Crude Oil Surges Into March, Ends Month In Bear Market!

This is not an April Fools day joke! After surging into the front end of March, crude oil reversed course and headed lower by...

Crude Oil Reverses Higher Once More – What To Watch

The near-term targets in WTI Crude Oil were hit, and traders got a pullback to buy into.

Now is where things get tricky. The latest bullish...

What To Make Of Commodities Reversals

Tuesday, many commodity ETFs gapped lower while the major indices gapped up.

Additionally, the Russell 2000 (IWM) finally cleared its pivotal price level at $209.

However,...

Is Crude Oil Creating Historic Bearish Price Reversal?

The Ides of March are in full effect. Investors have been rocked by war, inflation, and financial markets volatility.

At the center of all of...

Crude Oil Price Peak? Elliott Wave Points To Correction

What can you do when the market goes hard against the trade you just entered? Here we revisit our February post about crude oil futures (symbol...

Solar Sector ETF (TAN): Will Price Reversal End Downtrend?

The Solar Sector ETF (TAN) has begun to show up on investment radars once more.

Just weeks ago, solar stocks were left for dead. But...

Crude Oil Likely To Hit $127 After A Brief Pause

After a steep pullback, crude oil prices have reversed higher. I highlighted this bullish reversal in a research note here on See It Market...

Crude Oil and Energy Stocks, ETF (XOP) Heading Higher

We are not expecting crude oil or energy stocks to rally in a straight line up, but we are off to a good start.

The charts...

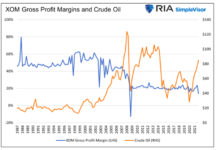

Big Oil and The Fallacy of a Windfall Profits Tax

Higher energy prices worrying you? Be afraid because Congress is coming to the rescue. Legislators are introducing a new bill called the “Big Oil...

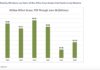

Rates Increase and Transportation (IYT) Clears its Major Moving Averages

Wednesday, the market rallied into the Feds rate announcement, showing speculator's optimism given the current downward trend.

It also helped that Monday, the Nasdaq 100...