We believe the Euro is poised to continue the downward trajectory it began at the start of the year. For traders who work a weekly time frame or slower, it might be difficult to see an entry opportunity to follow the trend. However there should be opportunities ahead for traders working on daily and faster time frames.

In this article we show two possible paths for the Invesco CurrencyShares Euro Trust ETF (NYSEARCA:FXE). Both scenarios call for continued declines during the next few weeks or months, and our main scenario envisions the declines continuing until late 2024 or into 2025.

The Elliott wave methodology is an anticipatory approach to finding trades. The conditions that justify an entry or an exit don’t suddenly spring into existence. Instead the conditions for the trade develop while you are observing the charts over a period of days or weeks or possibly months.

We typically share charts with weekly and occasionally daily candles in our articles, but sometimes there doesn’t appear to be a turn developing in the market on those time frames. In cases like that, the charts can still help you find trades on faster time frames by showing the expected direction and strength of a trending move.

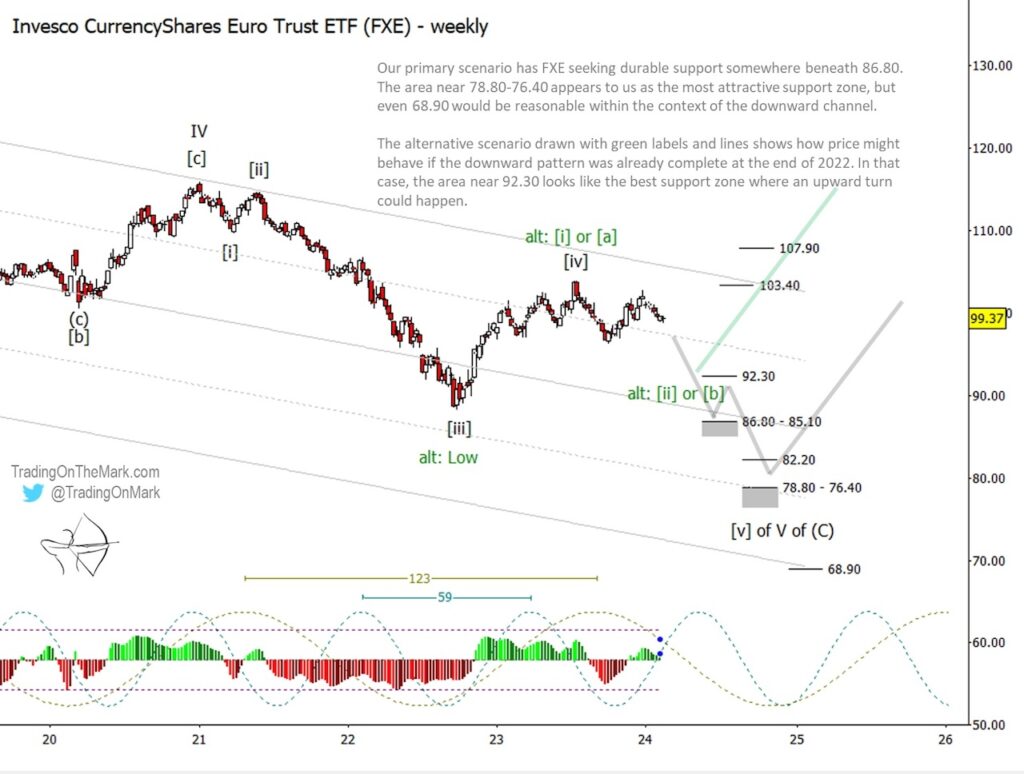

Our main scenario has FXE trying to complete the final stages of the large declining pattern that began in 2008. For the portion of the decline that is supposed to consist of a five-wave impulse, it appears that the fourth-wave high printed in July 2023. From that point, a smaller five-wave move should take price to new lows. We have drawn the main scenario with black wave labels and a gray path on the weekly chart below.

Important support near 92.30 could mark the point where the market decides whether to follow our main scenario or instead treat the 2022 low as THE low. If price finds durable support in that area, then it could take the alternative bullish path that we have drawn in green.

In both our main and alternative scenarios, any upward pullbacks will probably result in lower highs during the next few months.

If FXE follows the main bearish scenario, then supports near 86.80 and 85.10 represent the first major target for price to reach as it seeks a new low. Below that we see supports near 82.20 and the zone from 78.80 to 76.40. Support near 68.90 could constitute a stretch target for bears, but we think it’s unlikely to be tested.

The way to determine whether FXE is likely to reach each successive support level will be by examining the wave structure on weekly and daily time frames. The move downward from the lower high that was set at the turn of the year should consist of five smaller sub-waves. This would be true regardless of whether the main or alternative scenario is playing out.

Similarly, the final move downward move in the main scenario should consist of five smaller sub-waves.

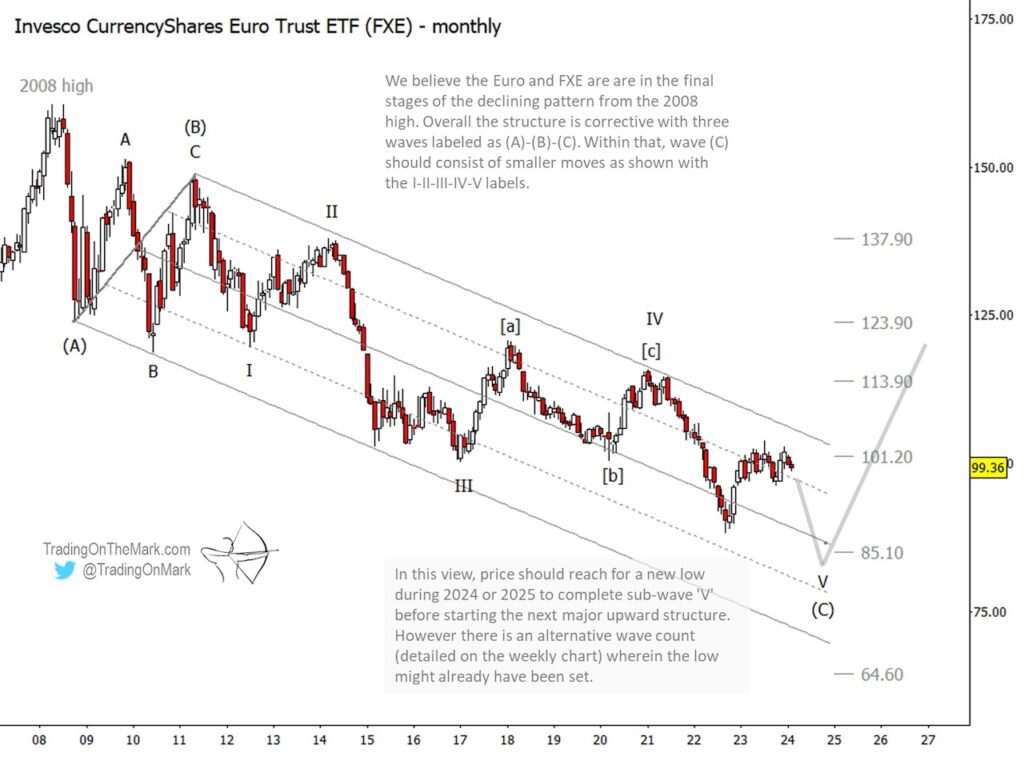

For context, we show our bigger-picture wave count with the monthly chart below. At the largest scale, the decline from 2008 consists of three waves labeled as (A)-(B)-(C). Wave (C) should itself consist if five smaller moves labeled as I-II-III-IV-V, with wave ‘V’ probably not yet complete according to the main (black/gray) scenario. The green scenario on our weekly chart treats wave ‘V’ as being complete and anticipates a higher low compared to 2022.

Trading On The Mark uses technical analysis to identify the trends and turns in intraday, daily and weekly markets for commodities, energy, currency, bonds and indices. Visit our website for more charts, and follow us on X for updates and special offers.

Twitter: @TradingOnMark

The authors may have a position in the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.