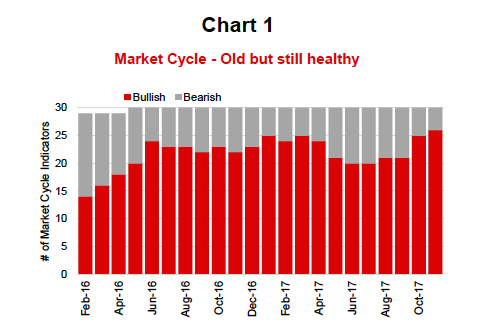

Bull Market Cycle Update: Let The Good Times Roll?

The amount of resources thrown at trying to develop rules or models to predict turns or direction is truly immense. The problem, though, is...

Contrarian Investing: The Pains, Gains, and Takeaways

Contrarian investing has always been a fascination of mine.

From the first time I read Humphrey Neill's classic book The Art of Contrary Thinking, I've been watching...

The Sun Shines For Solar Stocks

I regularly screen for ETFs making new 13-week highs or 13-week lows. This can help to identify emerging leadership before the move has already...

Mind Games: 3 Behavioral Traits Investors Should Be Mindful Of

In “Bubbles and Elevators”, we discussed how human beings do seemingly ridiculous things to fulfill their instinctive need to mimic what others are doing,...

Investing Strategy 101: It Pays To Follow Your Process!

One of the earliest recollections from my start in the industry was an investing strategy founded by Michael O’Higgins called the ‘Dogs of the Dow’....

Insights Into Investing Through Financial Bubbles and Elevators

Financial Bubbles and Elevators

Volumes have been written on behavioral finance and the seemingly “irrational” decisions investors tend to make to avoid straying from the herd....

Investor Skepticism Fuels Bearish Climate For Stocks In 2016

Investor skepticism is something that we hear about often in the stock market. More importantly, we feel it deep in our core.

It is usually...

Book Review: Steve Burns “The Most Helpful Traders On Twitter”

I've followed Steve Burns for the past few years and feel fortunate to include some of his work here on See It Market. Steve's...

SHORT-TERMism: Algos, ETF’s And Investor Performance

This post came over via Shane Obata and was written by Craig Basinger, Richardson GMP’s Chief Investment Officer.

“The stock market is a device for...

The Importance Of Mental Flexibility In Trading

Possessing mental flexibility is essential for any trader, but it is especially important for short-term traders who constantly have to reevaluate the merits of...