On June 12th, Goldman Sachs came out stating how bearish they are on oil.

I wrote a Daily about it on June 20th:

Bearish at the Bottom-Institutions Wrong on Oil

Not uncommon for me to stick my neck out and go against the big analysts. Heck, I have made a career out of looking at the economy and the market differently.

Plus, those who know me know that I often make bold calls.

However, not so fast on bragging rights just yet.

Nonetheless, with oil inventories hitting the tape today, it does make one wonder what planet these analysts live on?

I guess the one where the government did not drain reserves to lower costs and then neglected to replace those reserves.

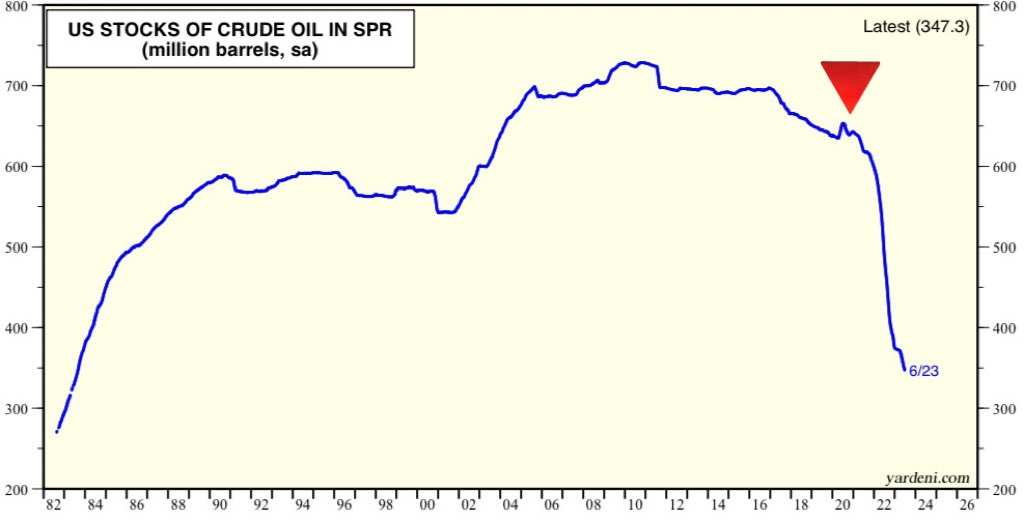

We live on the planet that this chart shows quite clearly, an alarming drop in reserves after a huge government drain.

The lowest amount of oil in reserves since 1983.

Plus, the analysts talk about a lack of demand, just as airline stocks are flying along with the Transportation Sector-another Daily featured this week.

Do Not Get Bearish While Transportation Leads

First off, note June 12th. THE LOW (so far).

Note June 20th. A rally into resistance (so far).

Hence, not bragging rights at this point.

Move to today’s price action and we see some resistance to clear over 63.00.

The Leadership Indicator is very interesting. The blue line as measured by the benchmark or red line, looks like potential change in leadership.

Should oil begin to outperform the S&P 500-not only will the Fed get concerned, but so should the deflationists.

Real Motion or the momentum is even more interesting.

The 50 (blue) sits atop the 200-DMA (green).

Momentum is gaining and could easily go back to a bullish divergence, just like it did briefly after June 20th. Momentum fell though since, so again, no bragging yet.

Last night’s Daily was about the Energy sector. What A Healthy Correction in Energy Looks Like

Maybe it’s nothing. Or then again, at the very least, it is worth watching..especially ahead of a holiday weekend.

Twitter: @marketminute

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author and do not represent the views or opinions of any other person or entity.