The Dollar

We do remain bullish on the U.S. Dollar (USD) vs the Canadian dollar (CAD) as we roll into 2017, but not nearly as confidently as past years. There are a number of key positives for the USD. The U.S. economy continues to chug along while the Canadian economy struggles, despite the rebound in oil prices. Interest rate differentials continue to favor the USD. And of course central bank policy has a Fed that is tightening while the BoC is neutral at best.

So why are we less confident? Well, long USD is perhaps one of the most crowded trades at the moment and investment history often teaches us that the crowd is wrong. If OPEC and non-OPEC countries even come close to compliance with announced production cuts, oil will easily stay above $50. While this is not our view, as we believe higher prices will lead to increased U.S. production and more cheating by OPEC. But it could happen, providing support for the CAD. However, the biggest factor causing us to be less enthusiastic USD bulls is simple valuation (chart). The CAD is currently about 7% undervalued against the USD. It can become more undervalued and stay undervalued for years, but each nickel will get harder to come by.

So, we are USD bulls with some trepidation. One reason that could really light a fire under the USD is tax reform. If the U.S. allows companies to repatriate overseas capital back, this can lead to a strong lift on the USD and potentially a shortage of USD funding. We would remind investors that during the bear market for the USD from 2001 to 2008, each year it was lower except 2005. During 2005 there was a tax holiday that allowed companies to bring capital back to America … that tax change interrupted a bear market for the USD. If we are in a bull market for the USD and a similar tax change occurs, that could really get the USD climbing higher.

Bond market

Despite stumbling across the 2016 finish line, bonds didn’t do too badly. Sure, higher yields were not good as they are never good for the bond market, but credit spreads contracted significantly in 2016, offsetting the blow. High yield bonds for instance returned 14% in 2016. The “spreads”, or excess interest that is paid to own corporate instead of government bonds, decreased faster than rates rose. However, as we enter 2017 spreads are low. Very low. High Yield sits at about 4% excess yield, while investment grade sits at 0.75%. They were lower in 2014/2015 but not by much and not for very long. We believe the prospects for further credit compression (lower spreads) is limited, so 2017 performance won’t have this lift.

Meanwhile, corporate debt has been climbing steadily over the past few years. Leverage always appears lowest at market peaks (because equity value, the denominator, is very high), but equity can vanish while debt does not until the equity has reached zero. Debt to assets, is pushing to levels not seen since the 90s.

Moody’s default rate has ticked up from 1% to 3% over past year, and what we are watching closely is the defaults of companies that have gotten used to paying very little interest on their borrowings. LIBOR (London Inter-Bank Offer Rate) is the benchmark rate for the vast majority of corporate loans, and, as it rises, so too does the interest payable on these loans. For example, when Avis Budget rental car struck the terms with their bankers on their most recent loan, the interest rate was LIBOR +2.75 – subject to a LIBOR minimum of 0.75%. So for a year, Avis was paying 3.5% on their loan. As of the end of 2016, a year in which LIBOR had risen from 0.62% to 1%, Avis’ interest costs went up for the first time since 2009 (the last time LIBOR was above 0.75%. Our concern is that, of the thousands of companies that borrow this way, many will be very accustomed to those flat rates. Estimates are that about 90% of loans have floors of 0.75% to 1%, which means that only now will most companies start seeing those costs rise. We hope they are ready.

For this reason, the leveraged loan or senior loan market, while offering investors interest that rises alongside interest rates, presents a new risk in the form of potential defaults.

The good news is that business conditions are still good and lending conditions continue to favor companies. We don’t feel that another credit crisis is looming, but the tailwinds in this market are gone.

Investment risks for 2017

You may have noticed a rather positive tone to this outlook. Economy is improving, earnings are rising, markets are at all-time highs, what’s not to like? Well there are a handful of risks we see for 2017.

Political – The honeymoon following the Trump victory has been blissful for investors but it could change on a dime (or tweet, for that matter). Planned policy changes on everything from tax reform, regulations, the affordable care act, immigration and trade remain vague at best. We recognize that policies announced during a campaign to appeal to one’s base can often be pared back or even forgotten once properly thought through or to gain proper consensus. But, the bigger risk for the markets may be the knee jerk reactions to tweets that are sent out with what appears to be limited thought regarding the potential consequences. So far, the market has not reacted but that may change once he is in office. Markets don’t like uncertainty and Tweets that bounce from undermining your own intelligence agencies, to pressuring companies to move plants, to threatening a trade war with China, to giving poor review of Saturday Night Live are the new definition of uncertainty. Someday the market may care.

The political risks are not just in the U.S., Europe is fraught full of political uncertainty as well in 2017, as there will be key elections in powerhouse nations, Germany and France, and also in the Netherlands, Hungary, Serbia and Slovenia. Plus, the UK will likely invoke Article 50 to begin multi-year negotiations which will lay out their path for an EU exit. None of this has us concerned over a flare up of a European crisis, but, given that we are in the age of election upsets, anything is possible. And, Europe still has festering banking issues, even with the recent bail-in of the world’s oldest lender Monte dei Paschi.

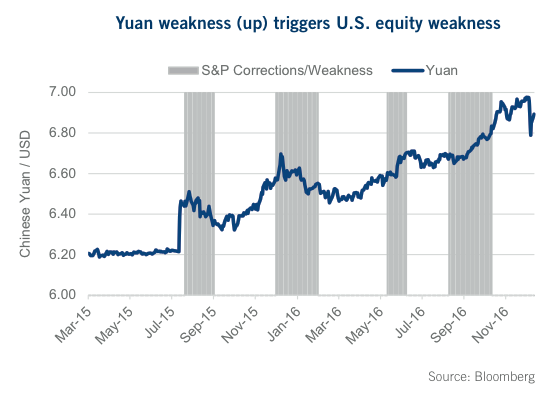

Yuan – China follows a pattern that investors should note. When growth softens, whether due to a slower global economy or internal moves on regulatory reform, their answer has historically been to increase credit. The

latest credit binge, which took place in late 2015 and early 2016, helped to stabilize economic growth and to increase home prices and commodity prices. Credit bubbles don’t end well, just ask America in 2007 or Japan in 1990. Someday, China’s will end. So watch for any deterioration or loss of momentum in home prices. Nearer term, we would watch currency moves as China manages capital outflows. This has flared up and caused global markets to be concerned in the past.

Tantrum – In 2013, we experienced what is called the Taper Tantrum, as markets and many interest rate sensitive assets declined due to rising bond yields. Again, we are in an environment of rising bond yields yet markets and most assets have responded positively. The reason being, as yields have moved higher, credit spreads have narrowed, helping offset or soften the impact. But, with spreads nearing historical low levels, this offsetting valve may be losing its efficacy. Another move higher in bond yields may have a much more pronounced effect on interest rate sensitive assets.

Of course there are always unknown risks out there that could surprise everyone. That being said, the current market appears to be a glass that is more half full than half empty.

Final Thoughts

The bull market will turn eight years old in March, which is now one of the longer runs in the past 100 years. We would say that many market characteristics appear to be late cycle, including the Fed tightening, energy and materials leading, some signs of inflation and more abrupt market swings. While those are not good things, the vast majority of our indicators point to a continuation of the current bull cycle for some time. Earnings growth is returning and economic data continues to strengthen. For now, we would view any sell-off as a buying opportunity and continue to recommend that investors be either market weight or mildly underweight equities.

Thanks for reading.

Twitter: @sobata416 @ConnectedWealth

Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.