Many U.S. money market funds are governed by the U.S. Securities and Exchange Commission (SEC- 1940 Act -Rule 2a-7) which imposes very conservative limits on the assets these funds can hold and the way they manage their investment portfolio to ensure minimal risk of loss.

In todays near-zero interest rate environment, money market funds are struggling to earn enough interest to pay a return to shareholders and cover their expenses. Many funds have cut their expense entirely. This situation is exacerbated when worsens fund holdings incur negative yields. In this scenario money market funds are forced to either pay to manage clients’ money or devise other strategies to pass the costs of negative-yielding investments onto fund holders.

Such a negative interest rate situation is currently playing out in Europe as the ECB adopted a NIRP, which drove yields on many money market instruments in Europe to below zero. Europe’s largest money market funds are taking action. One mechanism to pass on the costs to fund holders allows the funds to reduce the number of shares its investors hold but leave the net asset value constant. For shareholders this is similar to the previous example where you deposit $100 in your bank and see your deposit shrink to $98 over time. We suspect other legal, but deceiving, approaches will be employed to enable money market funds to keep their net asset values constant despite negative returns. Money market funds are not a charity. They will find a way to pass on the costs of negative yields on.

A NIRP, per the central bankers’ plans, will force some investors from the security of money market mutual funds into riskier assets. Short term commercial paper, municipal bonds and longer term Treasury notes may likely be in greater demand by such investors. Other investors may look to hard assets such as gold, silver and other commodities to help preserve their purchasing power. In both scenarios, cash investors aiming to avoid paying for safety will have to accept more risk.

Can more debt solve a debt problem?

In our article “The First Rule of Holes” we mentioned how monetary policy has increasingly encouraged more debt with little regard for the ability to service the accumulating debt on an individual, national and global level. If the intention of negative interest rates is to incur even more debt, one must question whether a continuation of the monetary policies that created the problem in the first place can actually solve the problem. We impart the wisdom of Will Rogers to help guide the central bankers: “When you find yourself in a hole, quit digging”

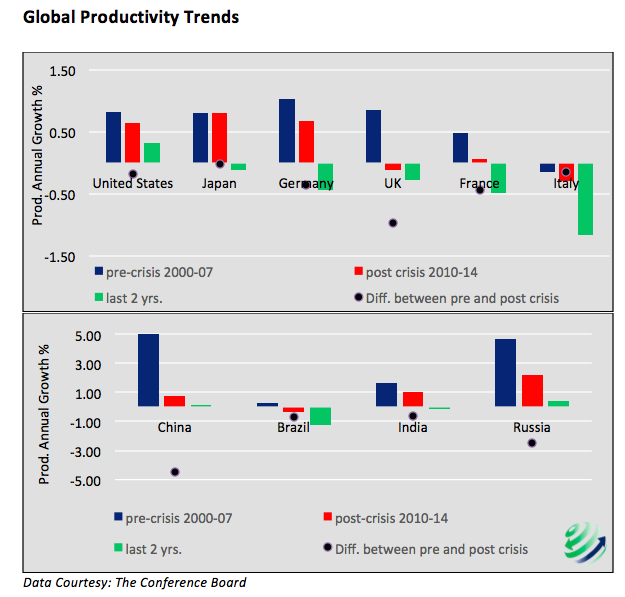

Furthermore, we should also consider if there is clarity among policy-makers around the extent to which the global debt burden is causing weak and stagnant economic growth. Productivity growth in the long run drives economic growth. Unfortunately, productivity growth has been steadily declining globally, a likely symptom of the buildup of unproductive debt. Consider the chart below showing negative trends in productivity growth for the world’s 10 largest economies. Note as well that 7 of the 10 economies are currently witnessing declines in productivity. The U.S. is leading the world’s largest economies with a paltry .33% productivity growth over the last 2 years and is on trend to follow most major economies into negative territory.

Financial Discipline

Governments and their central banks should encourage and reward financial discipline. Avoiding bankruptcy and the evils that accompany it are lessons everyone should heed. Strangely though, the idea of saving money appears to be a sin in the eyes of central bankers. Those exercising fiscal discretion are being punished by what amounts to a tax on their savings in the form of a negative interest rate. Is this a prudent message and does it seed societal problems as an unintended consequence?

As children we were properly taught by our parents to save money for a rainy day. The actions and policies of the central banks are now telling us that we should teach our children to disregard prudence and spend money like there is no tomorrow.

What does banning large denomination currency have to do with NIRP?

It is at this time when a NIRP is gaining popularity globally that we take notice that some of its loudest supporters including Larry Summers, former Treasury Secretary, and Mario Draghi, the current President of the European Central Bank (ECB) are advising an end to the issue of large currency denominations. They claim removing these bills will make criminal activities harder to commit. To their point, forcing a criminal to transact with two suitcases full of $50 bills instead of one suitcase full of $100 bills will complicate mischievous endeavors.

Having to resort to negative interest rates is not normal, despite efforts to sell it otherwise. In our opinion it is a desperate effort aimed at maintaining a faulty economic model amidst crumbling support as witnessed by perennially weakening economic growth and soaring debt levels. Drawing a link between NIRP and the sudden interest in eliminating the $100 bill in the U.S. and the €500 in Europe is not a stretch.

We believe the proposals to eliminate large bills are being conducted under the guise of thwarting criminal and terrorist activities. The reality is that eliminating large bills gives the government and financial system more control over the financial activities of the population. Making cash withdrawals more difficult, lessens the likelihood that individuals avoid the penalty of negative interest rates by storing cash outside of the banking system. Hoarding of cash reduces the ability of a NIRP to push savings into consumption or speculation.

At the end of the day these proposals have little to do with stopping crime and much more to do with extending the power of the banking sector and financial authorities to socially engineering an outcome they want to occur (i.e. individuals spend every dollar they have).

Summary

Negative interest rates are a tax! Not a traditional tax paid to the government, but an expense paid, on savings. Years of policy designed to encourage spending and discourage savings is likely reaching the end game; the point where those exhibiting prudence must be punished to keep the game going.

At some point, and likely soon, central bankers will be forced to realize the efficacy of lowering interest rates is vanishing and is hindering achievement of their goals. When this occurs a paradigm shift in the way monetary policy is conducted will likely occur. In our opinion, investors that understand this dynamic, and what it portends, will be in a much better position to protect and profit from the asset price adjustments that lie ahead.

Thanks for reading.

More from Michael Lebowitz: “This Stock Market Indicator Could Signal More Pain In 2016“

Twitter: @michaellebowitz

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.