Tag: gold

Will Gold’s 12-Year Cycle Send It Much Higher?

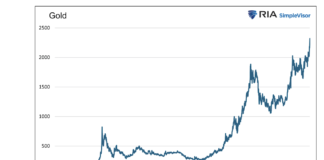

Gold spent the better part of the past 12 years trading in a wide sideways pattern.

This type of price action tends to drive away...

Gold / US Dollar Attempting Historic Bullish Breakout!

I have spent a lot of time discussing the bullish implications of Gold price patterns and the recent Gold breakout attempt.

So why not offer...

Gold, CPI and Inflation: Historical Correlations and Analysis

In the face of higher yields, higher dollar, gold has been rallying since early March-and really since October 2023 after the trough.

Although there have...

Is Gold Warning Us Or Running With The Markets?

Having risen by about 40% since last October, Gold is on a moonshot. Many investment professionals consider gold prices to be a macro barometer,...

Silver Breakout Adds To Massively Bullish Price Pattern!

I like what I am seeing of late in the precious metals space.

Gold has broken out to new highs... and now silver is beginning...

Silver Looks Ready For a Major Breakout!

Silver has been quietly building a bullish case for a trading breakout.

The Silver ETF (SLV) has been coiling just beneath major breakout resistance. And...

Is the Gold Miners ETF (GDX) Ready To Blast Off Higher?

Just as everyone is fawning over Bitcoin and stocks at all-time highs, Gold has quietly made all-time highs. And, just as we wrote earlier...

Gold Breaking Out of Bullish Inverse Head & Shoulders!

While all the headlines are focused on Bitcoin and the new highs for the major stock market indices, the price of gold is creeping...

Gold Price Breakout Bullish, But Silver Needs to Play Catch-Up

When the stock market is bullish and in cruise control, we usually see riskier assets performing well. As we often hear, "the market is...

Investor Sentiment Getting Greedy? Seems Unwarranted!

Several indicators of investor sentiment are showing rising "greed" levels. And when investors get greedy, it tends to imply that we are nearing a...