Based on data from Preqin, Bloomberg, and Pension & Investment Magazine, toward the end of 2016 private equity firms were sitting on approximately $860 billion of uninvested cash. A large segment of these private equity funds are buyers of credit and credit related instruments on behalf of their clients, and almost all of them employ some kind of leverage (some A LOT of leverage). Even assuming these firms ultra–conservatively lever up only 2x, and that only 50% of their assets are earmarked for the credit space, $860 billion would be enough to absorb all the NET new bonds (i.e. issuance net of bonds refis) sold in 2016, and leave more than $100B to spare (Morgan Stanley Corporate Credit Chartbook, Mar 6, 2017).

More importantly of course, the flow of new monies from pensions to various investment funds continues at a staggering pace. Again based on Bloomberg and Pension & Investment Magazine, just during the month of February investors committed $11.5B to new investments, and 64 companies have disclosed in their 10K filings that they will add an aggregate $26.9 billion to their pension plans.

So, for the here and now, is it all puppies and unicorns in bond land? Of course not.

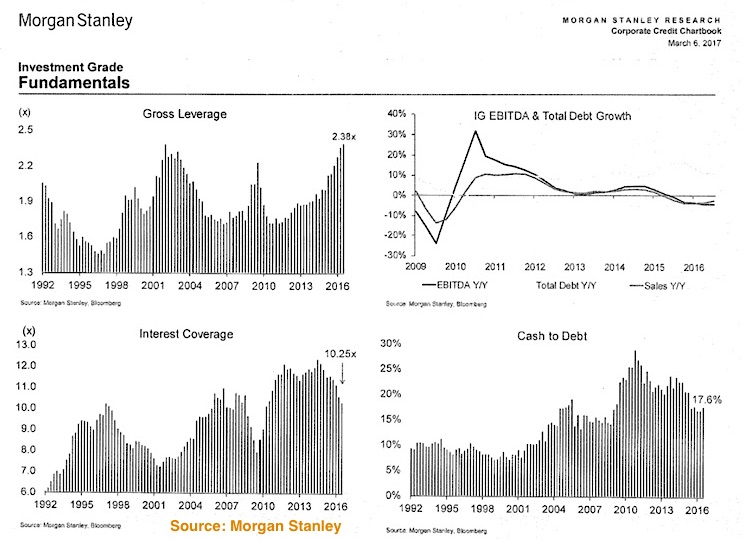

Gross leverage ratios of investment-grade companies are revisiting the highs of 2002/2003, and while the debt load grows, albeit at a slowing pace, EBITDA growth has been downright negative over the last couple of years. That is not a good combination in the long-term. Somewhat offsetting the high leverage, one can point to interest coverage levels only a bit above the historical average, and cash to debt ratios on companies’ balance sheets remain at a healthy level. (source: Morgan Stanley Corporate Credit Chartbook, Mar 6, 2017 – see slide below)

Also worth noting is that high leverage, while obviously disastrous once the credit cycle ends, alone does not tend to be sufficient to slow down corporate treasurers’ financial games. Structured finance was invented to make liabilities disappear from balance sheets, and, for example, today we saw Verizon issue a 10-figure ABS backed by payment plans owed on cell phone hardware. Dodd–Frank may have preclude banks from stuffing their money market accounts with these “alphabet monsters”, but rest assured that as this cycle matures any entity not under strict financial regulations will be more than happy to again embrace these instruments of financial alchemy.

In summary, the corporate bond market is in full pedal-to-the-metal mode; the drivers of this credit up-cycle do not seem to be anywhere close to exhausting themselves. There will be ups and downs triggered by headline risk, the Fed, the economy, geopolitics, and virtually anything else that can keep you awake at night. Of course this party will eventually end (and I mean EVENTUALLY….), and the reckoning this time will probably make ‘08 and ’09 feel like a walk in the park. Until then, standing in the way of this juggernaut may make for sexy click-baiting headlines, but will probably be as financially costly as overstaying your welcome once the party ends.

Thanks for reading.

Charts and data sourced to Bloomberg Finance and Morgan Stanley.

Twitter: @FZucchi

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.