Possessing mental flexibility is essential for any trader, but it is especially important for short-term traders who constantly have to reevaluate the merits of their open positions. There is a constant barrage of data that must be interpreted and filtered intraday, and it is the job of a professional trader to be as objective as possible and to adapt to the unfolding price action.

Of course, this is easier said than done, but recognizing the importance of mental flexibility in trading is a step in the right direction.

On Thursday, December 15, I was trading Pandora Media Inc. ($P). The stock was gapping up over 20 percent, as there was a recent music royalties ruling that was seen as being favorable. With this intraday news catalyst and large gap up, Pandora was at the top of my intraday “in play stocks” watch list.

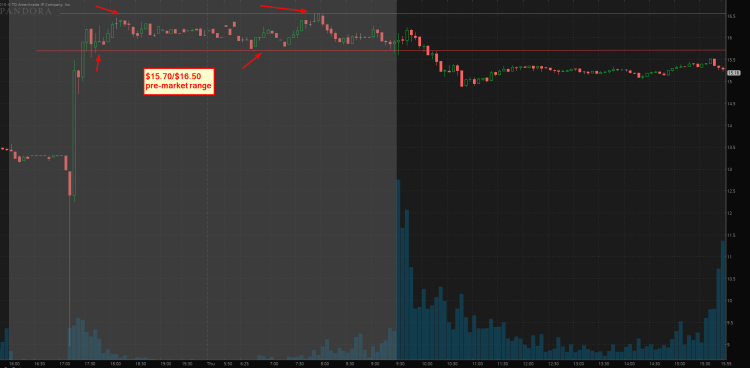

As you can see on the daily chart below, the stock was gapping up towards some potential resistance around $16.50-$16.70, where there was a confluence of technical resistance as well as a flat 200-day simple moving average. Ironically, when I first logged into my trading platform and saw where the stock was trading in the pre-market, my initial bias was actually to look for a spot to get short; I thought with such a large gap up that was so close to technical resistance, there was a chance the stock would pullback intraday as traders took profits.

Pandora Stock (P) – Daily Chart

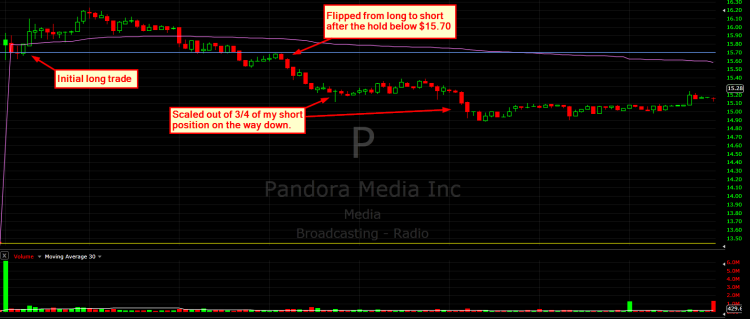

As you can see in the second chart below, the stock had formed a range in the pre-market between $15.70 and $16.50 (notice that the top of the pre-market range corresponded to the technical resistance on the daily chart). My plan for the open was to simply watch what the stock did at the bottom and/or top of the pre-market range. When the market first opened, Pandora stock dropped slightly below the bottom of the pre-market range but quickly got back above $15.70 (see chart). Once I saw the bid quickly get back above and hold above the $15.70 level, I got long some at $15.72 with a stop at $15.48. This was not an intraday trend play for me; I was simply looking to play the extremes of the pre-market range, and was waiting to see in which way the stock was going to trend intraday.

I sold about two-thirds of my long position around $16.15 or so. I wanted to take some profits into that $16.50 technical resistance level to cover my risk. However, as the chart below shows, around 10:00 a.m., the stock then broke below VWAP and broke below the opening low (needless to say, I was stopped out of the last third of my long position).

I noted on StockTwits that I did not have a problem “flipping” from long to short if there was a clear hold below the bottom of the pre-market range at $15.70; this is exactly what I did. After making new intraday lows, the stock retraced up to that $15.70 level where there was a seller on the tape. I flipped short around $15.60s after seeing the stock hold lower. The chart below highlights my trade management. I covered most of my short position slightly above and below $15, and I ended up covering the last bit later in the day.

What I would really like to emphasis in this trade review is the importance of being flexible in your plan. Planning is vital to be a successful trader, but adapting is equally – if not more – important. Whenever I am trading, I am constantly weighing the pros and cons of the price action I am seeing in relation to any position I have. To be clear, I am not advocating that you should flip in and out of a stock on a consistent basis. While your broker may enjoy such a strategy, I am simply trying to underscore the importance of being objective in your trading and adapting as you receive new information. As any professional traders will tell you, mental flexibility is key to have a successful trading career.

Thanks for reading.

Twitter: @MarketPicker

The author does not have a position in the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.