Stock Market Update: Crude Oil, Chip Stocks, and Critical Data In Spotlight

Oil prices soared to kick off March after weekend military strikes on Iran, raising geopolitical tensions and inflation expectations

Earnings are also in focus as...

Bonds, Silver & Yields Just Confirmed Something BIG

The Power of Market Message

Over the past several weeks, the market has quietly validated several themes discussed in Mish’s Daily:

Falling yields

Strength in silver and...

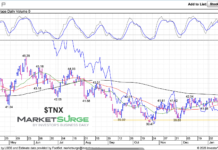

Treasury Bond Yields Test Major Price Support

Treasury bond yields, aka interest rates, have been falling in early 2026.

The 10-year treasury yield is the most importantly to consumers for auto rates...

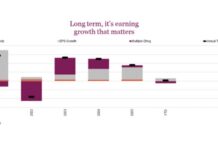

Stock Market Update: Corporate Earnings Going Global

Markets oscillate on many factors — from interest rates and risk appetite, to headline news and the economy. But in the end, it comes...

What Stock Splits Reveal About Today’s Economy and Market

The global equity arena is filled with big winners and big losers as AI infiltrates industries

Traditional split announcements have slowed, with the historically pivotal...

Big Pharma Is Buying — Why Biotech Stocks Could Outperform in 2026

Biotech is quietly stepping into a leadership role here in early 2026 — and the move is not happening in a vacuum.

After years of...

This Small Cap Signal Could Move The Entire Stock Market

Today, I discuss why small cap stocks may decide the stock market’s next big move.

Right now, small caps are showing clear leadership.

While the S&P...

Tesla Stock (TSLA) Testing 6-Month Support!

The stock market is all over the place right now.

Much of that is due to heavy rotation. Mag 7 names have fallen back with...

Is The Housing Market About To Surprise Everyone?

In today’s Mish’s Market Minute video, we break down the current state of real estate and why investors should be paying attention right now.

Real...