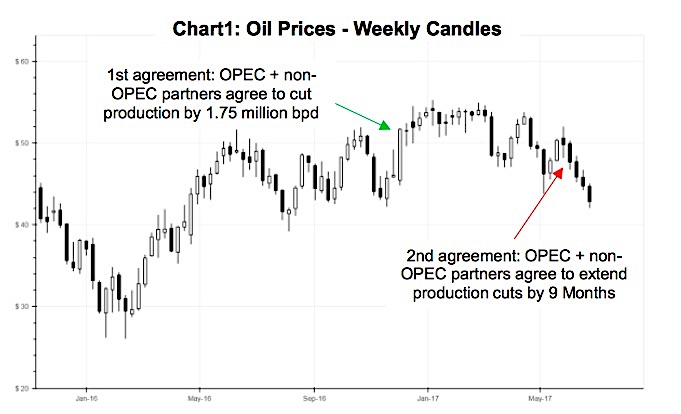

Crude Oil Market Review And Outlook For 2H 2017

This post was written with Chris Kerlow of Richardson GMP.

Crude Oil: A lot Can Change In Just 3 Years...

In the 1st half of 2014,...

Turnaround Tuesday: Wall Street Cliche Or Trading Edge?

What is Turnaround Tuesday? Is it a Wall Street cliché, media company selling headline, or verifiable trading edge? Maybe all of the above, depending...

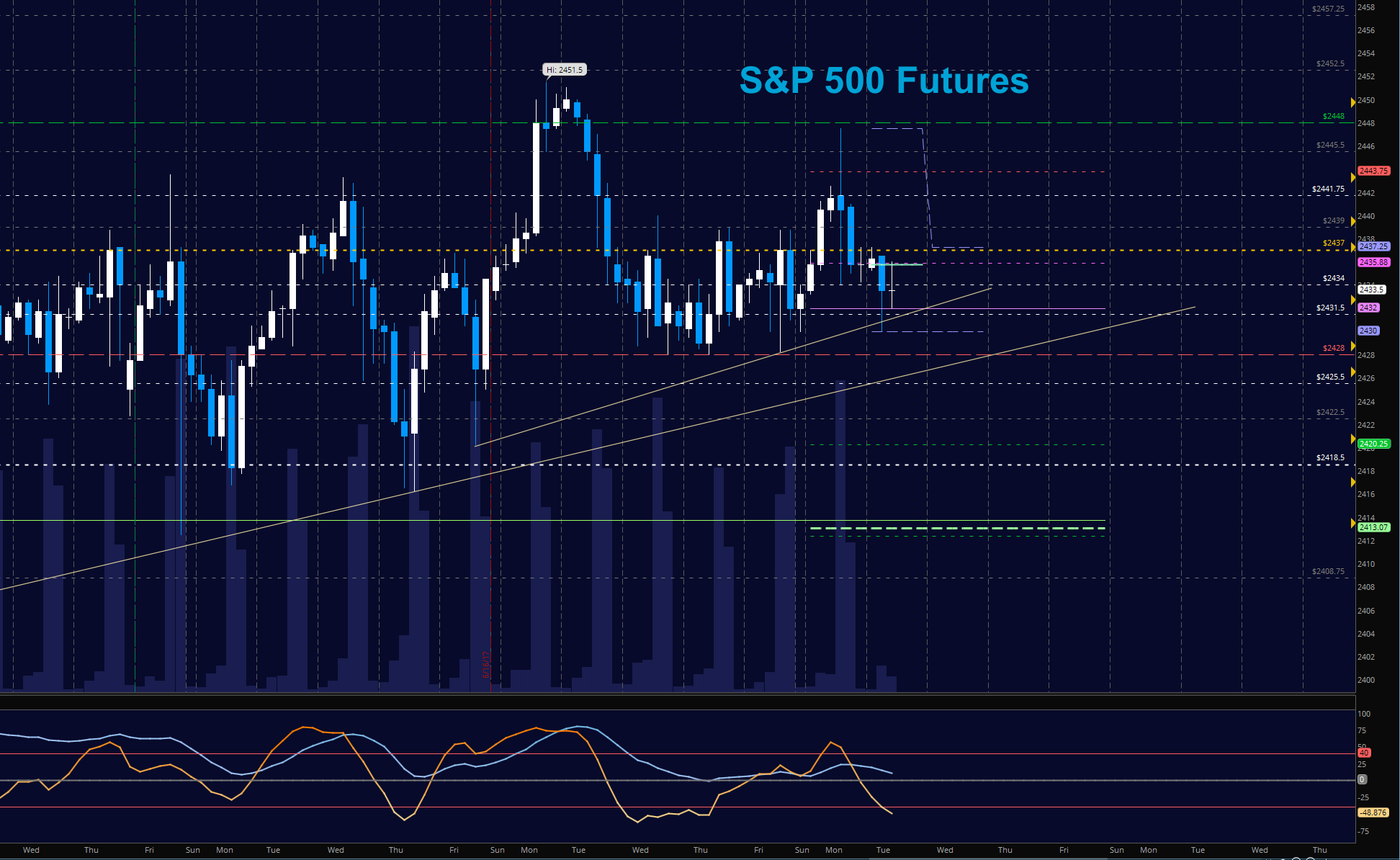

S&P 500 Futures Trading Outlook For June 27, 2017

Stock Market Trading Considerations For June 27, 2017

Stocks are trading mixed heading into Tuesday’s session. After opening higher yesterday, the S&P 500 (INDEXSP:.INX) reversed...

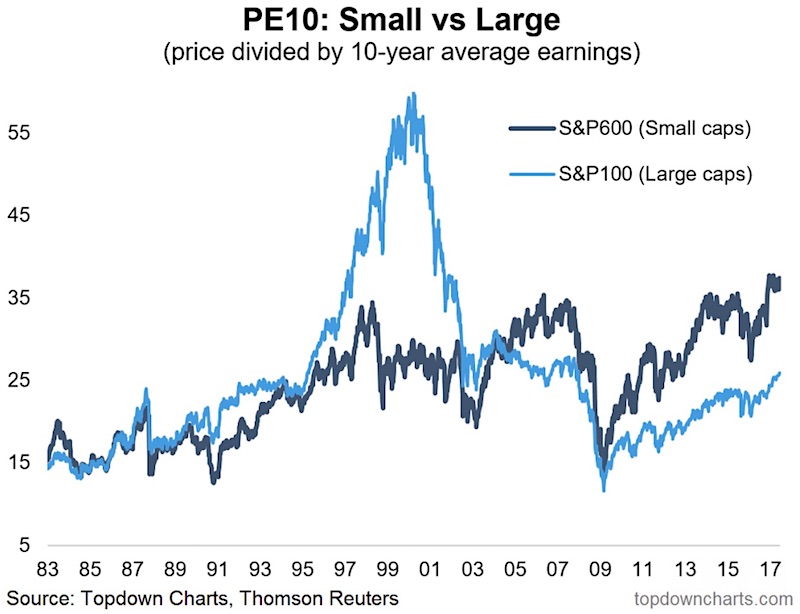

Small Caps PE10 Valuation Ratio Getting Lofty

A number of analysts and commentators have been discussing the increasingly high levels of the "Shiller PE", also known as CAPE or PE10, for...

S&P 500 and Nasdaq Futures Weekly Trend Outlook – June 26

BIG PICTURE - What's Ahead?

Looking across the major stock market futures indices, the Dow Jones Industrials (INDEXDJX:.DJI) and S&P 500 (INDEXSP:.INX) closed below the weekly...

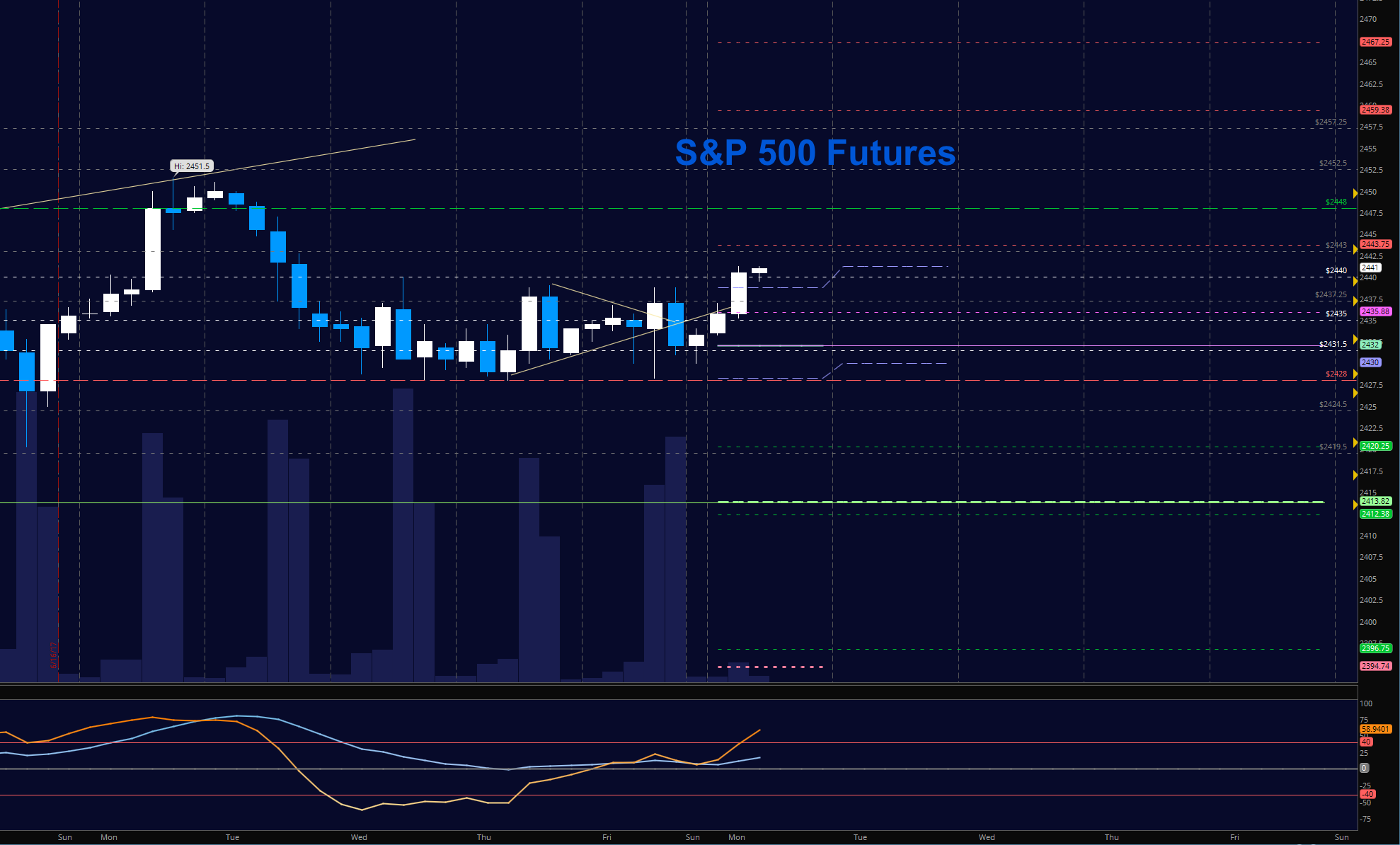

S&P 500 Futures Trading Outlook For June 26, 2017

Stock Market Futures Trading Considerations For June 26, 2017

Traders are resuming bullish control as the S&P 500 (INDEXSP:.INX) opens the week above price levels...

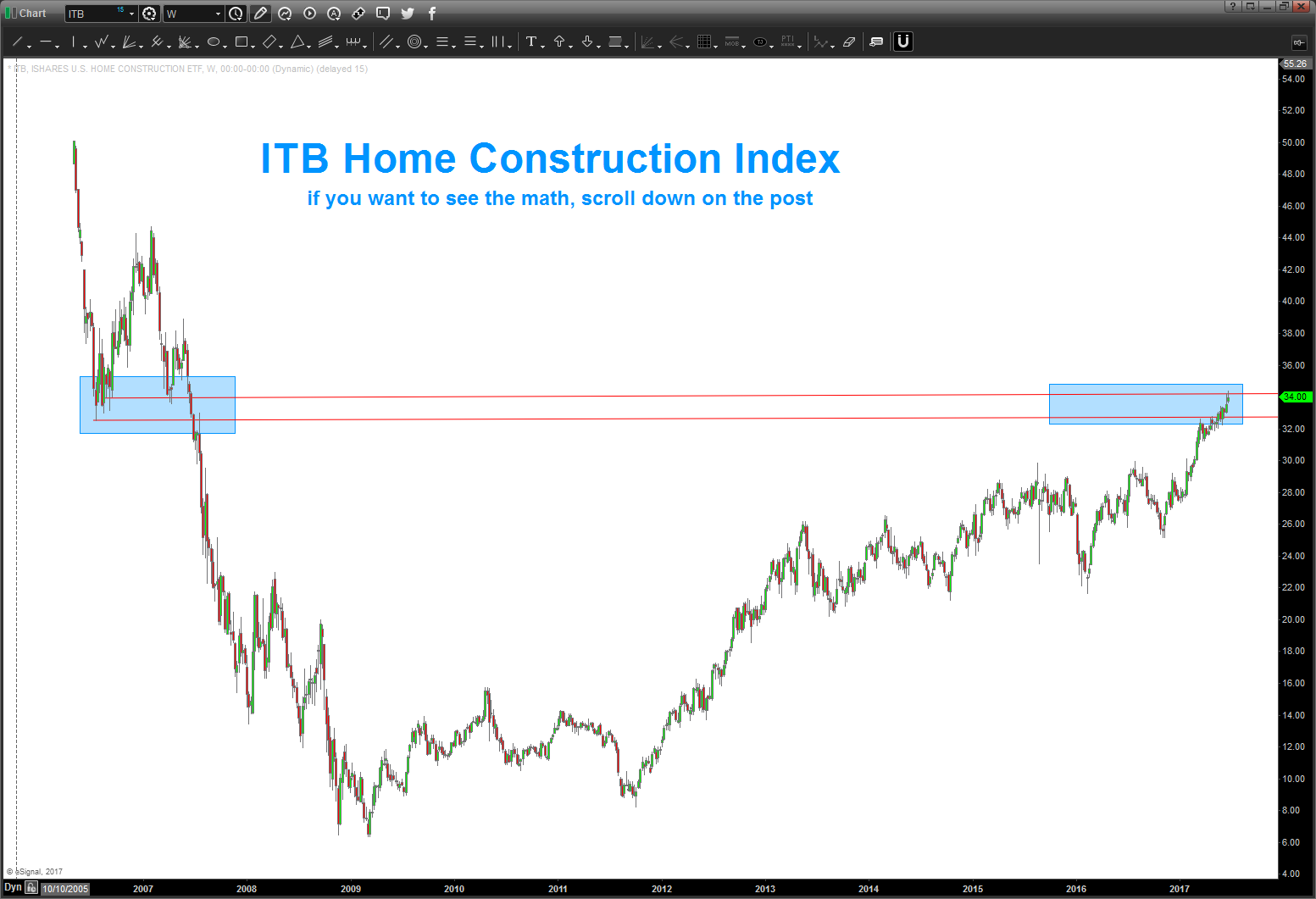

2 Housing Sector ETFs That May Be Topping

The housing sector is very sensitive to interest rates. So the past several months have been pretty darn good to stocks related to real...

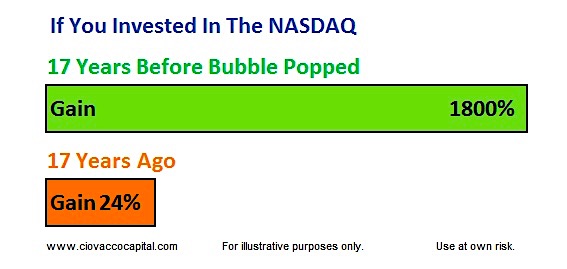

2017 vs 2000: Are Equities Really In A Bubble?

Bubbles Are Characterized By Building Euphoria

During investment bubbles, the gains over the years reach near-silly levels. For example, the last 17 years of the...

S&P 500 Weekly Outlook: Investors Look For New Leadership

In this week’s investing research outlook, we analyze the technical setup of the S&P 500 Index (INDEXSP:.INX), key stock market trends and indicators, and discuss emerging...

Sector Update: Health Care and Biotech Stocks Hot

I recommended the Health Care Sector ETF (NYSEARCA:XLV) in my June 8th "On The Mark" newsletter, predicting a short-term move up to the 79/80 area.

Today...