios. If we can fight our feelings at market tops and adhere to risk management plans, we will have cash on hand to take advantage of relative bargains when markets bottom.

Warren Buffet once said, “buy when people are fearful and sell when they are greedy.”

Rule #7: Markets are strongest when they are broad and weakest when they narrow to a handful of blue-chip names.

Breadth matters! Markets are strongest when most sectors and indexes are hitting highs, and many stocks within the indexes are also hitting highs.

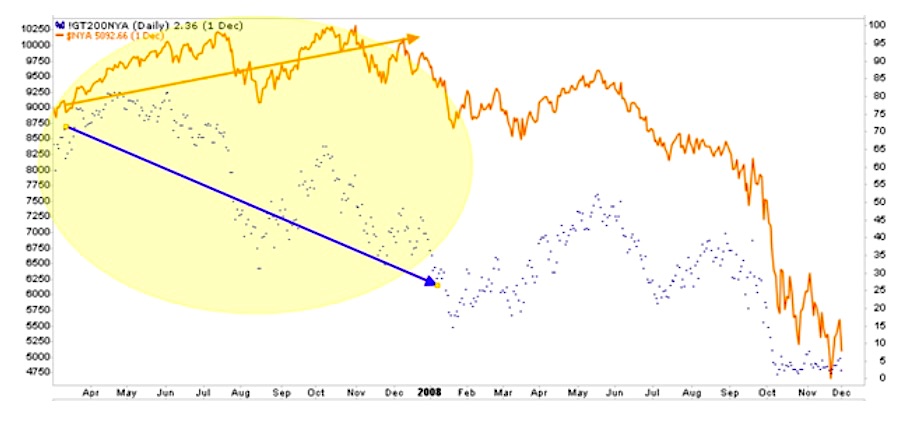

Bob warns to be wary when market indexes are hitting all-time highs despite many stocks not following. The graph below shows the market’s poor breadth leading into the 2008 Financial Crisis. Markets rose by about 10% through 2007, yet the increasing number of stocks trading above their 200 dma fell steadily. Many investors ignored this signal as they were enamored with record highs.

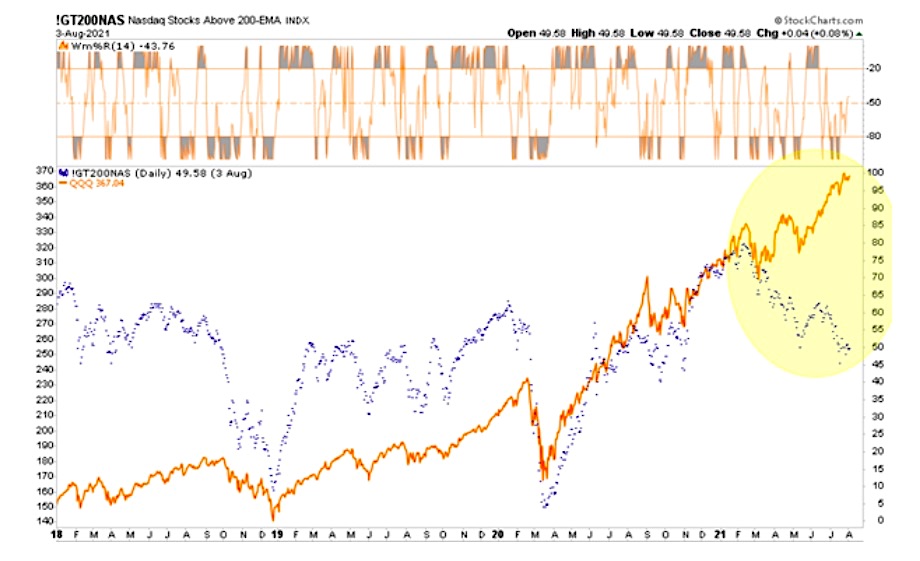

The following graph shows the NASDAQ is currently at or near record highs, yet the number of stocks within the index trading above their respective 200 dma is steadily falling. As it is said, the troops are not following the leaders higher.

Rule #8: Bear markets have three stages – sharp down, reflexive rebound, and a drawn-out fundamental downtrend.

This rule is a description of the typical path of bear markets. Most significant bear markets start with a sharp and often unexpected decline. Following the sell-off comes the emergence of dip buyers. Thinking the market will bounce back as it has done on each prior dip, buyers scoop up shares at what appear relatively cheap levels compared to previous highs.

These dips are a great place to reduce exposure and/or hedge if you did not before the initial drop in a true bear market.

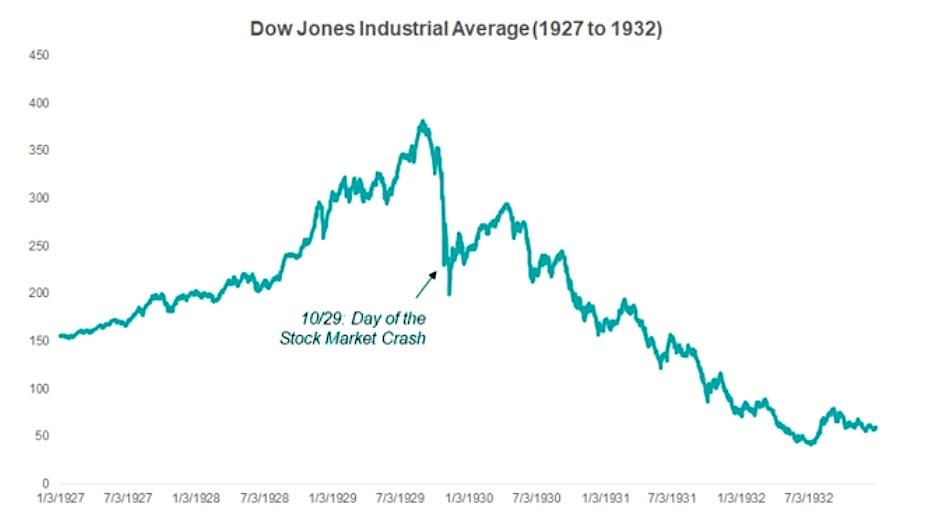

The decline continues after the brief respite, albeit often at a slower pace. As the market falls, investors are increasingly consumed with fear as losses mount. Usually, a bear market ends with a capitulation sell-off (circle below). The following graph from 2020 follows the typical three-stage bear market pattern. The following chart shows the same three wave pattern from 1929.

Rule #9: When all the experts and forecasts agree – something else is going to happen.

At its core, rule #9 offers comfort for today’s contrarians. Today, almost everyone seems to be on the same page that markets only go in one direction, up. Regardless of their economic opinion or valuations, most investors think the Fed has its back and will not let prices drop appreciably. Anything that changes the current mindset will result in a rude awakening, resulting in too many sellers and too few buyers.

In the words of Sam Stovall from Standard and Poors: “if everybody’s optimistic, who is left to buy?”

In today’s environment, we see a similar blind faith in the Fed in the bond markets. Junk bonds, for instance, are trading with negative real yields. Investors are all but guaranteed to lose purchasing power. The only way to profit is if new investors are willing to accept even more negative real yields.

As we wrote in Undermining Capitalism with Unreal Values and Crass Distortion: “Even if we assume zero defaults, which is impossible for an index of junk-rated bonds, investors will still lose money on an inflation-adjusted (real) basis.”

As it is said, when everyone is on one side of the boat, go to the other side.

Rule #10: Bull markets are more fun than bear markets.

Of course, bull markets are more fun. For starters, it is much easier to pick stocks in a rising market. More importantly, investors make money during bull markets. Looking like a genius and making money enamors us to bull markets.

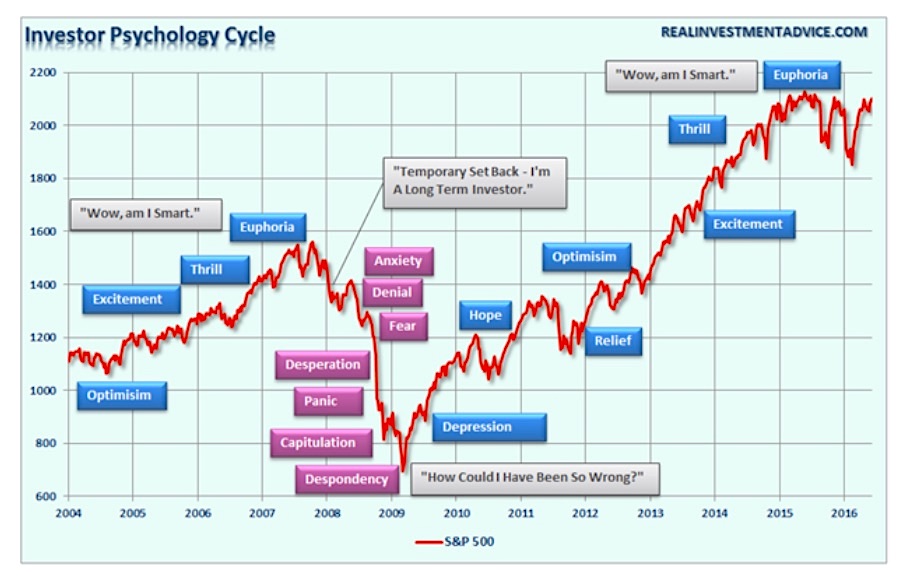

The graph below shows the multiple emotional cycles ranging from euphoria to despondency and back to euphoria.

Markets are currently in the euphoria stage. While it seems easy to pick stocks and make money, we argue this is the most challenging investment stage. The potential upside is greatly limited, and the risks are palatable. Conversely, the despondency stage is the easiest. At market troughs, valuations are the cheapest, and the risk involved is relatively minimal.

Famed investor Benjamin Graham made the term “margin of safety” popular. We should be more comfortable buying an asset at or below its intrinsic value than paying multiples of its intrinsic value. Simply, the amount we can be wrong is much more limited when buying a cheap asset with a “margin of safety.”

Summary

Bob’s rules are not etched in stone like the ten commandments. Markets often defy Bob’s wisdom and stay distorted on the upside and downside for long periods. During such periods, as we are currently in, we do not have the option of ignoring his wisdom. Now, more than ever, we must closely follow our plan and have sturdy signals in place to help us ride up with the market yet manage risk and protect when Rule #1 proves true once again.

Before you make another trade, you may want to ask yourself- WWBD?

Twitter: @michaellebowitz

The author or his firm may have positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.