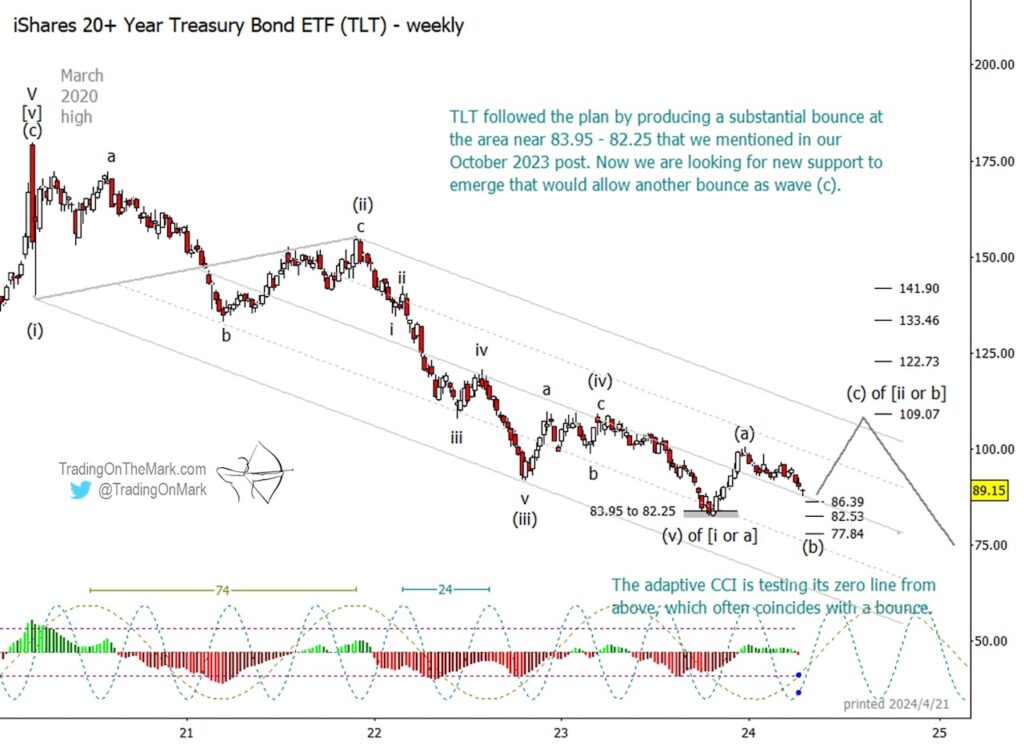

If you made use of the Elliott wave support area we identified in our October post, then you probably caught a good trade in treasury bonds via the iShares 20+ Year Treasury Bond ETF (NASDAQ:TLT) that we charted.

Now we’re watching a similar setup for another bounce that could start from nearby.

We believe TLT completed a major Elliott wave downward pattern segment late in 2023, and we’ve been following the progress of an upward corrective move out of the low. The rally that we alerted readers to in October was probably the first segment of the correction in treasury bonds, which we have marked as upward wave (a).

Traders can now evaluate the subsequent retracement wave (b) for signals that the next upward wave (c) of the correction is ready to begin.

An appealing Fibonacci-based price support waits nearby at 86.39, although it’s conceivable that wave (b) could retrace as far as 82.53 or even 77.84 before finishing.

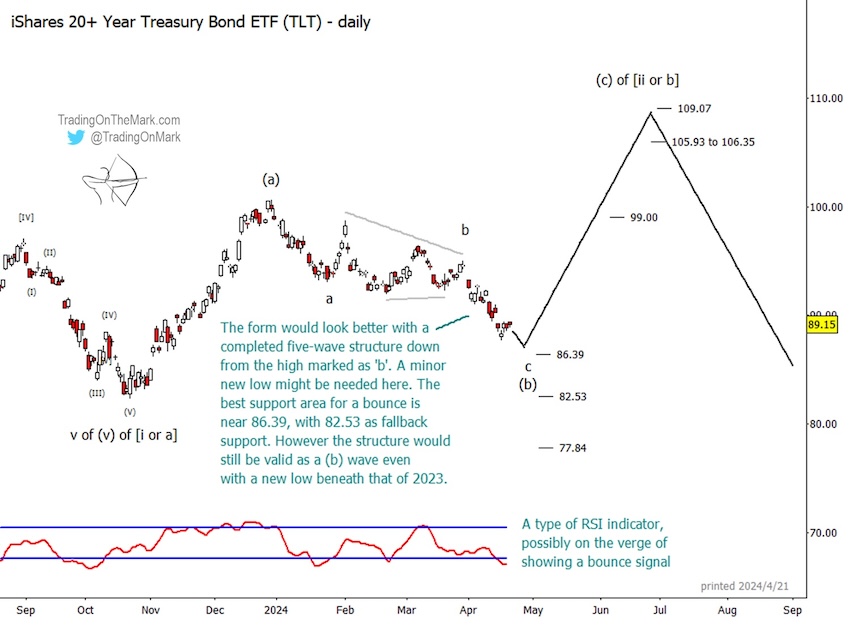

On the daily chart shown below, the decline from the point we have marked as ‘b’ does not yet appear to include five small sub-waves, and thus we think there is room for TLT to make at least a minor lower low nearby.

If treasury bonds / TLT begins to climb, then the best target for upward wave (c) is probably 109.07. The rally should consist of five sub-waves, and resistance near 99.00 and the zone from 105.93 to 106.35 could demarcate the moves.

As we showed on the weekly chart, higher “stretch” targets for the rally can include 122.73, 133.46 and 141.90. Those areas would come into play if the expected rally hasn’t yet produced a complete five-wave structure by the time price reaches the 109 area.

Twitter: @TradingOnMark

The authors may have a position in the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.