It has been quite a while since I have written about the state of the corporate bond market.

Longtime readers know that I follow the corporate credit markets very closely as the main tell of what drives equity markets. And considering the noise surrounding the markets, it probably a good time for a 2017 market update.

Without diving into the details of why I believe credit leads stocks, the basic thesis is this: the Fed’s quarterly Flow of Funds Release Z.1 – Table F.223 – shows beyond dispute that since the end of the credit crisis the only net buyers of equities have been companies themselves, either through stock buybacks, or buying each other’s stock in M&A transactions.

From 2007 through Q3 of 2016 companies have been net buyers of more than $4 trillion of stocks. By contrast, all other market participants have been net sellers of approximately $200 billion worth of equities.

None of the net buying of stocks by companies would’ve been possible without the corporate credit market funding the buybacks and the mergers and acquisitions. For the record, I do not dismiss fundamental analysis, technical analysis, or macro trends that can disrupt the economy and by consequence the markets. However as long as credit remains open to companies, the dynamic of the last eight years overwhelmingly suggests that the bull market in equities will continue despite the many inevitable pullbacks – some probably very sharp and very scary – that we have seen, and will certainly see in the future.

So where does corporate credit stand now?

The short answer is that over the last several months it has been on one of the most torrid runs of the post crisis era.

- Corporate issuance of nearly $1.7T in 2016 again exceeded all years since 2009;

- If March corporate bond sales continue at the pace of the first few days, annual issuance will hit the $500 billion mark before the end of the first quarter;

- Despite the massive supply of new bonds, risk spreads for both investment-grade and high-yield bonds are getting squeezed to multiyear lows;

- New large bond issues are routinely oversubscribed multiple times over, and almost always bonds price at yields below the morning’s Initial Price Talk;

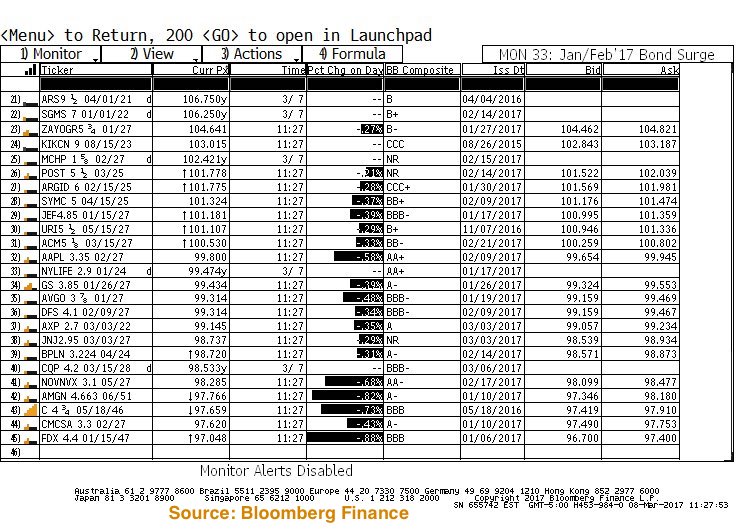

- Bond managers who buy into new issues are routinely rewarded as prices exceed par shortly after the bonds start trading in the secondary market. This of course creates a positive reinforcement loop for those managers, especially those who run leveraged funds; see chart below: secondary market pricing of sampling of large bond issues sold in January and February

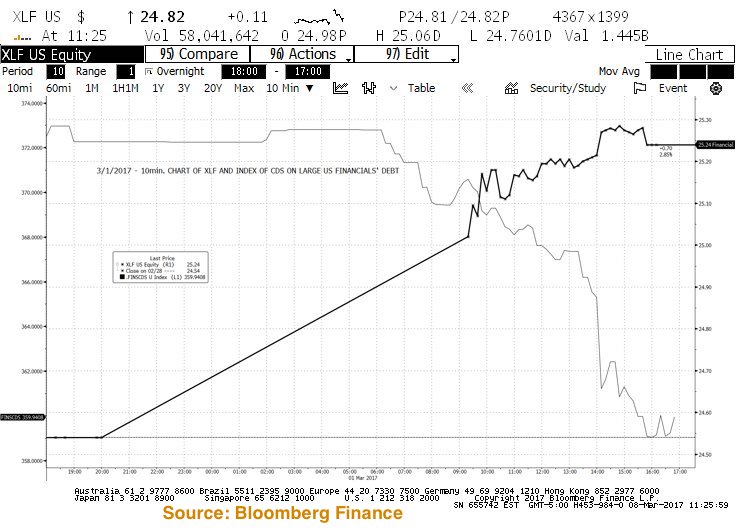

- On the credit default swaps (CDS) front, the story is the same. Spreads on Investment-grade and high-yield CDS indices have collapsed to near pre-crisis lows, allowing natural buyers of bonds to purchase cheap “insurance” on their holdings, and forcing credit bears to painfully unload their long CDS positions, and/or to become stock buyers as they try to hedge out their exposure in the far more liquid equity markets. This was in plain view last week when a sudden spike lower in the CDS of large US financial institutions led to a more than 3% pop in the stocks of those banks.

So, when does this bond-buying orgy end or at least pause? As is always the case when discussing finance and investments, that question can only be answered in the context of one’s timeframe. Like all securities, bonds are susceptible to becoming overbought; or, as a follower of DeMark technical analysis would describe it, buyers and sellers inevitably reach points of exhaustion. Through those lenses, spreads on IG and HY bonds and CDS’ are indeed reaching downside (tightening) exhaustion levels (a few more weeks to go maybe?). Therefore, it should not surprise anyone if sooner than later bonds make headlines for heading in the wrong direction. Bond scares have occurred almost every year since 2009 and there is no reason to think air pockets won’t show up again, maybe even more often than in the last few years.

However, no matter how frightening bond corrections will be (and in the summer of 2011 and in January of 2016 the European crisis and the meltdown in energy scared the bejesus out of credit players and financial markets as a whole), as long as the large buyers of credit – mostly pensions, insurance companies, and other institutions which must match their assets to long dated liabilities – continue to receive more and more money to invest, they will eventually return to the credit markets and rip both bonds and – by extension stocks – back to the upside.

These happy days will only end when the bond buyers run out of money, and for now that notion could not be further removed from the facts.

continue reading on the next page…