2. Lower interest rates and more stable cash flows, which help reduce the cost of debt, mean that equilibrium leverage is likely higher than most of the post-war period

Goldman’s claim is purely speculative. How does anyone know where the “equilibrium leverage” level is other than by reflecting on historical patterns?

Yes, interest rates are abnormally low, but for them to continue being an on-going benefit to corporations, they would need to continue to fall. Additionally, those “stable cash flows” are an artifact of extraordinary Fed policy which has driven interest rates to historical lows. If the economy slows, those cash flows will not remain stable.

3. Corporate debt in aggregate has a longer maturity which has reduced the refinancing risk

This too, I believe, is a misleading argument. Goldman claims that the percentage of short-term debt as a share of total corporate debt has dropped from roughly 50% in 1985 to 30% today. The amount of corporate debt outstanding in 1985 was $1.5 trillion and short-term debt was about $750 billion.

Today total corporate debt outstanding is $9.7 trillion and short-term debt is $2.9 trillion. The average maturity of debt outstanding may be longer today, but the nominal increase in the amount of debt means that the corporate refinancing risk is much bigger now than it has been at any time in history.

4. The corporate sector runs a financial surplus (income exceeds spending) which implies that capital expenditures are less dependent on external financing and less vulnerable to a profit squeeze.

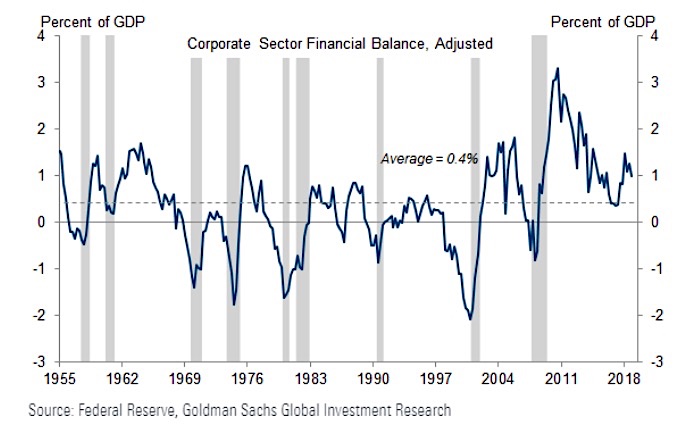

According to Federal Reserve data on corporate financial balances, the corporate sector does currently have surplus balances that are above the long-term average, but the chart below highlights that those surpluses have been declining since 2011. The recent boost came as a result of the corporate tax cuts and is not likely to be sustained. Historically, as the economic cycle ages, corporate balances peak and then decline, eventually turning negative as a precursor to a recession. If corporate financial surpluses continue to erode, capital expenditures are likely at risk as has been the case in most previous cycles.

Summary

In a recent speech, Dallas Fed President Robert Kaplan stated that the high ratio of corporate debt to U.S. GDP is a concern and that it “could be an amplifier” if the economy turns down. A few days later, Fed Chairman Jerome Powell echoed Kaplan’s comments but followed them by saying, “today business debt does not appear to present notable risks to financial stability.”

“Today” should not concern Chairman Powell, tomorrow should. In that speech, entitled Business Debt and Our Dynamic Financial System, Powell contrasts some key characteristics of the mortgage crisis with current circumstances in corporate lending and deduces that they are not similar.

Someone should remind the Chairman of a speech former Chair Ben Bernanke gave on October 15, 2007, to the Economic Club of New York. Among his comments was this:

“Fortunately, the financial system entered the episode of the past few months with strong capital positions and a robust infrastructure. The banking system is healthy.”

That was exactly 12 months prior to Congress passing legislation to bailout the banking system.

As I suspected, you do not have to search too hard to find a Goldman Sachs report downplaying the risk of subprime mortgages in the year leading up to the subprime crisis.

In February 2007, Goldman penned a research report entitled Subprime Mortgage: Bleak Outlook but Limited Impact for the Banks. In that report, after elaborating on the deterioration in the performance of subprime mortgages, Goldman states, “We expect limited impact of these issues on the banks as bank portfolios consist almost entirely of prime loans.”Goldman followed that up in October 2007 publishing a report on financial crisis poster child AIG titled, Weakness related to possible subprime woes overdone.

Goldman Sachs and their competitors make money by selling bonds, being paid a handsome fee by corporate counterparties. Do not lose sight of that major conflict of interest when you read reports like those I reference here.

Even though it rots teeth and contributes to diabetes, Coca-Cola will never tell you that their soft drink is harmful to your health, and Goldman et al. will never tell you that corporate bonds may be harmful to your wealth if you pay the wrong price.

Banks will continue to push product without regard for the well-being of their clientele. As investors, we must always be aware of this conflict of interest and do our homework. Bank and broker opinions, views, and research are designed to help them sell product and make money. If this were not true, there never would have been a subprime debacle.

Twitter: @michaellebowitz

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.