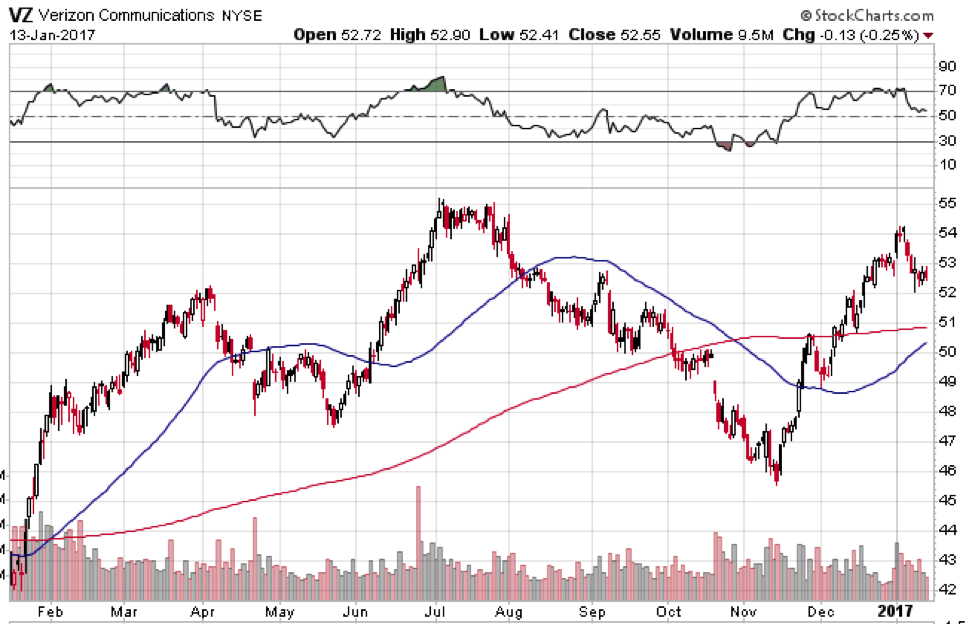

With Verizon’s stock currently trading at $52.50, traders could sell an April 21st $52.50 Call for $1.70.

Such a trade would forego any capital growth potential, but would increase the income potential by another 12.44% per annum.

PFIZER STOCK (PFE)

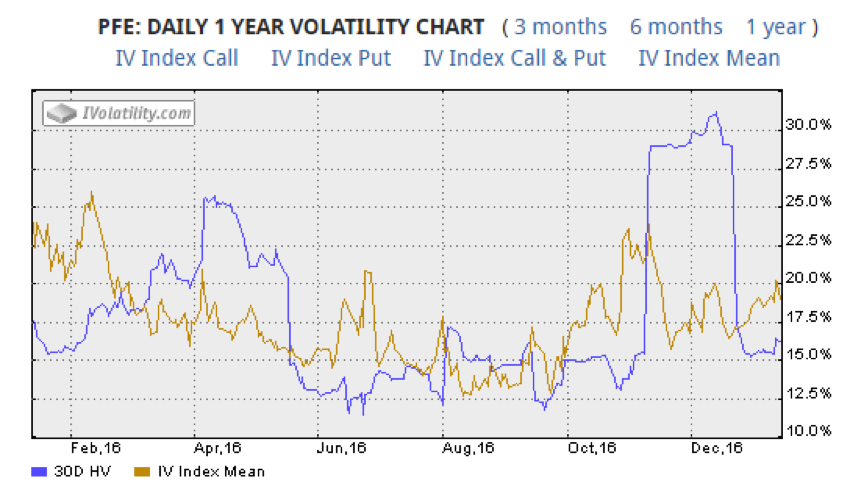

Pfizer is another stock that will never set the world on fire from a growth perspective, but it does have defensive qualities and pays a juicy 3.94% dividend.

The stock has been trading between $27.50 and $37 in recent times and is currently smack bang in the middle of that range at $32.50.

Implied volatility is currently around 20%, having been as low as 12.5% and as high as 25% in the last year.

Traders wanting to increase the yield from their portfolio could sell an April 21st $33 call for $0.89 which would add another 10.5% per annum income potential to the holding.

Options trading involves risk and is not suitable for some investors. Check with your financial advisor before making any investment decisions. Thanks for reading.

Twitter: @OptiontradinIQ

The author does not have a position in any mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.