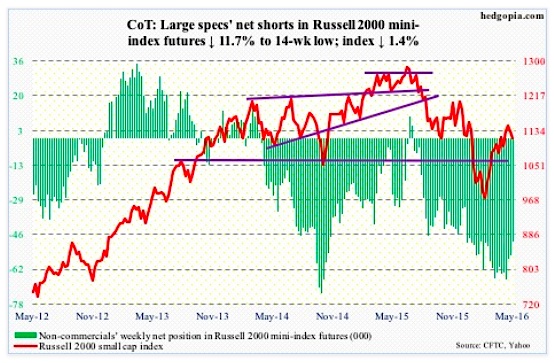

Russell 2000 mini-index: During the January collapse in U.S. stocks, the Russell 2000 fell out of a rising trend line drawn from March 2009. After a February hammer reversal, March and April were positive months, with the April high kissing the belly of that trend line but getting rejected.

In the meantime, the index this week lost dual support at 1120-ish – horizontal line going back to September 2013 as well as two-month channel. The $686 million that came out of IWM, the iShares Russell 2000 ETF, in the week ended Wednesday probably played a role in this.

Resistance working and support failing, that is not a good combo.

The index is currently trapped between 50- and 200-day moving averages, with the former about to go flat and the latter declining. There is decent support at 1080. On Friday, it dropped to 1101.57 before reversing.

COT Report Data: Currently net short 49k, down 6.5k.

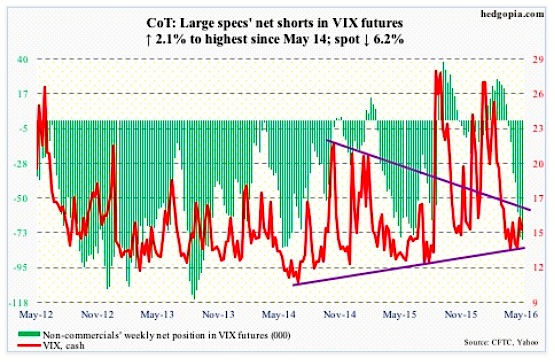

VIX: The good: there is a 10/20 crossover (moving average) on spot VIX (Volatility Index), with plenty of room to run on a weekly chart. The bad: daily indicators are now overbought. And the ugly: the VIX is struggling to stay above its 50-day moving average, with 16-16.50 acting as a ceiling.

On Friday, that resistance was in play again, with the Volatility Index unable to save the 50-day.

The VIX-to-VXV ratio fell back to low 0.80s after a mid-0.80s reading last week. With this, in seven of the last eight weeks, the ratio has been in high 0.70s to low 0.80s. Compressed spring!

COT Report Data: Currently net short 77.4k, up 1.6k.

Currencies

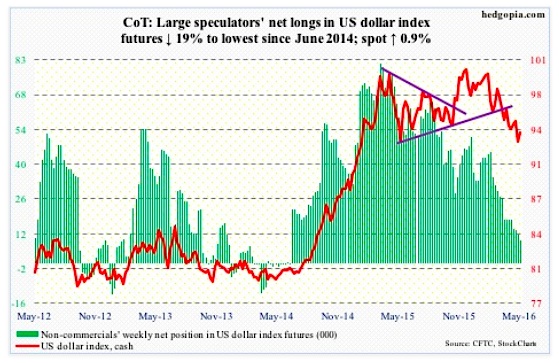

US Dollar Index: Just when it looked like the US Dollar Index was breaking down came a weekly hammer reversal candle. The week started with Monday continuing to extend last week’s breakdown, only to see a major Tuesday reversal. With rally the next three sessions, it is back above 93.50, which was lost last week.

If this week’s action is a precursor to an imminent rally for the US Dollar Index, there is a lot of repair work that needs to be done. The 50-day moving average is still dropping. Shorter-term moving averages can at least begin to go flat, unless the US Dollar Index comes under renewed pressure.

Non-commercials continue to cut back net longs, which are now the lowest since June 2014.

COT Report Data: Currently net long 9.2k, down 2.2k.

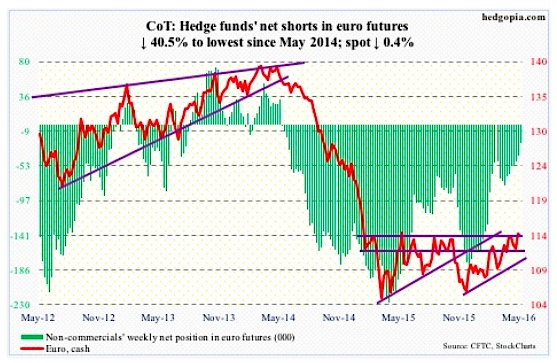

Euro: The European Commission forecast weaker growth in the Eurozone this year – from 1.7 percent in February to 1.6 percent. Last year, the economy expanded 1.7 percent. Next year, it expects growth of 1.8 percent, down from prior forecast of 1.9 percent.

More worrisome, as far as the ECB and its attempt to ignite inflation is concerned, it is seen to rise just 0.2 percent this year, lower than previous prediction of 0.5 percent. In 2017, inflation is expected to rise 1.4 percent, versus previous forecast of 1.5 percent. This is still below the ECB’s inflation target of close to two percent.

On Monday, the Euro broke out of resistance at 114-114.50, which goes back to January last year, but reversed hard in the very next session. Both daily and weekly indicators on the Euro are now grossly overbought. The currency is literally sitting on that resistance, but odds favor it weakens going forward, with a shooting star on a weekly chart. It is a bearish reversal pattern, which suggests it was a healthy advance at the beginning – particularly having come in the wake of a breakout – but bears’ ability to force prices down raises the yellow flag for the Euro.

COT Report Data: Currently net short 23.6k, down 16k.

Thanks for reading.

Twitter: @hedgopia

Read more from Paban on his blog.

The author may hold positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.