Introduction

In my mind, ETF selection is different from ETF strategy. ETF strategy requires choosing among different index methodologies and compositions to find the most appropriate ETF to implement your investment objective. Researching ETFs to match your investment strategy oftentimes ends with only one reasonable choice. However, there are occasions when one must choose between a number of similar ETFs. Asset allocation models in particular may run into this issue when using ETFs to implement its strategy. This is because their models are tied to benchmark indexes and there is usually a number of different, but similar, ETFs that can be used. This is where ETF selection comes in as it takes ETF strategy one step further and hand picks one from many competing ETFs with similar index methodologies/compositions. Much thanks in advanced to Rick Ferri of Portfolio Solutions for his inspiring categorization methods.

Narrowing down the field starts with understanding the playground

Let’s begin by defining the overall US ETF marketplace as about 1600 funds (and growing) with over $7 trillion (and growing) in assets. Of these 1600 ETFs about 95% of them are tracking “indexes” with a so-called passive approach to investing; while the remaining consist of the actively managed variety, with no index to track.

The primary focus of my research will be on the 95%, so that’s where I am going to focus my energy here. Simply put, an ETF is a product designed to trade like a stock and track an underlying basket of stocks, or an index. An ETF gives investors easy access to areas of the global marketplace previously with high barriers to entry, they are transparent, tax efficient, inexpensive, trade continuously throughout the day, etc. There are many benefits to using ETFs but there are a lot choices, which could confuse investors. The number one mistake would be to assume that all ETFs are designed to do the same thing. Index providers create and develop indexes and license their products to ETF companies for a fee. This is a big and competitive business as index providers and ETFs compete for assets. With 1600 ETFs and growing don’t be fooled that all ETFs are the doing the same thing.

As of this writing there are roughly 1500 ETFs that track indexes in a passive manner. What does this mean, tracking indexes in a passive manner? It means that the job of an ETF is to mimic via fair representation, not necessarily full replication, the index it has licensed to track. The problem lies in labeling everything an index as an uninformed investor is likely to believe all indexes function to capture a broad market movement in a manner such as the S&P 500 Index or the Russell 2000 Index, for example. This is far from the case. In fact, it is actually the vast minority of ETFs that track these standard benchmark indexes. This is where the confusion lies: just because an ETF is passively tracking an index, doesn’t mean that the index is passively trying to capture broad representation of a market or segment of a market. There are many ETFs whose goal is to beat the market or become a market in its own right. This is why it is so important to know the index that an ETF tracks. If you know your index, then you will know your ETF.

Know your index and know your ETF

Since an ETF is designed to track an index, it is crucial to determine what function each index is actually designed to perform and understanding its construction is great first step. This is what my research strives to do for you, so I will walk you through my thought process.

With this in mind, let’s begin by distinguishing between two primary types of indexes. There are indexes which are barometers for academic and economic research as well as measurement tools in which to base the performance of alternative strategies and actively managed funds. Securities in these indices are selected to fairly represent, a broad market/segment/industry/etc. and it is weighted by market capitalization. I will refer to these indexes as “benchmarks”. The alternative is a competing product to benchmark indexes and are structured in a way to become a market of its own or to outperform another index. They may eliminate sections of the market in order to create a new market, weight securities in an attempt to outperform another index, or just market a new product. Index composition is anything but passive, as securities are subjectively selected or excluded, and they may or may not be market cap weighted. These will be referred to as “strategy” indexes.

In order to determine if an index is a strategy or a benchmark, I believe that the securities in the index must be classified according to its reason for selection and its method of weighting. This is a method introduced to me by Rick Ferri at Portfolio Solutions and I believe that categorizing ETFs in this manner helps clarify your investment choice and simplifies the problem of labeling everything as an index.

Categorization is crucial

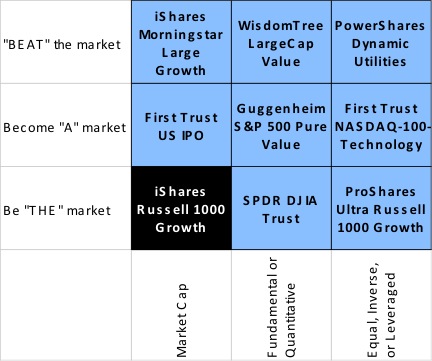

Categorizing an ETF in this manner is a crucial part to ETF strategy as well as selection. Keep in mind that when categorizing an ETF it is essentially categorizing the index which the ETF tracks. An index is defined by the method that it selects its underlying securities and how they are weighted. Let’s go over my twist on Rick’s index strategy box classification system and then I’ll show you some real world examples.

The method of selection can be lumped into three general buckets that I have labeled as 1) be “THE” market, 2) become “A” market, and 3) “BEAT” the market. These can be briefly described as follows:

Be THE market: This is to fairly and passively replicate a broad market or segment of a market, whose standards are generally used worldwide.

Become A market: Securities are screened subjectively by index providers to create a marketable product. Screening goes beyond what benchmark indexes do when segmenting by size, style, or industry.

BEAT the market: An attempt to select securities that an index provider believes will outperform a benchmark.

Index weightings are pretty straight forward. Securities in an index can be weighted based on market capitalization, on some fundamental or quantitative metric; or be equal weighted, inverse, or leveraged.

Benchmark indexes are only those that are designed to “be THE market” and market cap weighted. Everything else implements some kind of strategy. Once this categorization is complete then it’s time to get down to the business of choosing an ETF.

Table 1: Know where index belongs

Source: J. Beck Investments with inspiration by Portfolio Solutions LLC.

Table 2: Categorizing in the real world (don’t let the name fool you)

Source: J. Beck Investments with inspiration by Portfolio Solutions LLC.

If one were to invest just on name alone, then you might think that there was more than just one benchmark ETF in the table above. This could leave you investing in an ETF not designed to perform as it sounds. This categorization may be subjective and debatable, but at least it assures investors that they are getting what they paid for.

One of these boxes is not necessarily better than another, but classifying your index will help you understand your investment better.

Building a portfolio, one ETF at a time

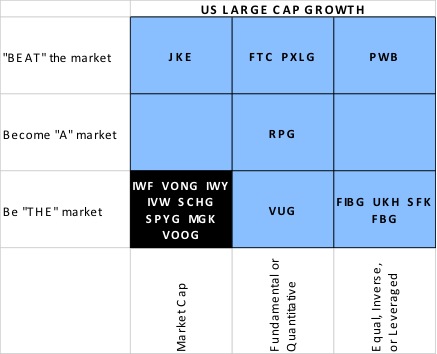

Now that I have gone over some of the basic practices in ETF research, let’s take it to the next level and use this to help choose a US Large Cap Growth ETF for a hypothetical asset allocation portfolio. To review, there are some 1600 ETFs to select from and we need just one benchmark ETF that represents the US Large Cap Growth market. Since this is an asset allocation model, we are not basing our choice on which US Large Cap Growth ETF will perform the best, but one that fairly represent this market. In other words it is market cap weighted and securities are selected to “be THE market.” We therefore need to eliminate all of the ETFs that are incorporating a “strategy”. The first step is to filter through all of the ETFs to come up with only those that broadly track the style that we are targeting.

After running my filter, I am left with 20 ETFs that broadly track the US Large Cap Growth market. My job is now to categorize each of these ETFs into one of the nine style boxes discussed in detail above. The purpose of this is to help eliminate any ETF that is not a benchmark ETF. In some cases, elimination is pretty straight forward like the two actively managed funds with no underlying index at all (Columbia Select Large Cap Growth and SPDR MFS Systematic Growth Equity). Others take a little more research. Below is a table summarizing my categorization of the US Large Cap Growth ETFs. As you can see, my research now leaves me with 8 true benchmark ETFs in the bottom left box, while the remainder can be eliminated for purposes of this example.

Table 3: U.S. Large Cap Growth ETF categorization (tickers symbols)

Source: J. Beck Investments with inspiration by Portfolio Solutions LLC.

Below lists the 20 U.S. Large Cap Growth ETFs along with their ticker symbols and underlying index. I have highlighted in blue the ETFs categorized as benchmark ETFs.

Table 4: Broad based US Large Cap Growth ETFs

Source: J. Beck Investments

Since benchmark ETFs take up relatively little space in the ETF world, it is not surprising that this categorization leaves us with just 8 benchmark ETFs (highlighted above) versus the 12 strategy ETFs. As benchmark ETFs are limited in what can differentiate them from one another, it is also not surprising that there are just four issuers competing in this segment: Blackrock, Charles Schwab, State Street, and Vanguard. Where do you go from here?

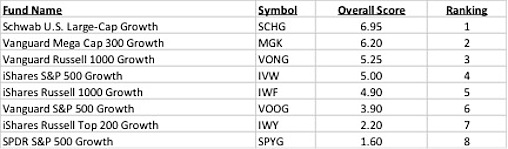

SELECTING among competing benchmark ETFs

If one were looking to invest in a strategy ETF, then the research might not need to go any further as things like costs and efficiency might not be as important as the strategy itself. However, when selecting among competing ETFs things take a slightly different turn.

All else being equal, when selecting an ETF it is important to at least compare a fund’s costs, efficiency, liquidity, and breadth to judge its merits as an investment. There are many metrics one can look at, but some of the ones that I look at are assets under management, expenses, holdings, tracking error, and trading spreads. Admittedly, I don’t account for everything, but if a choice is too close to call, then I may have to do a little more digging before making a choice. Until then, I believe that I am covering enough ground to make a conviction call without bogging myself down with too much data.

I then proceed to rank the ETFs in each metric, come up with a weighted average score and select a winner, so to speak. The overall topped ranked fund then becomes my ETF of choice for its particular segment, industry, or market. I prefer this ranking methodology largely because of its simplicity and its consistent approach across the ETF marketplace. A drawback of course is that my weightings are subjective and I have removed certain individual repulsions or convictions, like sector/country concentration for example. This is done in exchange for a consistent and more systematic approach to ETF selection. Keep in mind that this part of my ETF selection process is not to forecast a fund’s economic outlook, but rather to judge how well an ETF is constructed and trades.

So how did my model rank the 8 broad based US Large Cap Growth ETFs?

Table 5: U.S. Large Cap Growth ETF ranking

Source: J. Beck Investments

Why is categorization critical?

A question that has come up when I originally did this analysis was: Why haven’t you included the Vanguard Growth ETF (ticker: VUG)? Well it does have over $14 billion in assets, second only to the iShares Russell 1000 Growth behemoth ($23B). It also has one of the lowest expense ratios and the smallest tracking error, so what gives? I knew the answer already, but as an experiment, I included it in my ranking and sure enough it ranked #1, ahead of the Schwab U.S Large Cap Growth ETF. So, what gives?!?! The “super-growth factor” is what gives. If you read its prospectus, you will see that VUG weights its securities based on a “super-growth factor” or by analyst’s estimates for future long-term growth. By categorizing first, I realized that this is not a benchmark ETF at all, but rather a strategy ETF (see where it lands in Table 3). This doesn’t make it a bad investment, but if you are using this in an asset allocation model or labeling it as a benchmark ETF then you are making a mistake.

Categorization of ETFs should be adhered to strictly when tying asset allocation models with ETF investing strategy otherwise you will not be comparing apples to apples. Then my ranking system will allow you to select among competing ETFs.

Conclusion

Taking the time to understand the mechanics and makeup of an ETF will help you make better investment decisions regardless of whether you are investing in a strategy or a benchmark ETF. Once you narrow your choices to ETFs with similar investment strategies, my ranking methodology will help determine which ETF to use. I hope that this brief educational piece has been a good start to understanding the intricacies of ETF research.

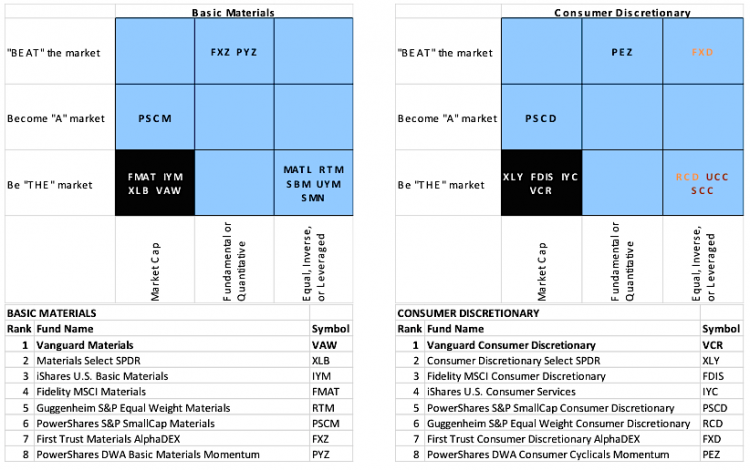

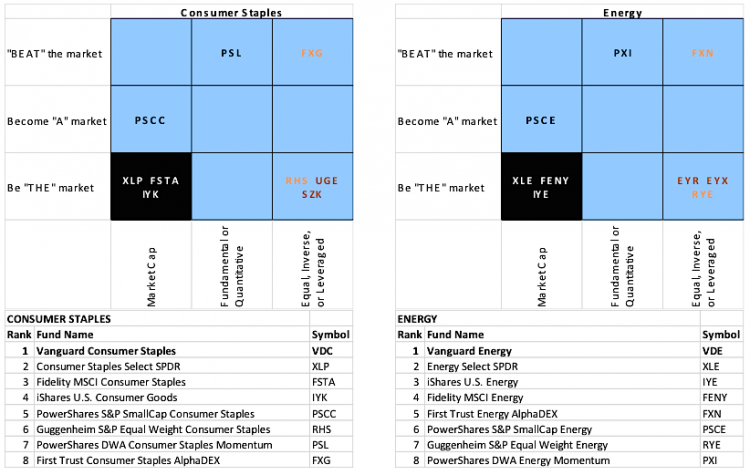

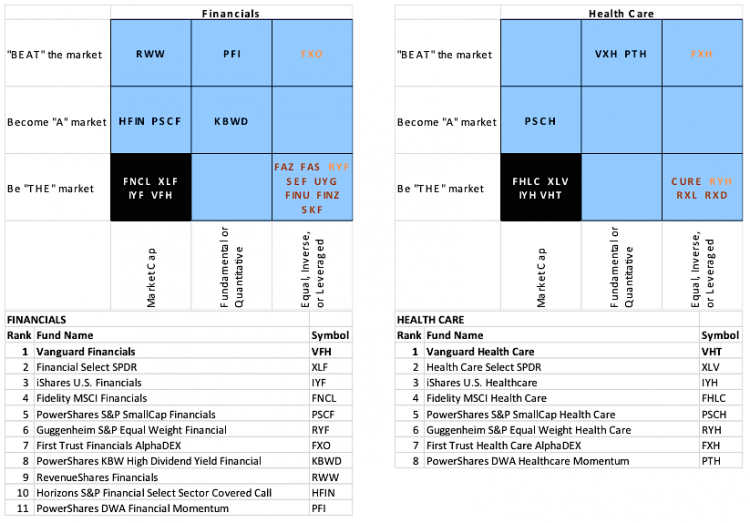

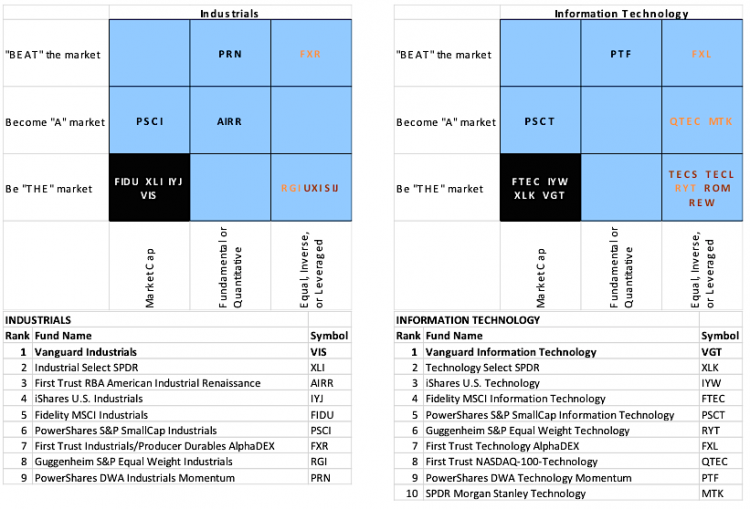

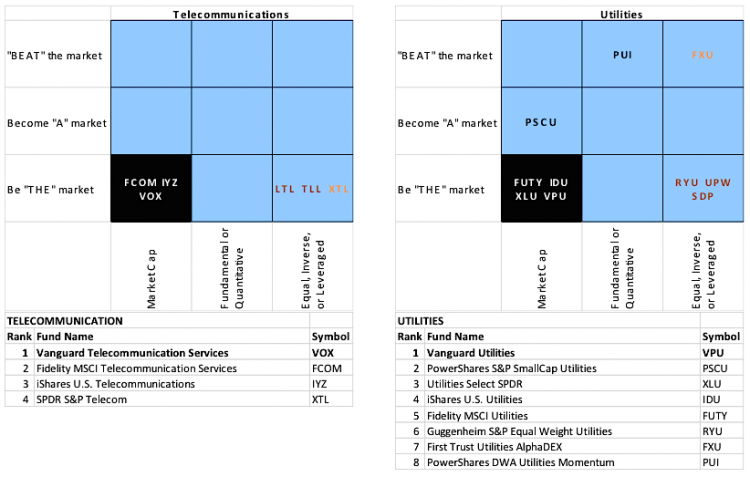

The Appendix that follows categorizes and ranks each of the 10 sectors used to make up my U.S. Sector ETF Portfolio. Both benchmark and strategy indexes were ranked as long as they were broad based US sector ETFs, largely out of my curiosity. An apples to apples comparison would need just to rank amongst competing benchmark ETFs.

A special thank you to Rick Ferri of Portfolio Solutions for introducing me to his index strategy boxes, which have been an inspiration to me.

For more of my thoughts on the 2015 financial markets, you can read my recent post: 2015 Sector Outlook. You can also read my work here on See It Market or on my J Beck Investments blog. Thanks for reading.

Follow Jonathan on Twitter: @jbeckinvest

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.