“It’s unbelievable how much you don’t know about the game you’ve been playing all your life.”

– Mickey Mantle

Introduction

The word discipline has two closely related applications. Discipline may refer to the instruction and nurturing of an individual. It can also carry the connotation of censure or punishment. The purpose of discipline, in either case, is to sustain integrity or aim toward improvement.

Although difficult and often painful in the moment, discipline frequently holds long-lasting benefits. Conversely, a person or entity living without discipline is likely following a path of self-destruction.

The same holds true for an economic system. After all, economics is simply the study of the collective decision-making of individuals with regard to their resources. Where capital is involved, discipline is either applied or neglected through the mechanism of interest rates.

To apply a simple analogy, in those places where water is plentiful, cheap, and readily available through pipes and faucets, it is largely taken for granted. It is used for the basic necessities of bathing and drinking but also to wash our cars and dogs. In countries where clean water is not easily accessible, it is regarded as a precious resource and decidedly not taken for granted or wasted for sub-optimal uses.

In much the same way, when capital is easily accessible and cheap, how it is used will more often be sub-optimal. If I can borrow at 2% and there appear to be many investments that will return more than that, I am less likely to put forth the same energy to find the best opportunity. Indeed, at that low cost, I may not even use borrowed money for a productive purpose but rather for a vacation or bigger house, the monetary equivalent of using water to hose off the patio. Less rigor is applied when rates are low, thus raising the likelihood of misallocating capital.

Happy Talk

In November 2010, The Washington Post published an article by then Federal Reserve (Fed) Chairman Ben Bernanke entitled What the Fed did and why: supporting the recovery and sustaining price stability. In the article, Bernanke made a case for expanding on extraordinary policies due to still high unemployment and “too low” inflation. In summary, he stated that “Easier financial conditions will promote economic growth. Lower corporate bond rates will encourage investment. And higher stock prices will boost consumer wealth and help increase confidence, which can also spur spending. Increased spending will lead to higher incomes and profits that, in a virtuous circle, will further support economic expansion.”

To minimize concerns about the side effects or consequences of these policies he went on, “Although asset purchases are relatively unfamiliar as a tool of monetary policy, some concerns about this approach are overstated.” In his concluding comments he added, “We have made all necessary preparations, and we are confident that we have the tools to unwind these policies at the appropriate time.” During her tenure as Fed Chair, Janet Yellen reiterated those sentiments.

Taken in whole or in part, Bernanke’s comments then and now are both inconsistent and contradictory. Leaving the absurd counterfactuals often invoked aside, if asset purchases were in 2010 “unfamiliar as a tool of monetary policy,” then what was the basis for knowing concerns to be “overstated”? Furthermore, what might be the longer-term effects of the radical conditions under which the economy has been operating since 2009? What was the basis of policy-makers’ arguments that extraordinary policies will not breed unseen instabilities and risks? Finally, there is no argument that the Fed has “the tools to unwind these policies,” there is only the question of what the implications might be when they do.

In the same way that no society, domestic or global, has ever engaged in the kinds of extraordinary monetary policies enacted since the Great Financial Crisis (GFC), neither has any society ever tried to extract itself from them. These truths mandate that the uncertainty about the future path of the U.S. economy is far more acute than advertised.

Even though policy-makers themselves offered no evidence of having humbly and thoroughly thought through the implications of post-GFC policies, there is significant research and analysis from which we can draw to consider their implications apart from the happy talk being offered by those who bear no accountability. Looking back on the past 60+ years and observing the early stages of efforts to “unwind” extraordinary policies offers a clearer lens for assessing these questions and deriving better answers.

The Ghost of Irving Fisher

Irving Fisher is probably best known by passive observers as the economist whose ill-timed declaration that “stock prices have reached a permanently high plateau” came just weeks before the 1929 stock market crash. He remained bullish and was broke within four weeks as the Dow Jones Industrial Average fell by 50%. Likewise, his reputation suffered a similar fate.

Somewhat counter-intuitively, that experience led to one of his most important works, The Debt-Deflation Theory of Great Depressions. In that paper, Fisher argues that overly liberal credit policies encourage Americans to take on too much debt, just as he had done to invest more heavily in stocks. More importantly, however, is the point he makes regarding the relationship between debt, assets and cash flow. He suggests that if a large amount of debt is backed by assets as opposed to cash flow, then a decline in the value of those assets would initiate a deflationary spiral.

Both of those circumstances – too much debt and debt backed by assets as opposed to cash flow – certainly hold true in 2018 much as they did in 2007 and 1929. The re-emergence of this unstable environment has been nurtured by a Federal Reserve that seems to have had it mind all along.

Even though Irving Fisher was proven right in the modern-day GFC, the Fed has ever since been trying to feed the U.S. economy at no cost even though extended periods of cheap money typically carry an expensive price tag. Just because the stock market does not yet reflect negative implications does not mean that there will be no consequences. The basic economic laws of cause and effect have always supported the well-known rule that there is no such thing as a free lunch.

Cheap Money or Expensive Habit?

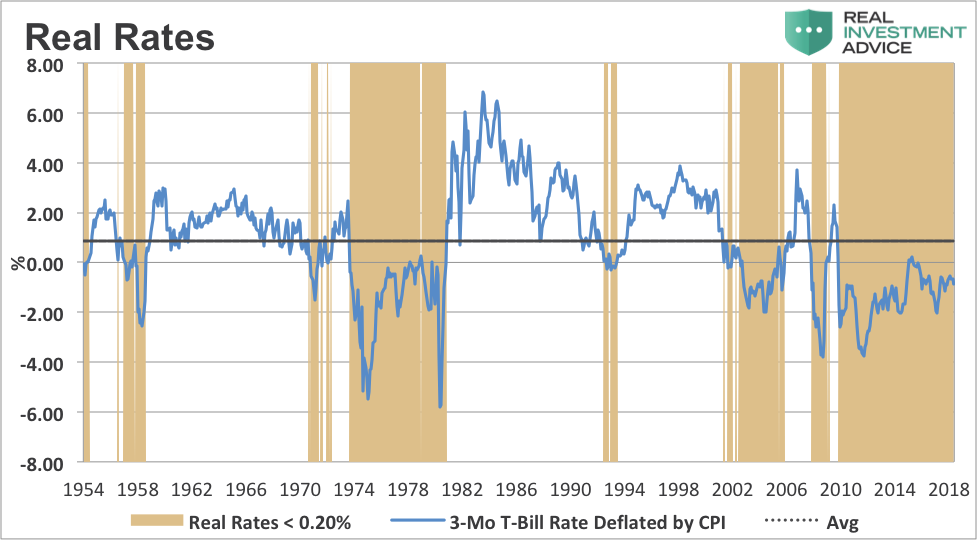

Interest rates are the price of money, what a lender will receive and what a borrower will pay. To measure whether the price of money is cheap or expensive on a macro level we analyze interest rates on 3-month Treasury Bills deflated by the annualized consumer price index (CPI). Using data back to 1954, the average real rate on 3-month T-Bills is +0.855% as illustrated by the dotted line on the chart below.

When the real rate falls below 0.20%, 0.65% below the long-term average, we consider that to be far enough away from the average to be improperly low.

The shaded areas on the chart denote those periods where the real 3-month T-Bill rate is 0.20% or below.

Continue reading on the next page…