Of note, there are two significant timeframes when real rates were abnormally low.

The first was from 1973 to 1980 and the second is the better part of the last 18 years. The shaded areas indicating abnormally low real interest rates will appear on the charts that follow.

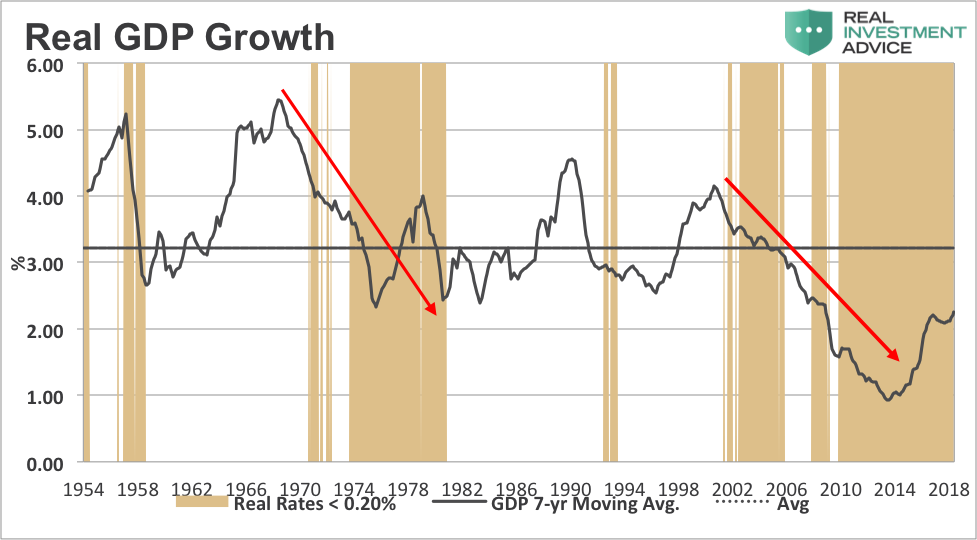

The chart below highlights real GDP growth. The post-war average real growth rate of the U.S. economy has been 3.20%.

Based on a seven-year moving average of real economic growth as a proxy for the structural growth rate in the economy, there are two distinct periods of precipitous decline. First from 1968 to 1983 when the 7-year average growth rate fell from 5.4% to 2.4% and then again from 2000 to 2013 when it dropped from 4.1% to 0.9%.

Interestingly, and probably not coincidentally, both of these periods align with time frames when U.S. real interest rates were abnormally low.

Revisiting the words of Ben Bernanke, “Easier financial conditions will promote economic growth.” That does not appear to be what has happened in the U.S. economy since his actions to reduce real rates well below zero. Although the 7-year average growth rate has in recent years risen from the 2013 lows, it remains below any point in time since at least 1954.

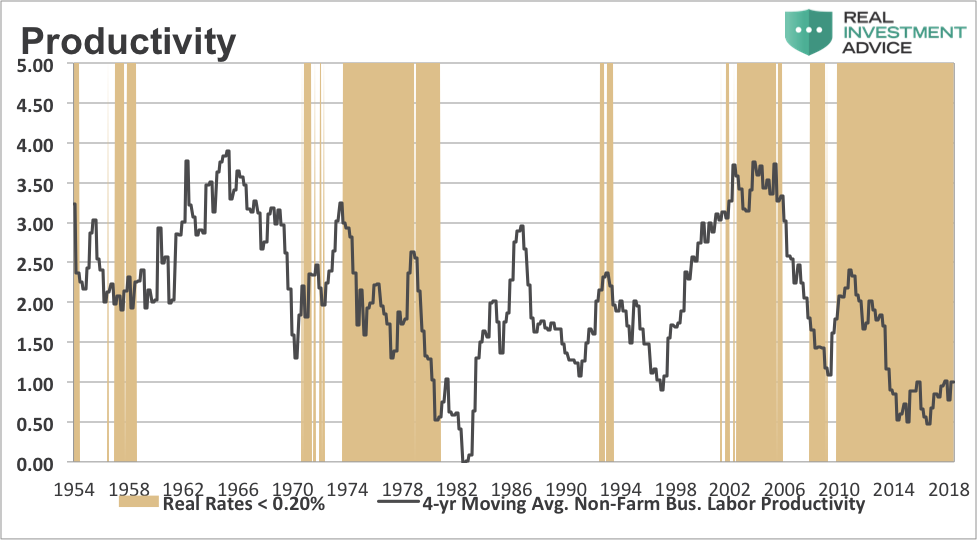

Similar to GDP growth in periods of low rates, the trend in productivity, shown in the chart below, also deteriorates. This evidence suggests something contrary to the Fed’s claims.

Despite what the central bankers tell us, there is a more convincing argument that cheap money is destructive to the economy and thus the wealth of the nation. This concept no doubt will run counter to what most investors think, so it is time to enlist the work of yet another influential economist.

Wicksell’s Elegant Model

Knut Wicksell was a 19th-century Swedish economist who took an elegantly simple approach to explain the interaction of interest rates and economic cycles. His model states that there are two interest rates in an economy.

First, there is the “natural rate” which reflects the structural growth rate of the economy (which is also reflective of the growth rate of corporate earnings). The natural rate is the combined growth of the working age population and the growth in productivity. The chart of the 7-year moving average of GDP growth above serves as a reasonable proxy for the structural economic growth rate.

Second, Wicksell holds that there is the “market rate” or the cost of money in the economy as determined by supply and demand. Although it is difficult to measure these terms with precision, they are generally accurate. As John Maynard Keynes once said, “It is better to be roughly right than precisely wrong.”

According to Wicksell, when the market rate is below the natural rate, there is an incentive to borrow and reinvest in an economy at the higher natural rate. This normally leads to an economic boom until demand drives up the market rate and eventually chokes off demand. When the market rate exceeds the natural rate, borrowing slows along with economic activity eventually leading to a recession, and the market rate again falls back below the natural rate. Wicksell viewed the divergences between the natural rate and the market rate as the mechanism by which the economic cycle is determined. If a divergence between the natural rate and the market rate is abnormally sustained, it causes a severe misallocation of capital.

If the market rate rises above the natural rate of interest, then no smart businessman would be willing to borrow at 5% to invest in a project with an expected return of only 2%. Furthermore, no wise lender would approve it. In this environment, only those with projects promising higher marginal returns would receive capital. On the other hand, if market rates of interest are held abnormally below the natural rate then capital allocation decisions are not made on the basis of marginal efficiency but according to the average return on invested capital. This explains why, in those periods, more speculative assets such as stocks and real estate boom.

To further refine what Wicksell meant, consider the poor growth rate of the U.S. economy. Despite its longevity, the post-GFC expansion is the weakest recovery on record. As the charts above reflect, the market rate has been below the natural rate of the economy for most of the time since 2001. Wicksell’s theory explains that healthy, organic growth in an economy transpires when only those who are deserving of capital obtain it.

In other words, those who can invest and achieve a return on capital higher than that of the natural rate have access to it. If undeserving investors gain access to capital, then those who most deserve it are crowded out. This is the misallocation of capital between those who deserve it and put it to productive uses and those who do not. The result is that the structural growth rate of the economy will decline because capital is not efficiently distributed and employed for highest and best use.

Per Wicksell, optimal policy should aim at keeping the natural rate and the market rate as closely aligned as possible to prevent misallocation. But when short-term market rates are below the natural rate, intelligent investors respond appropriately. They borrow heavily at the low rate and buy existingassets with somewhat predictable returns and shorter time horizons. Financial assets skyrocket in value while long-term, cash-flow driven investments with riskier prospects languish.

The bottom line: existing assets rise in value but few new assets are added to the capital stock, which is decidedly bad for productivity and the structural growth of the economy.

Summary

As central bankers continue to espouse policies leading to market rates well-below the natural rate, then, contrary to their claims, structural economic growth will fail to accelerate and will actually continue to contract.

The irony is that the experimental policies, such as those prescribed by Bernanke and Yellen, are complicit in constrainingthe growth the economy desperately needs. As growth languishes, central bankers are likely to keep interest rates too low which will itself lead to still lower structural growth rates. Eventually, and almost mercifully, structural growth will fall below zero. The misallocated capital in the system will lead to defaults by those who should never have been allocated capital in the first place. The magnitude and trauma of the ensuing financial crisis will be determined by the length of time it takes for the economy to finally reach that flashpoint.

As discussed in the introduction, intentionally low-interest rates as directed by the Fed is reflective of negligent monetary policy which encourages the sub-optimal use of debt. Given the longevity of this neglect, the activities of the market have developed a muscle memory response to low rates. Adjusting to a new environment, one that imposes discipline through higher rates will logically be an agonizing process. Although painful, the U.S. economy is resilient enough to recover. The bigger question is do we have Volcker-esque leadership that is willing to impose the proper discipline as opposed to continuing down a path of self-destruction? In the words of Warren Buffett, chains of habit are too light to be felt until they are too heavy to be broken.

Twitter: @michaellebowitz

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.