This week was filled with more earnings reports headlined by some of our own companies, like Fiverr, travel companies such as Airbnb (non investment), while also seeing the divergence between Starbucks and Dutch Bros (big!).

We also got jobless claims, ano while it was a single date point and one that is historically volatile, we think it could be the early sign of a cooling jobs market. This supports our view that the FED can get an all clear to cut by Q3 as economic activity moderates. Now onto the data!

Summary:

Fiverr Leading In Organic Traffic / Earnings Beat and Raise

Shopify Suggests Consumer Is Strong / Balances Growth and Profits

Airbnb Prices Down, Profits Up / Good Sign For Inflation

Fiverr Continues to Execute. Beat and Raise, Showcased via Best in Class Traffic

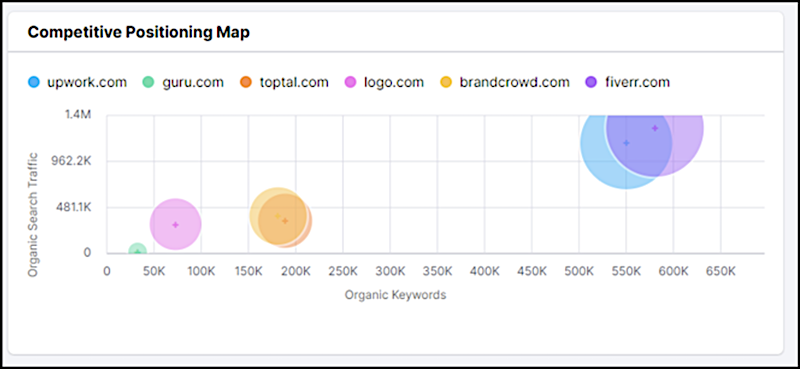

Fiverr reported earnings this week and beat their guidance both on the top line revenue along with bottom line profits, while also increasing their full year guidance. Spend per buyer rose 8%, showing that their efforts to move into higher valued buyers is taking place. They really emphasized AI and how the platform is well suited to capture some of the opportunity within AI.

One data point they shared was that they have over 10,000 experts currently on the platform and that AI transactions on the platform grew 95% year on year. They are also embedding AI into their product with their search product Fiverr Neo leading to 3X conversion for gigs. We will have more on this after we speak with the management on Monday.

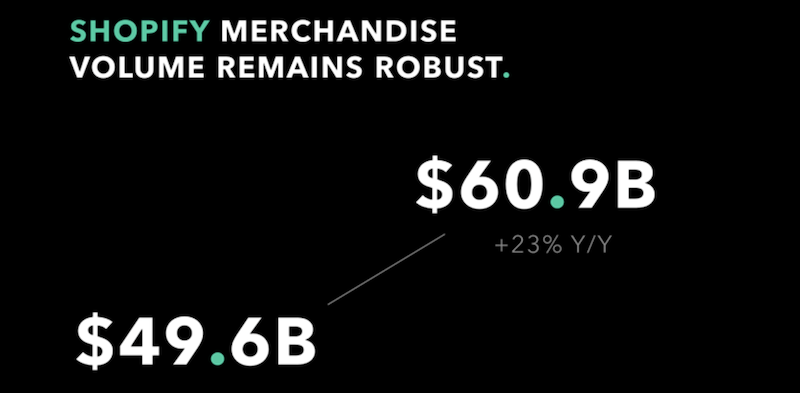

Shopify a Bellwether for Consumer Continues to Grow +20%.

Shopify also reported earnings and this is a bellwether to measure consumption trends as hundreds of billions of dollars of merchandise value flows through their platform annually. Management on the call signaled that the consumer remains resilient. This showed up with gross merchandise volume hitting $60.9 billion up from $49.6 billion or 23% growth.

The company continues to push internationally while also pushing into brick and mortar locations. So while they don’t give a complete picture of the consumer, online and offline, it is clear that online commerce continues to perform.

Strong Airbnb Report, Avg Price Down Good Signal for Inflation

Last but certainly not least was Airbnb, who reported earnings this week. While the company continues to execute well, the data extracted from this one is really around the price per stay. We saw booking value grow above 10% and nights booked grow at 10%, all while the average price for a one bedroom stay fall 2% (as mentioned on earnings call).

So while this shows that the consumer remains resilient and continues to spend, it also shows that inflationary pressures within the service economy have moderated.

Twitter: @_SeanDavid

The author and/or his firm have positions in the mentioned companies and underlying securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.