How did we come to see a Negative Interest Rate Policy (NIRP)?

Over the past 30 years, many central banks have tried to re-order the natural drivers of economies. As opposed to savings and investment driving production and consumption, they moved consumption to the front of the line, meaning it came at the expense of savings and investment.

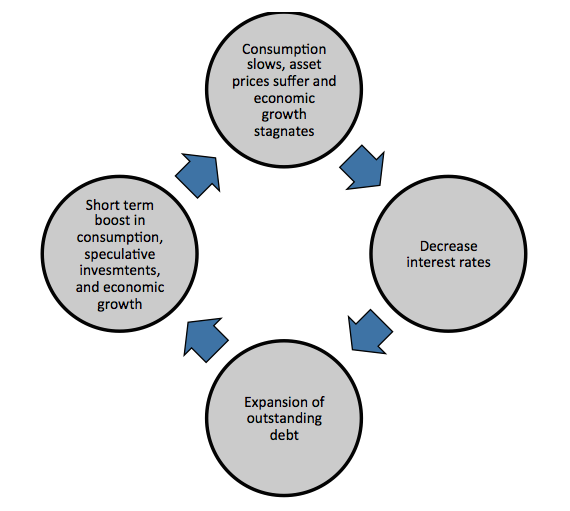

These efforts disrupt the natural order of activities in a healthy economy and encourages an economic cycle fueled by debt. The Central banks model, as shown below, illustrates how ever-lower interest rates are used to encourage additional borrowing to drive consumption and lift asset prices; all in the hope of ultimately achieving economic growth.

Currently economic growth in most of the largest nations is deteriorating, and once again the central bankers are grasping for remedies. However today is different than the past. Unlike prior instances of stalled growth, the central bankers’ main policy tool, interest rates, has reached a supposed limit of zero percent. To combat the situation, some central banks are employing a new tool to preserve the cycle shown above. The method to their madness is a negative interest rate policy (NIRP). This article describes a NIRP and related matters every investor should be considering. It also discusses a link between NIRP and a recent appeal of some leading economists to fight crime by eliminating large currency denominations.

A better understanding of negative rates may lead you to our opinion that the concept of a NIRP is sheer desperation akin to a last second Hail Mary pass in football, but with even lower probability of success.

Negative Interest Rates

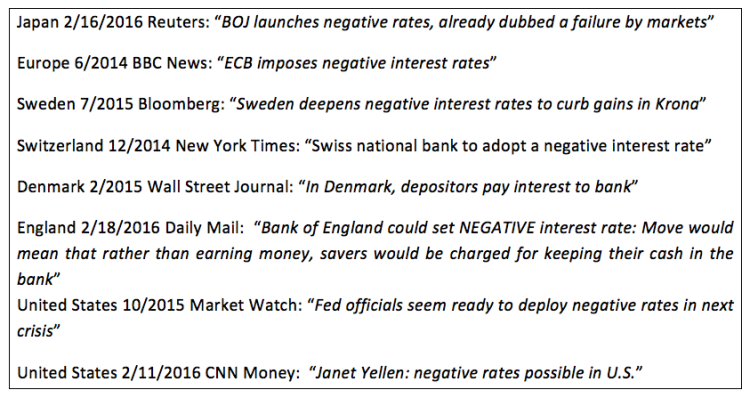

A negative interest rate is a simple concept, yet those promoting such an economic remedy make the matter sound like a PhD dissertation and appear to be confusing the public. Before explaining what negative interest rates are, and why a central bank might promote them, we share a few headlines to highlight their developing global popularity:

When making a deposit in a bank, one is electing to forego consumption today and save money for the future. A deposit is effectively a loan to the bank that can be withdrawn at a future date without notice or penalty. Traditionally, banks pay interest on deposits to compensate for the time value of money as well as the potential default risk associated with the bank. As importantly, they also pay interest on deposits to incent people to forego consumption and allow the bank to leverage the deposit into higher yielding loans to other borrowers. This arrangement has defined banking since its earliest roots in ancient Greece nearly 4000 years ago.

Negative interest rates, however, are quite a different arrangement. They essentially ignore or negate the time value of money and any default risk associated with the entity charging negative interest rates. For example, imagine depositing $100 into your bank account only to find out that you have $98 left when you go to withdraw it in a year or two. Not only were you not compensated for the time value of money and the default risk assumed, you actually paid the bank while still assuming these risks. Equally confounding, assume you approached your mortgage banker to take out a mortgage to purchase a house and were told that you would be compensated monthly for taking such action. Welcome to the world of negative interest rates. It really is that simple; and that bizarre.

Why a negative interest rate policy?

To consider why central banks are promoting a NIRP we need to understand their goals and the tools at their disposal to achieve them. Most central banks are entrusted with the important role of managing their nation’s monetary policy to enable strong economic growth, full employment and moderate inflation. To accomplish this feat, many central banks adjust short term interest rates to influence borrowing, investing and ultimately consumption.

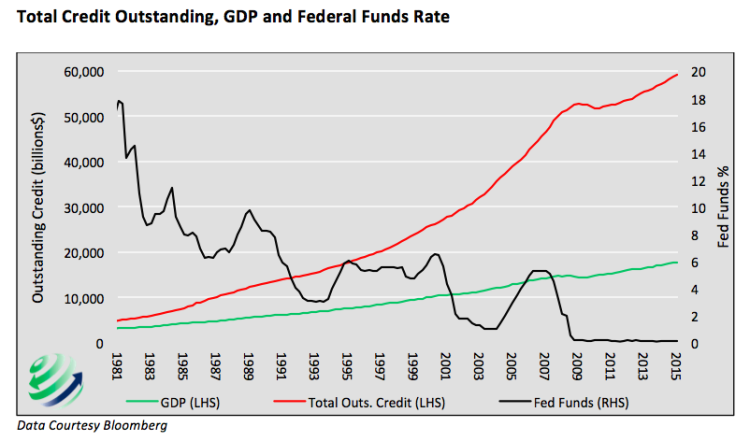

Over the last 30+ years many central banks have become increasingly dependent upon lower interest rates to meet their economic goals. Think of this strategy as continually pulling forward tomorrow’s consumption to today. At some point you run out of tomorrows. The following graph shows the rise in total credit outstanding, GDP and the Federal Funds rate (the rate the Federal Reserve adjusts to influence borrowing and lending) in the United States.

The sharp increase in total credit outstanding or “debt”, relative to the increase in GDP, is a reflection of the rising leverage driving economic activity. In the 1980’s it took roughly $1.50 of debt to generate $1.00 of output. Today the economy needs almost $5.00 of debt to generate the same $1.00 of output. Borrowing for long periods of time in amounts greater than your ability to service the debt with economic output, as shown above, is only possible with low interest rates and/or very gullible lenders.

Since 1995, U.S. Treasury debt outstanding quadrupled, however the total annual interest expense paid by the Treasury remains roughly the same. Declining interest rates make refinancing existing debt with new debt cheaper, and prolongs the borrower’s ability to service that debt, but there is a limit to how effective such a policy can be. It seems plausible that as debt levels expand and most nations approach zero or even negative rates, that limit is being reached.

Cash

The investment asset class most affected by negative interest rates is cash. Cash is a term investors’ use synonymously with money invested in the money markets. The term also applies to bank deposits, but for purposes of this article, we focus on funds invested in money market mutual funds. Money market investments are considered “money good” by many investors. In other words they are as “risk free” an investment security as one can find as there is the belief is that there is little to no risk of loss of principal. Money market mutual funds typically invest in short term fixed income products, such as U.S. Treasury Bills, collateralized lending agreements, certificates of deposit and high quality commercial paper.

continue reading on the next page…