‘Tis the season for tax-loss selling: an annual rite of passage for both seasoned investors and investing neophytes.

When the days get darker and the mornings a little chillier, something curious begins to occur—that reluctance to sell those losing positions that didn’t work out flips to a willingness to discard those biggest losers, almost as if price become irrelevant.

So why wait to the end of the year? Well, it’s complicated, but the decision-making process surrounding selling investments that didn’t work out centers around regret.

Watching a stock continuously trend lower can be a painful gut- wrenching experience, especially when you feel you were right and everyone who is selling is acting irrationally. This can continue for some time and continue as a blemish on your portfolio. We’re hardwired to avoid the feeling of regret as much as possible and can go to great illogical lengths to avoid the feeling. It’s classic loss aversion, a prevalent behavioural bias that leads all of us to avoid pain. In portfolio land, that means losing money. To avoid experiencing the pain of a “real” loss, investors often continue to hold onto a losing investment far too long. In your subconscious, if not your conscious, it’s easy to think a loss isn’t a loss as long as you don’t sell—because there is always a chance. Funny, winners don’t work that way.

This reluctance to sell your losers fades this time of year as investors tally their realized gains to see what this the current tax situation will be. With major indices up over 20% year to date, there should be no shortage of gains, and tax minimization strategies can offer some relief. Death and taxes are the only two certainties in life—fortunately tax-loss selling can at least help with one of them.

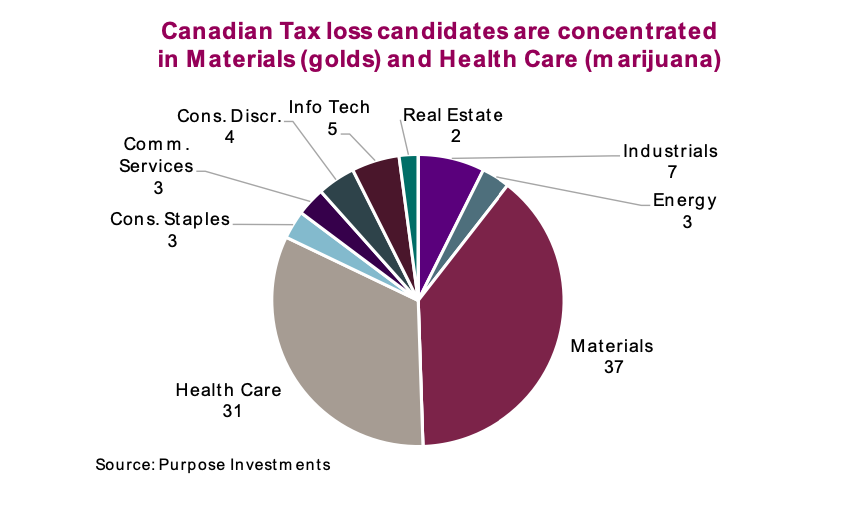

Looking through the list of companies with a market cap over $100m that are down over 20% from their average two-year price, what jumps out is that most of the prime tax-loss candidates are small cap companies and clustered within a few select industries. Out of 95 companies, the average market cap was $652 million and just 11 are over $1 billion. Of those, half are cannabis companies, and the remainder is made up largely of precious metal companies. Weed and gold companies make up the overwhelming majority of the tax-loss candidates list. Recent performance of our prime candidates also supports the idea that they have been facing elevated selling pressure. The average one-month performance as of November 23, 2021, was -12% compared with the Toronto Stock Exchange at -1%.

Investment implications

The market is made up of thousands of individuals making thousands of decisions for thousands of different reasons. It is this ‘mob’ that then influences the price of stocks, bonds, etc. Attempting to ascertain the mood or next move of this crowd is near impossible, except in unique situations such as tax-loss selling time. Taxes distort rational economic behaviour. This time of year, that distortion is likely heightened selling pressure on tax-loss candidates. And where there is a distortion, there is an opportunity.

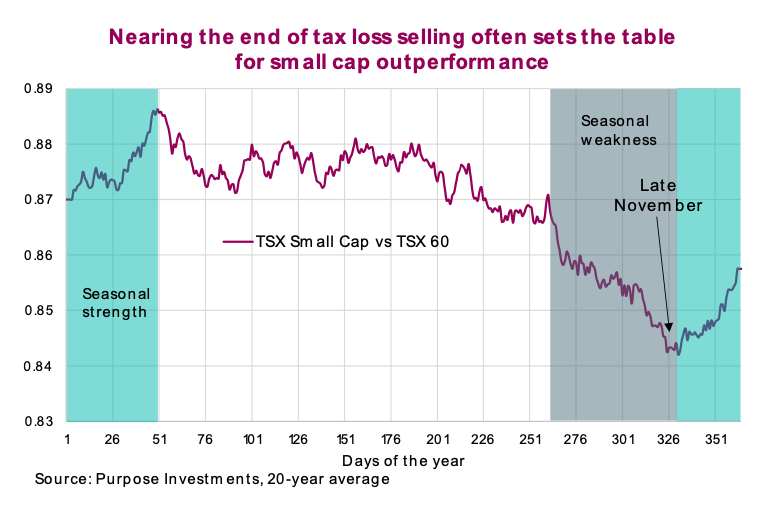

This distortion can be seen in small caps. A large cap company, say Barrick, that is a tax-loss

candidate probably won’t see its price pushed around too much because of some tax-motivated

sellers. It’s too big and too liquid. As you move down the size spectrum and liquidity becomes

scarcer, the impact of motivated sellers become more notable. This can be seen in the relative performance of small cap vs large cap. Over the past 20 years, small-cap underperformance relative to the TSX 60 begins in September and carries though to the beginning of December. From then, when the selling pressure begins to abate, small caps have historically enjoyed a period of strong relative outperformance until around mid-February.

The seasonal aspect of this trade creates an interesting opportunity to specifically target companies that are facing undue selling pressure that leads to mis-priced assets or stocks. Assuming the market is at least semi-efficient, once the tax-loss selling pressure abates these tax-loss candidates can gain back some of their lost ground. Of course, other influences may overwhelm this tax-loss selling price distortion, but that is why it is called investing. All else equal, the tax-loss selling candidates of today may enjoy a rebound once this tax-motivated selling pressure ends.

An additional note about mutual funds: Don’t forget that mutual funds are taxed differently to their end investors. In years of big gains, it is important to check with fund companies before buying near the end of the year to see if there are gains that will be distributed to unit holders at the year-end. Late-in-year buyers may be faced with tax bills on gains that they did not participate in. Surely there’s a better way!

Source: Charts are sourced to Bloomberg L.P., Purpose Investments Inc., and Richardson Wealth unless otherwise noted.

Twitter: @ConnectedWealth

Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.