Tag: investing research

2022 Predictions For Investor Conferences & Events

The following research was contributed to by Christine Short, VP of Research at Wall Street Horizon.

Since the start of the COVID-19 pandemic, one of...

The Large-Cap Stock Market Indices Reach a Pivotal Point

With a stock market gap up on Tuesday, many traders scrambled to re-enter as they grappled with FOMO (fear of missing out).

Additionally, the market...

Steel ETF (SLX) Coiling For A Big Move!

Elevated steel prices have consumers (and investors) concerned about inflation. And whether inflation strengthens or lightens up may depend on the next move in...

Hormel’s Stock (HRL) Is Struggling As Important Earnings Date Approaches

The following research was contributed to by Christine Short, VP of Research at Wall Street Horizon.

Corporate Earnings - Weekly Executive Summary:

- A household...

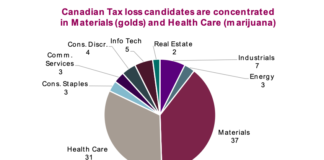

Tax Loss Selling May Lead To Small Cap Stocks Out-Performance

‘Tis the season for tax-loss selling: an annual rite of passage for both seasoned investors and investing neophytes.

When the days get darker and...

Corporate Earnings Paint Robust Picture Of US Market

The following research was contributed to by Christine Short, VP of Research at Wall Street Horizon.

Key Takeaways

- Retailers reporting better than expected results, say...

COVID-19 Shakes Up Fitness and Health Club Industry

Fitness is an important part of our lives. Many of us participate in physical activities to relieve stress and stay healthy.

Gyms are an important...

Bitcoin and Cryptocurrencies Undergoing Healthy Price Reset

Pretty much everyone in crypto is hurting this week, with the overall Cryptocurrency market cap decreasing by over $300 billion since Sunday 11/14.

The first...

Is Carrier Global Stock Price Set For New Highs?

Carrier Global stock (CARR) appears to have ended its 2-month correction with the recent turn higher.

Initial confirmation came when the stock price recently broke...

Platinum Futures Breakout Points To Higher Price Targets

The rally in platinum futures prices received another bullish confirmation this week.

As you can see on today's chart, Platinum futures broke out over near-term...