Tag: fibonacci retracements

No Need To Panic On Outside Days

The S&P 500 Index (INDEXSP:.INX) put in an outside day on Monday. This deserves respect from traders and investors of all time frames, as well...

Apple (AAPL) Stock Chart Update: Cycles, Fibonacci, Gann

Yesterday, I shared my thoughts on where Apple's stock (NASDAQ:AAPL) was headed next. I used daily, weekly, and monthly charts to provide context and...

Treasury Bonds Chart Update (TLT): Fibonacci Price Targets

The 20+ Year Treasury Bond ETF (NASDAQ:TLT) finally broke out of a double bottom reversal formation. The move was accompanied by a bullish breakout in...

S&P 500 Target Reached, Where Do We Go From Here?

In just a month and a half the E-mini S&P 500 has rallied over 150 points. That's a pretty spectacular move - were you...

The Key To Trading Fibonacci Retracements

Trading Fibonacci retracements as a low risk/high reward entry is an approach that's been around for a long long time.

At times, it can be...

Chart Spotlight: S&P 500 Reaches Important Level For Traders

The S&P 500 Index $SPX is battling its 50 Day moving average (DMA) around 2040, seeing a major tug-o-war play out between the bulls and bears....

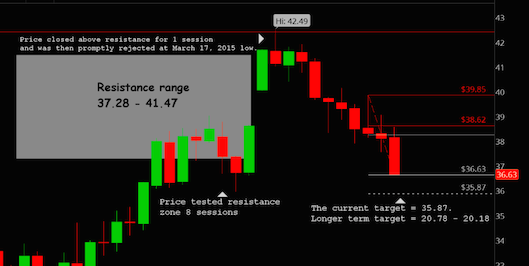

Crude Oil Update: Why Fibonacci Price Targets Matter

In January of 2016, I wrote an article on Crude Oil Futures where I identified a resistance zone of 37.28 to 41.47 using my Fibonacci...

Chart Of The Week: S&P 500 Testing Key Fibonacci Level!

Since putting in a double bottom formation in mid-February, the S&P 500 Index has rallied with strength over the past month. The question facing bulls...

Crude Oil Looks Lower: New Downside Price Target

The Crude oil market has garnered a lot of interest over the last year. Much of it has to do with its steep and...

Stock Market Update: $SPX Fibonacci Price Levels To Watch

Less than a month ago, I pondered the question "Is It Time To Wave Goodbye To the Bull Market In 2016?". In that post,...