How To Determine When A Market Trend Is Over

You've probably heard the saying "the trend is your friend until the end." Well, for most markets these days, the trend is up. Here...

How to Trade Through an Overnight Gap Against Your Stock Position

When holding an overnight stock position, you run the risk of having that stock gap against you at the open.

The way to combat...

When Stocks Flash a Reversal of Fortune

We've all been there before.

A stock we own is trending higher, moving from lower left to upper right on trading screens.

And all the sudden,...

3 Questions to Ask About the 200-day Moving Average

All eyes are on the 200-day moving average as the S&P 500, along with many individual stocks, begins to test this key long-term barometer.

Why...

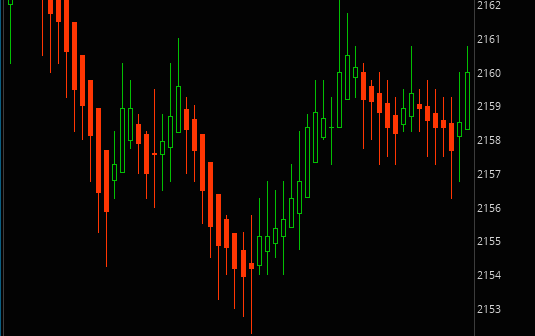

Quantifying Candlesticks for Trading Systems

Candlesticks are often a trader’s first exposure to technical analysis.

As a quantitative system developer for a high frequency and market making firm I can...

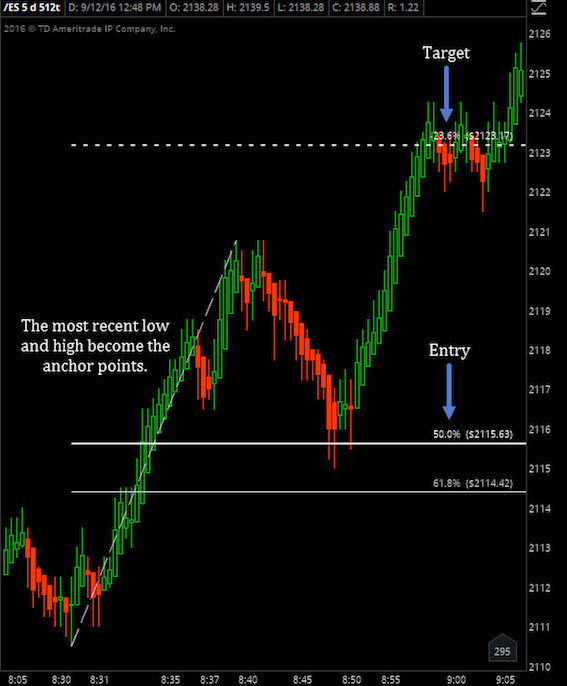

3 Simple Tools For Trading The Futures Markets

When developing your own trading strategy the adage KISS – "keep it simple, stupid" is an important one to remember. This carries over to...

Understanding Market Structure For Better Trading Results

We can all agree that the markets are in constant ebb and flow, never moving in a straight line, always undulating. So how then,...

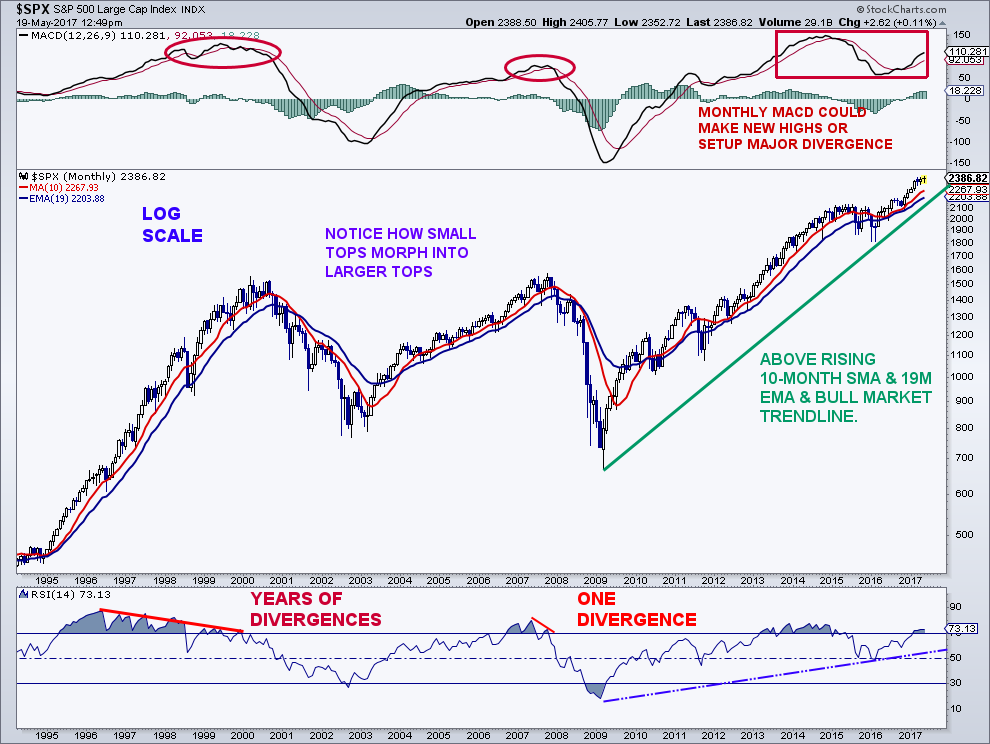

What Major Stock Market Tops Look Like

Stock Market: Markets Don’t Peak Quietly

Over the past few weeks in my newsletter, "On The Mark," I discussed some things that generally occur at major...

How To Use The Heikin Ashi Candlestick For Better Trading

Heikin Ashi Candlestick: This Unknown Candlestick is Highly Valuable to Short-Term Traders

One of the most popular chart types among traders is the Japanese Candlestick....

How To Fade The NYSE Tick When Trading E-Mini S&P 500

As short-term active traders, we want to enter and exit according to the most relevant information. Earnings and quarterly projects just don't give us...