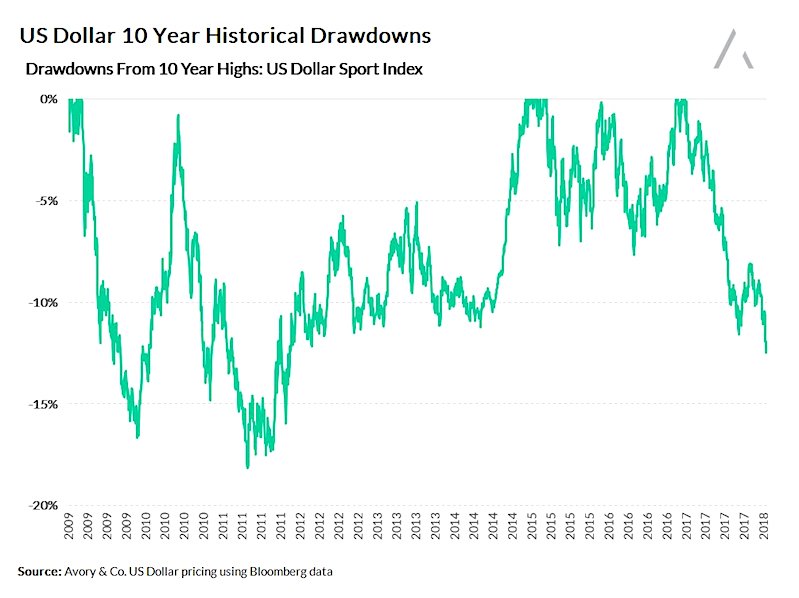

The US Dollar Index is in the midst of its second-longest drawdown streak since early 2009-2010.

The US Dollar is now 13 percent off its 10-year highs.

Inside The U.S. Dollar Decline

Over the last 5 years the US dollar has been a focal point for multinational companies. The higher the dollar climbed the more negatively it impacted revenue conversions from local currency to USD.

We are now seeing the opposite taking place as the dollar is experiencing its largest drawdown since the financial crisis. With nearly 50% of the S&P 500 generating revenues externally, investors shouldn’t be surprised by a lift in revenue over the short-term.

Looking at stock prices, it’s evident that this is being taken into consideration.

ALSO READ: Rising Oil Prices and Interest Rates Concerning

Twitter: @_SeanDavid

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.