The following is a recap of the February 3 Commitment of Traders Report (COT) released by the CFTC (Commodity Futures Trading Commission) looking at Commitment of Traders data and futures positions of non-commercial holdings as of January 31.

Note that the change in COT report data is week-over-week. Excerpts of this blog post also appear on Paban’s blog.

3 Commitment of Traders Report Charts Looking At Spec Futures Positions in Crude Oil, Gold and the US Dollar

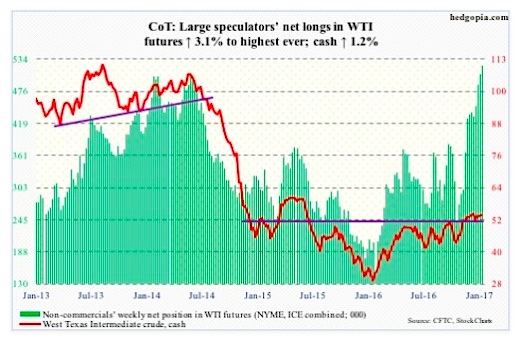

Crude Oil Futures

On the daily trading chart, the Bollinger bands are tightening. This is hinting that a large move may be nearing. The path of least resistance remains down, but traders will have to watch key support/resistance.

Even as crude oil prices are showing signs of indecision, non-commercial traders now hold record net long positions. Beware some unwinding – timing notwithstanding!

February 3 Commitment of Traders Spec Data: Currently net long 522.9k, up 15.6k.

Gold Futures

Gold recently defended its 50 day moving average (roughly $1,185/ounce). And on the weekly chart, spot gold has room to rally, sporting a fresh bullish MACD crossover.

February 3 Commitment of Traders Spec Data: Currently net long 119.2k, up 9.7k.

US Dollar Futures

The Dollar bottomed last May at 91.88, then peaked at 103.82 on January 3 of this year. A 38.2-percent retracement of that move puts it at 99.26. Last week, the Dollar fell to 99.20 before bids showed up. The chart is oversold (daily).

Worse case, it falls to around 98, which is the rising trend line off the May 2016 low. This is critical support.

February 3 Commitment of Traders Spec Data: Currently net long 46.6k, down 1.9k.

Thanks for reading.

Twitter: @hedgopia

Author may hold a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.