When starting out with options, a natural place to begin is with covered calls. It’s a very easy to understand strategy for those that are familiar with stock ownership.

The strategy involves buying a stock (if you don’t already own it) in lots of 100 shares. The total size will depend on each investors capital base. The investor then sells a call option over those shares in exchange for collecting a premium. One call option contract represents 100 shares, so investors can sell multiple call options if they have a particularly large stock holding.

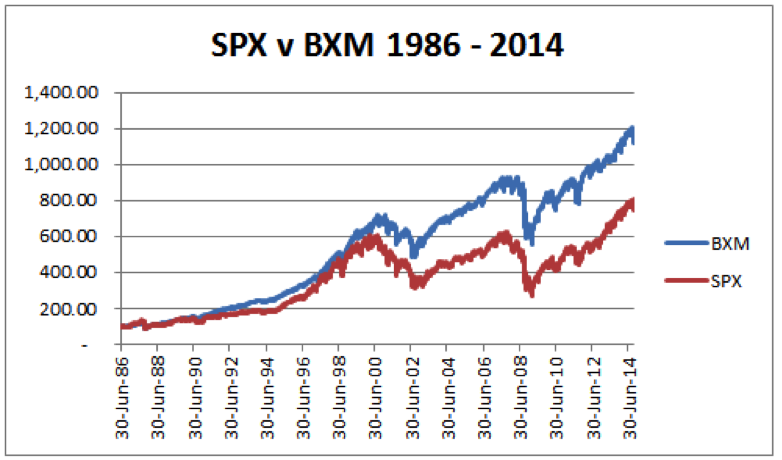

Covered calls have been shown to outperform pure stock ownership over the long term while also decreasing volatility.

Based on data provided by the CBOE, we can see that CBOE S&P 500 Buy Write Index (BXM) has significantly outperformed the S&P 500 over the tracking period of 1986 to 2014.

If we convert both indexes to a starting point of 100 on Jun 30th, 1986 BXM has risen to 1,160.02 for a return of 1,060.02%. The S&P 500, on the other hand, has risen to 804.52 for a gain of 704.52%.

Covered calls work really well on blue chip, low volatile stocks. This way you can generate a tidy sum from selling the call options and also receive a healthy dividend while you own the stock.

Here are two stocks that meet that criteria:

VERIZON STOCK (VZ)

Verizon has traded between 42 and 55 over the past 12 months and has recently experienced a minor pullback.

Verizon is a pure defensive play and with stocks having risen dramatically since the election, it could be time to start looking at defensive stocks again.

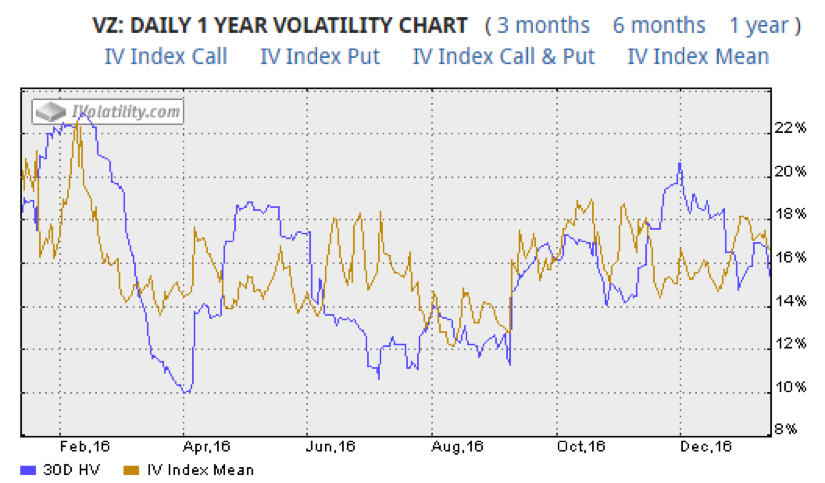

The beauty of this stock is that it will experience very low volatility with implied volatility only ranging from 12% to 22% in the past year.

Add that to the fact the stock pays a chunky 4.40% dividend it can be a worth addition to any portfolio.

By combining stock ownership with covered call trading, investors can further boost the income potential from this telecommunications giant. Now let’s look at Verizon’s stock chart to see how it looks.

continue reading on the next page…