Tag: financials

Bearish Trigger For Financials Sector ETF (XLF)

About a month ago, we highlighted a bearish divergence in the semiconductor ETF (SMH) that indicated a potential rotation away from this growth-oriented group into more...

Chart of the Week: Financial Sector ETF (XLF) Faces Key Resistance

With all eyes on the Fed this week, along with all of the other macro influences, I’m digging into the charts and noticing the...

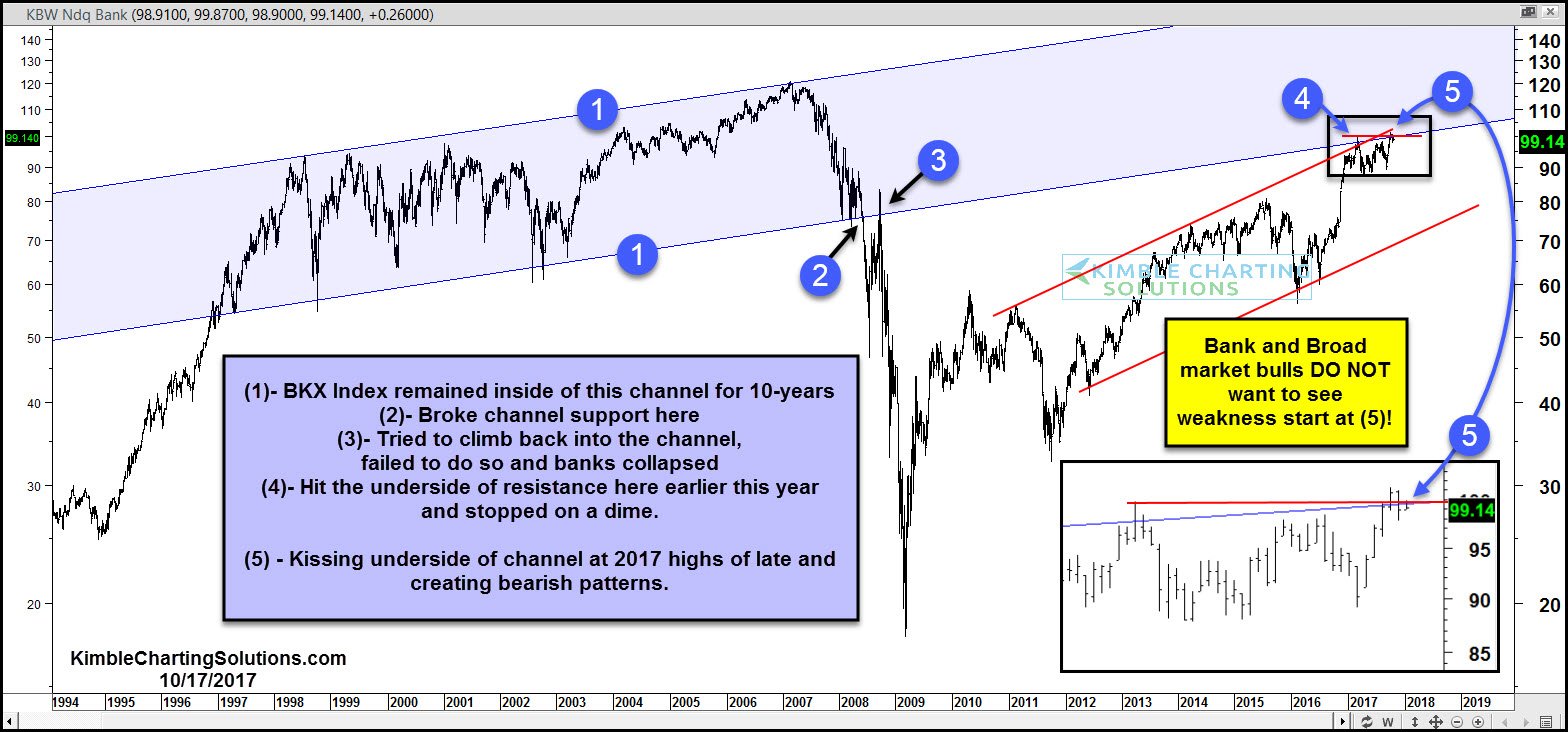

Investors: What Happens Next For Banks Stocks Is Important

The financial sector and banks stocks have always carried weight in the markets. The markets tend to perform well when they are leading, and...

Corporate Credit Markets: Party Like It’s 2017!

It has been quite a while since I have written about the state of the corporate bond market.

Longtime readers know that I follow the...

Financials Sector (XLF) Showing Signs Of Strength

One of the biggest things happening in the market right now is the move seen in financial stocks relative to the broader market (i.e....

Smart Money Positions For Rotation Into Financial Stocks

Smart Money Option Traders Position for Rotation to Financial Stocks / Sector

Financial stocks, Banks and Insurance in particular, have been one of the places...

Global Divergence Warned Of Pullback In U.S. Bank Stocks

In May, Arun Chopra, CFA, CMT and I noted the following market divergence between U.S. bank stocks (XLF) and Deutsche Bank (DB).

We were concerned that...

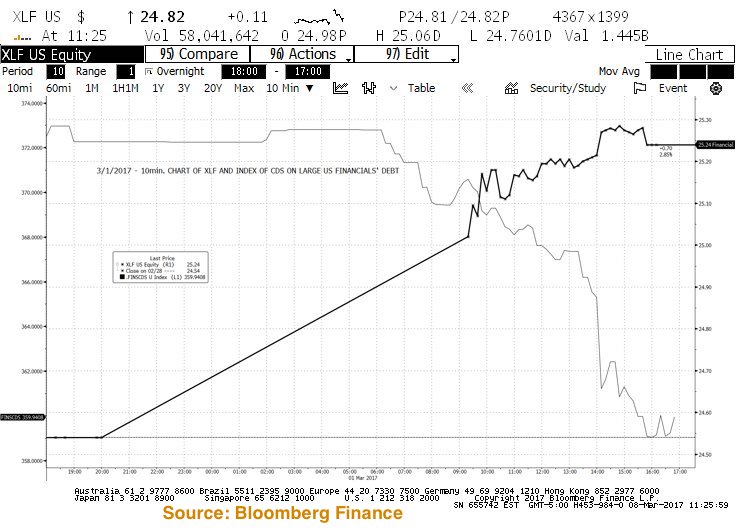

Financial Sector ETFs Fall Flat Despite February Rally

Perhaps one of the biggest surprises of the 2016 correction has been the overall depressing price action in bank stocks, financial services, and financial...

Did The Banking Sector Peak? Here Are The Implications

The financial and banking sector has been hard hit over the past month. But it shouldn't be surprising given the recent stock market decline...

Investors Bottom Fishing In Basic Materials And Financials

S&P 500 Index (SPX) Forms A Hammer

Last Wednesday, the stock market made a short-term bottom, declining sharply before reversing course. Crude Oil prices also...