Stock to Bond Ratio Testing Important Price Support!

It's important for investors to follow stocks and bonds. And even more important to understand the relationship between them.

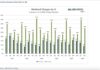

Today, we highlight the past 20-years...

Bond Yields Decline An Early Warning Sign For Market?

Typically interest rates fall when the economy is slowing and inflation is dead (often a result of a slowing economy).

Today, we are beginning to...

What Is Happening with Government Bonds and Junk Bonds?

Statistically, one of the most bullish days of the year, July 1st was rather surprising.

Our family of stock market ETFs was not so happy on...

Junk Bonds versus Government Bonds: Why It Matters

When stocks are in a bull market, we tend to see assets like growth stocks and junk bonds perform well as investors are in...

Could Interest Rates Fall Into The 3’s Again?

Inflation and interest rates seem to be hot topics in 2024.

So today we take a look at the 10 Year US Treasury Bond Yield...

Federal Reserve Outlook Changes Slightly: What’s Next?

Summary of the Federal Reserve Decision (Kobeissi Letter):

1. Federal Reserve leaves rates unchanged for 7th straight meeting

2. Officials raise 2024 inflation forecast from 2.4%...

Long Bonds Rally: Should Investors Pay Attention?

After a huge down move that began in December 2021, the long-dated treasury bonds ETF (TLT) has had a few shallow short-covering rallies, but...

Is German 10-Year Bond Yield Nearing Historic Breakout?

Government bond yields and interest rates have been rising all around the world. And investors aren't quite sure what to make of it.

Perhaps there...

Why Active Investors Should Follow Junk Bonds

Bonds issued by companies with a credit rating of BB or lower by S&P or Fitch, or Ba or lower by Moody's, are considered junk...

Treasury Bonds Nearing “Bounce” Buying Opportunity (Elliott Wave)

If you made use of the Elliott wave support area we identified in our October post, then you probably caught a good trade in treasury...