With all the news flying around, we have found incredible confidence in our trading strategies by following the technical picture.

This is the fourth week I have covered the Economic Modern Family or stock market ETFs for my weekend update.

And the ETFs have done its job.

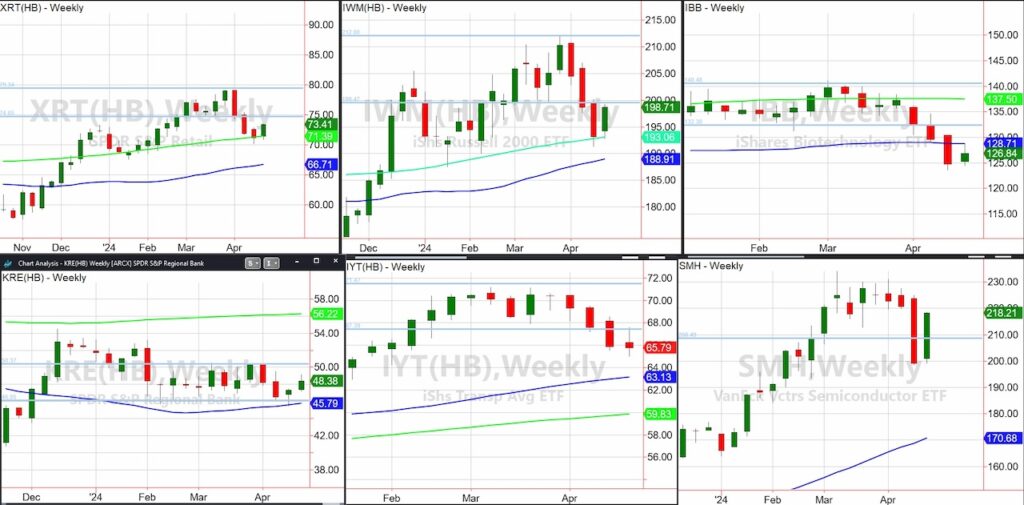

From 4 weeks ago when Granny Retail and Granddad Russell sold off hard after failing to take out the weekly channel highs-

To

The week prior when both held key weekly moving averages-

To

This past week when Sister Semiconductors Sector ETF (SMH) after Google and Microsoft earnings, took the lead again as the only member to clear back through the weekly channel lows.

The Family got us cautious, prepared us for a correction, then a bounce and now-how do we prepare for this week?

Let’s talk about the Semiconductors Sector (SMH) before we move on.

If it weren’t for our Wonder Woman, would we even be covering the rest of the Family’s potential to rally?

After the spectacularly horrible red candle a week before, this week, with all the fuss, it is still only an inside week.

The green candle showing this past week’s trading range is inside the trading range of the week before.

The best part of the chart is that SMH cleared back into the weekly channel. Now it has more work to do.

Maybe NVDA saves the day?

Looking at Granny XRT-this pop you see off the 200-weekly moving average is a great start.

But is it enough?

Keep $75.00 in mind as XRT MUST clear that level to continue the march higher.

As for the rest of the Family,

The Russell 2000 IWM also had an inside week, holding the 200-WMA and finding resistance at the weekly channel bottom.

Biotechnology IBB, another inside week, is the naughty child in the Family. If IBB can clear the 50-WMA (blue) that would be a positive.

The biggest concern for this week is Transportation IYT.

Basically closing unchanged for the week, a further slide this week will send a red flag.

While last week we were friendlier coming into this past week partly on the heels of relative strength in the Regional Banks sector KRE, this week we will watch IYT CAREFULLY.

We have seen the Family throw curve balls from what bottoms first to what tops out first.

IYT Transportation is super important in gauging the economy and next moves in the market.

Now, isn’t that a lot easier than trying to track interest rates, inflation, economic statistics, earnings, and the media talking heads?

Twitter: @marketminute

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author and do not represent the views or opinions of any other person or entity.