Tag: fibonacci support levels

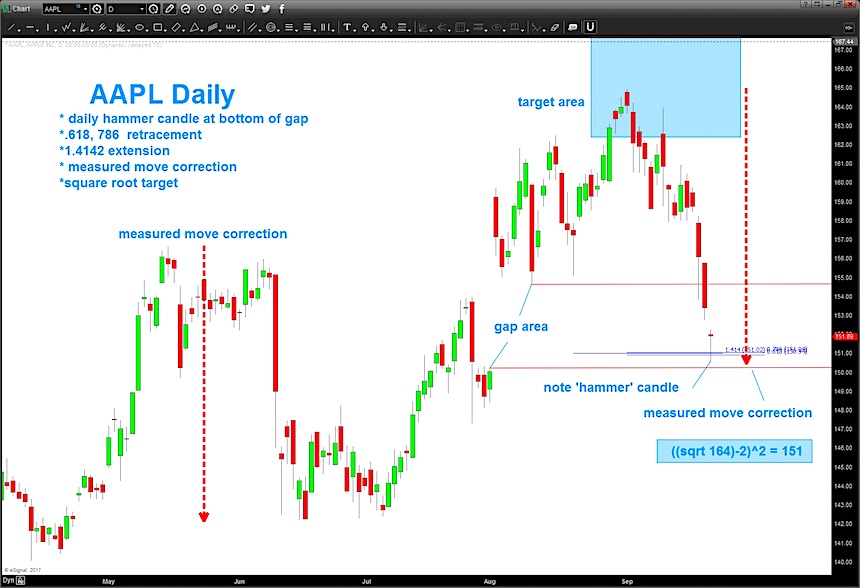

Apple (AAPL) Stock Chart: Why Bulls Need $151 To Hold

Back in mid-August, I discussed why Apple (NASDAQ:AAPL) may be nearing a top. I offered a big picture look at Apple's chart along with...

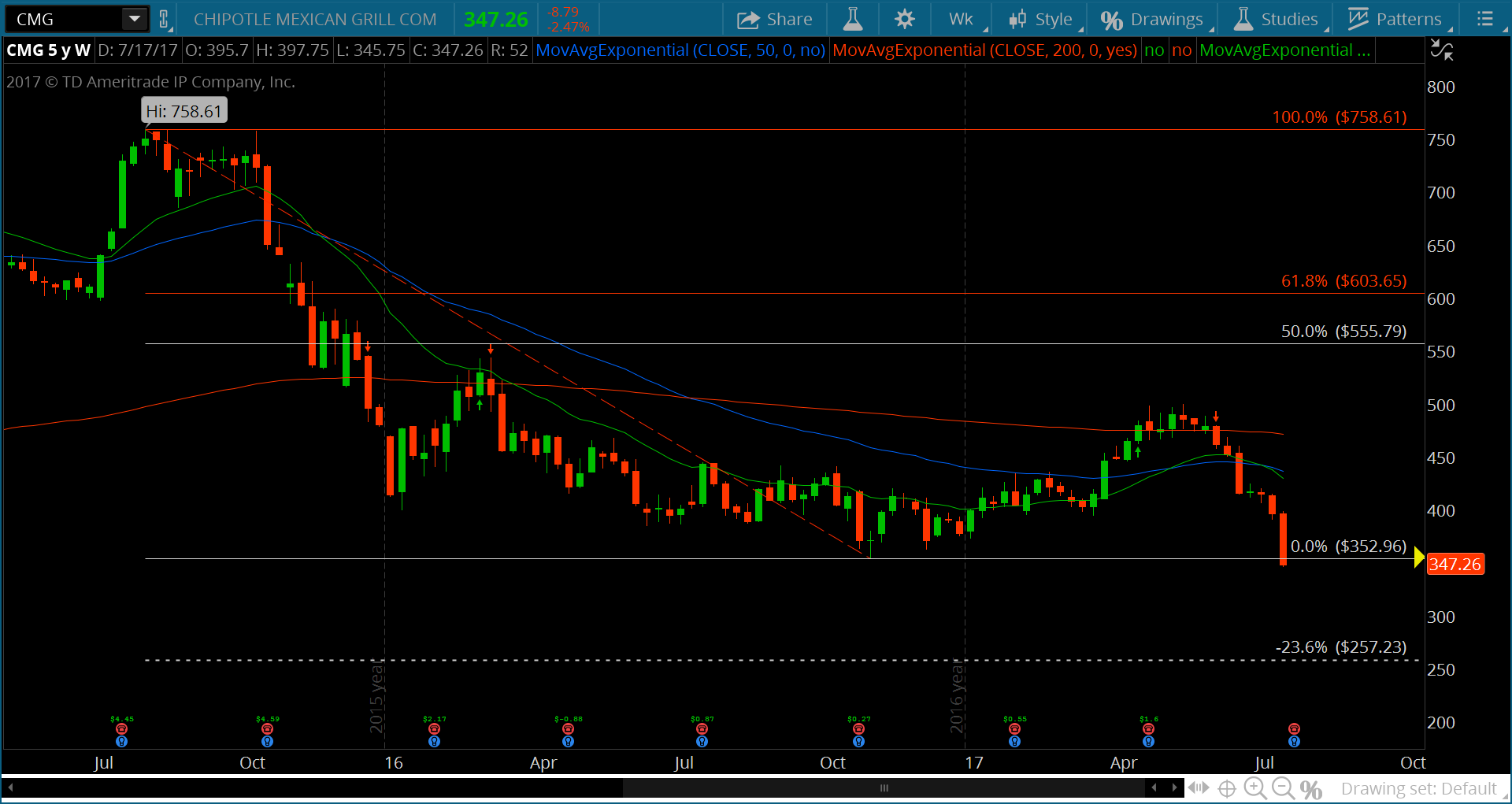

Chipotle Stock (CMG) Update: Long-Term Price Target At $257

Chipotle’s stock price (NYSE:CMG) broke key price support recently and this should open up a new wave lower.

But traders should use caution on the...

S&P 500 Update: Navigating The Choppy Price Action

The choppy price action on the S&P 500 (INDEXSP:.INX) continues... Prices reversed higher today following a rough week that saw the index close on...

Gold Update: Can The Yellow Metal Get Up Off The Mat?

Since the presidential election, there has been relentless selling going on in the gold market. Last Thursday, I highlighted Gold as being oversold and...

S&P 500 Technical Update: Are You Confused Yet?

My hiatus from writing is officially over. And I can't say that I missed a lot. At least from a price perspective. The S&P...

Crude Oil Looks Lower: New Downside Price Target

The Crude oil market has garnered a lot of interest over the last year. Much of it has to do with its steep and...

Stock Market Update: $SPX Fibonacci Price Levels To Watch

Less than a month ago, I pondered the question "Is It Time To Wave Goodbye To the Bull Market In 2016?". In that post,...

Crude Oil Declines Into Major Fibonacci Price Target, Rallies

Crude oil futures prices dipped below $27 per barrel last week before recovering with a late week rally that recaptured the psychological level of $30.

That...

Will Investors Say Goodbye To The Bull Market In 2016?

Hello 2016, goodbye bull market. Or is it just another market correction?

Markets move in 3 directions: up, down and sideways. Let’s go take a...

S&P 500 Update: The Troops Are Lagging The Generals

During the first week of November, with the S&P 500 in a resistance area (2,100 – 2,135) that has produced many, many failures, I...