Recently there has been a surge of articles pertaining to rising inflation as the Federal Government plans to add more debt with upcoming spending from the infrastructure bill and another stimulus package.

Inflation has also become an increasingly touchy topic.

Wednesday, Janet Yellen (Treasury Secretary) backtracked her recent comments about how it might be necessary to increase interest rates to keep the market from overheating.

However, fear of inflation could still be why investors are hesitant to add more money to the current market. If so, it can also be seen in the reluctance of the stock market indices to clear/hold over recent highs.

Additionally, two of the major stock market indices are having trouble at their current price levels with the Russell 2000 (IWM) back underneath its 50-DMA at $223.28 and the Nasdaq 100 (QQQ) floating not far above its 50-DMA at $308.99.

However, if the markets’ weakness stems from fear of rising inflation, Mish has successfully stayed ahead of the curve with her repeated trade picks in commodities going back to the beginning of the pandemic.

More government spending paired with an increasing deficit made room for commodities to flourish, like the Corn ETF (CORN), Sugar ETF (CANE), Gold ETF (GLD), and Investco Agricultural Fund (DBA).

With that said, commodities that were thought to decrease in value under the new administration are making push upwards.

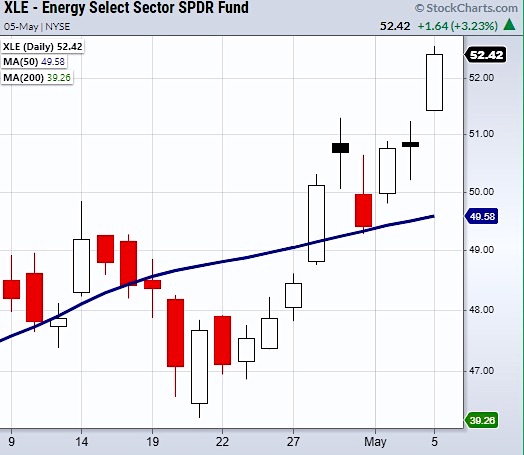

One sector is the Energy Sector ETF (XLE).

XLE has recently crossed back over its 50-DMA and now is making a run for highs at $54.37.

If securities continue to have trouble heading into the second half of the year and the inflation rate increases, the commodities space offers a safer play in this choppy market.

ETF Summary

S&P 500 (SPY) Resistance 420.72.

Russell 2000 (IWM) Watching for second close under 223.38 the 50-DMA.

Dow (DIA) Doji day at new high area.

Nasdaq (QQQ) Next support at 325.06.

KRE (Regional Banks) Doji day. Support 67.41.

SMH (Semiconductors) Resistance 241.50 area.

IYT (Transportation) 269.36 the 10-DMA support.

IBB (Biotechnology) Next support 146.75.

XRT (Retail) Holding over the 10-DMA at 93.44.

Twitter: @marketminute

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author and do not represent the views or opinions of any other person or entity.