The Max Pain theory suggests that stock and commodity prices will often move towards specific prices on specific option expiration dates. “Max pain” is the price level where option holders experience “maximum pain” by losing the most money.

The Maximum Pain theory is considered to be controversial, and there is disagreement over whether the option expiration price movements can be explained by regular market mechanics. Some proponents of Max Pain believe that markets can be manipulated by “banging the close” or by other mechanisms.

Let’s look at a simplified futures market to demonstrate what might happen as we approach option expiration.

For simplicity, let’s assume that all of the sold options are “covered” – the seller the options holds a portfolio of covered calls and covered puts. By constructing these hedged positions, the option sellers have a portfolio where they will earn hedged profits from the time decay of the options that they have sold.

Eventually, most of the option positions will expire worthless, but the rest of the options will be unwound, rolled forward or offset by futures contracts.

As all of these transactions flow through the markets in the final week, day, hours and minutes into option expiration, we can imagine how the options market – for a period of time – can become the tail that wags the dog of the futures market itself.

Whether the principles of Max Pain come from the natural flow of the market orders or from a form of intervention, we can demonstrate a connection between prices and the points of Max Pain for some stocks, commodities and ETFs.

Incorrect Math

I agree with Max Pain proponents who say that market dynamics can influence price in and around the option expiration date. However, I do not believe that the Max Pain theory uses correct math to properly estimate the eventual settlement price. Max Pain price levels are based upon the value of the options, rather than the delta of them. Here is the logical fallacy for Max Pain proponents: Large traders don’t hedge the value of their trading positions – they hedge the delta (and gamma) of them.

To use a baseball analogy, Max Pain makes a great play at shortstop, but then throws the ball over the first baseman’s head.

Op-ex Price Magnets

The Op-ex Price Magnet improves upon the Max Pain theory by shifting the focus from option value to option delta. Large option traders manage their delta exposure in real-time and measure their value-at-risk by it. When there is a large divergence between the Price Magnet and the price of the futures, then the option sellers in aggregate are holding options contracts that are not optimized for profit and risk. This view implies that the option sellers will take corrective action to optimize their portfolio profits.

Corrective action by the option sellers might include buying or selling futures or by buying or selling options, the net effect of which will have the tendency to see convergence between the futures price and the delta-neutral Price Magnet.

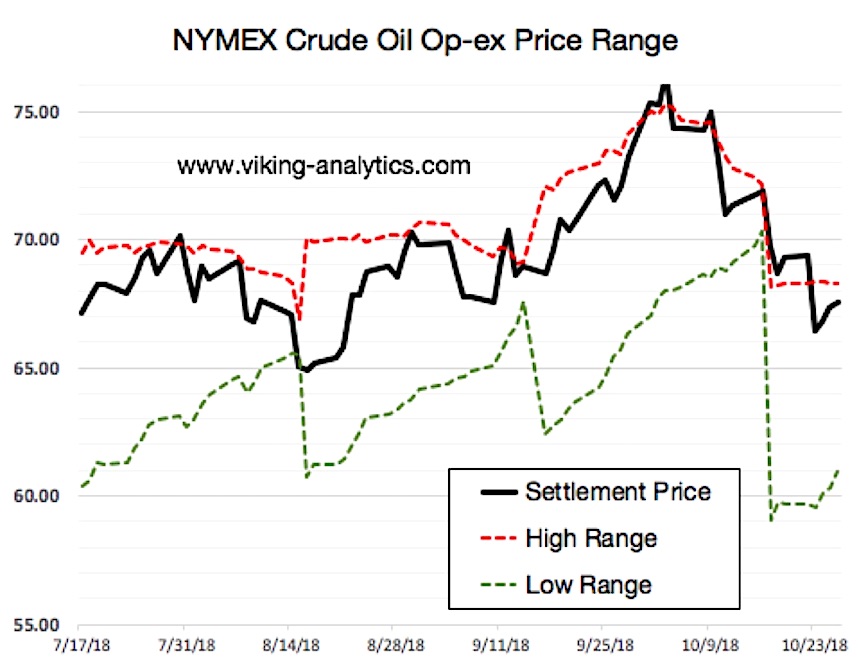

This dynamic can be seen in the crude oil graph below, where the price of crude oil periodically reaches the high range of the Price Magnet, only to revert back towards the range mid-point on or before the option expiration day.

To learn more about the Op-ex Price Magnets, please visit our website.

Like other market indicators, the Op-ex Price Magnet is not 100% reliable; however, we can demonstrate mean-reversion of asset prices towards the Price Magnet very consistently across many different stock and commodity markets.

Conclusion

Proponents of Max Pain have done a service by highlighting the potential effects of option expiration on stock and commodity prices. Option expiration is an important time stamp for many different kinds of investors. Nevertheless, Max Pain falls short by incorrectly focusing on the values of the listed call and put options to forecast a settlement price.

Large active traders in the options markets manage their portfolio by actively managing their positions in a delta-neutral (and gamma-neutral) portfolio. Therefore, if investors believe in the concept of Max Pain, then they should consider focusing upon and tracking the levels of delta-neutral instead of maximum value thresholds.

We are very interested to hear any feedback on these ideas. For more information, or to inquire about subscription options, please visit our website.

Twitter: @Viking_Analytix

The authors may have a position in the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.