The markets were a little cranky to start 2015, as stocks headed lower during each of the first three trading days. There are all sorts of studies on January market performance, but I found Chris Kimble’s piece on the lack of a santa rally particularly interesting. The poor showing into the last week of December and first week of January definitely set the tone for a choppy month.

The markets were a little cranky to start 2015, as stocks headed lower during each of the first three trading days. There are all sorts of studies on January market performance, but I found Chris Kimble’s piece on the lack of a santa rally particularly interesting. The poor showing into the last week of December and first week of January definitely set the tone for a choppy month.

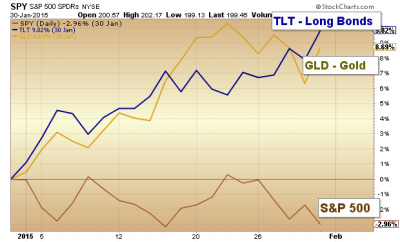

But there was so much more going on around the world: The Crude Oil collapse, an embattled Russia, European elections and discontent, a falling Euro, ECB QE, etc… You get the point. It was a busy month. So what did investors do? In short, they scooped up some Gold and Bonds and remained uncertain about US stocks. Gold is still a question mark here with concerns about a slowing economy and debates over inflation deflation, while bonds have continued to do well (a carryover theme from 2014).

But that only scratches the surface. I hope you will take a few moments to review some of our best research posts from the month of January in our latest installment of The Best of See It Market. This is your chance to check in on our work – please feel free to provide feedback/comments any time. We greatly appreciate your readership.

Stocks & Bonds:

- 3rd Worst Santa Claus Rally Since 1950: Reason For Concern? by CHRIS KIMBLE

- 3 Reasons For Recent Stock Market Volatility by ANDREW NYQUIST

- Philippines ETF (EPHE) A Strong Emerging Markets Play In 2015 by MIKE ZACCARDI

- Bank Stocks Near ‘Make It Or Break It” Point In 2015 by JAMES BARTELLONI

- Bullish On Apple? This Options Trade Could Net 43% In 16 Days by GAVIN MCMASTER

- Will Germany Help Lead International Markets Higher? by ANDREW THRASHER

- Market Trends & Insights: Investing Through The Big Chill by JEFF VOUDRIE

- ETF Investing: 2 High Growth Sectors To Avoid by DAVID FABIAN

- Are International Stocks Returning To Favor? by MIKE ZACCARDI

- Will The ECB Give Investors 50 Billion Reasons To Celebrate by KARL SNYDER

- Will Crude Oil Lead Stocks Lower? Or Is This Time Different? by MARIA RINEHART

- Shift In RSI Weakens Biotech Sector (IBB) by AARON JACKSON

- Why Investors Should Watch 1976 On The S&P 500 by CHRIS CIOVACCO

- Is Apple (AAPL) Ready To Breakout? by ANDREW NYQUIST

Currencies & Commodities:

- Euro Likely To Move Lower Before A Tradable Bounce by TRADING ON THE MARK

- US Dollar Chart Pattern: Countertrend Move Imminent by JAMES BARTELLONI

- Is A January Gold Rally Taking Shape? by AARON JACKSON

- Crude Oil Nearing 52 Week Lows: What’s Next For Crude? by DAVID BUSICK

- Will The Gold To Silver Ratio Peak In 2015? by ANDREW NYQUIST

- FX Pairs Spotlight: Follow That Dollar! by DAVE FLOYD

Must-Read Education:

- Using And Applying The Dividend Valuation Model by ALLAN MILLAR

- 5 Ways For Traders To Overcome Performance Anxiety by STEVE BURNS

- An ETF Selection Methodology For 2015 And Beyond by JONATHAN BECK

- Top Trading Links: Making Sense Of 2015! by AARON JACKSON

Look for another installment of “The Best of See It Market” next month. Thanks for reading.

Twitter: @seeitmarket