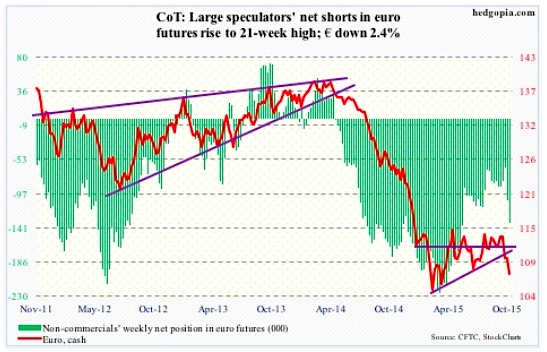

Euro: Markit’s final Eurozone PMI reading for October came in at 53.9, weaker than a prior estimate of 54 but up from September’s four-month low of 53.6. It has been above the 50 mark since July 2013.

Prices in the region were flat year-on-year in October. The good news is that prices are not dropping. The bad news is that the ECB has a two-percent target.

So is October’s inflation reading enough to nudge Mario Draghi, ECB president, and his team toward adding more stimulus come December? The bank has been buying €60 billion in assets every month, and that program runs through next September.

Two weeks ago, post-governing council meeting, Mr. Draghi dropped strong hints of possible announcement of additional stimulus in December. Then last week, he seemed to be backpedaling a little bit.

Since that meeting until Thursday, the Euro dropped four percent. If jawboning is having this kind of an effect, why act? Come Friday, it dropped another 1.3 percent. The spike in U.S. rates and prospects of disadvantageous interest rate differential is hurting the Euro. Five-month support at 108-plus is now gone. Momentum is down at the moment for the Euro. The low in March this year was 104.62.

November 3 COT Report: Currently net short 134.3k, up 28.4k.

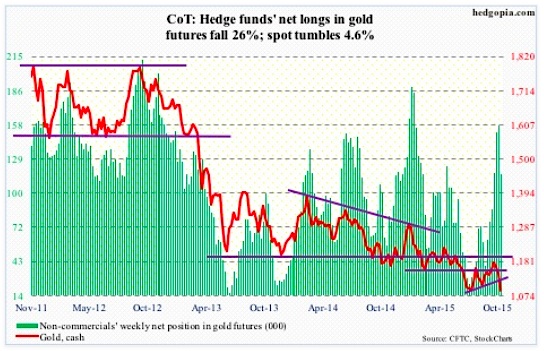

Gold: Since spot Gold failed at 1,180-plus resistance four weeks ago, it has been all downhill. Gold has now been down for three consecutive weeks, with eight straight daily declines.

The daily chart for Gold looks grossly oversold, hence a bounce is always possible, but on a weekly basis there is room for it to go lower still.

Leading up to – and even during – the latest sell-off in Gold, non-commercials have been aggressively buying. Last week, their net longs were the highest since February this year. Enough in enough. This week, the Gold bulls pulled in their horns.

November 3 COT Report: Currently net long 116.3k, down 41.1k.

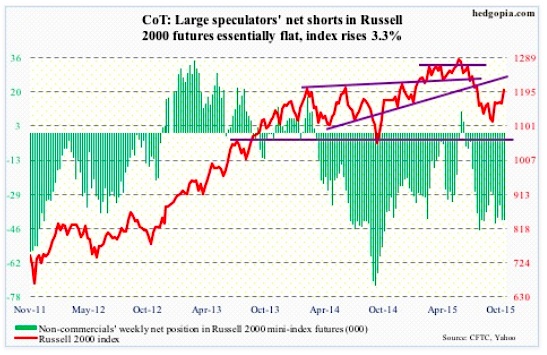

Russell 2000 mini-Index: Last week, the Russell 2000 broke out of resistance at 1170, only to drop back below it the very next session. This week, bulls were at it again, and succeeded. A couple of things need consideration in this regard.

With the move this week, the Russell 2000 is sitting right underneath the daily upper Bollinger band. Daily conditions are way overbought. And last but not the least, there is massive resistance at 1210-ish, which goes back to March last year.

Near-term, the best bulls can hope for is this. The index retreats, and finds support at 1170. This week, buyers showed up near that level on both Thursday and Friday. If this is lost, then there is the 50-day moving average, which is turning up.

November 3 COT Report: Currently net short 41.7k, up 243.

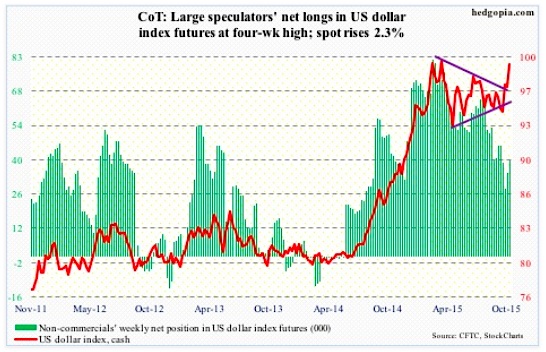

US Dollar Index: Coming into the week, the US Dollar Index was overbought on a daily basis, but had room to rally on a weekly chart. The latter prevailed. The index tacked on another 2.3 percent this week. Friday alone produced a 1.2-percent gain.

With this, the US Dollar Index is now past six-month resistance at 98-plus.

Is it a fundamental shift in sentiment? Probably not. At least not now. The US Dollar is riding the coattails of the spike in two-year yields.

If it is a genuine change in sentiment, it is not evident in how non-commercials are positioning themselves. At least not yet. That said, we would not know until the next CoT report how these traders reacted to Friday’s jobs numbers.

Should sentiment shift to the bullish side, God help U.S. multinationals and U.S. exports. And U.S. corporate earnings. Operating earnings estimates of S&P 500 companies for next year have been coming down but at $126.94 the dollar and a whole host of other things will need to cooperate before they are realized.

November 3 COT Report: Currently net long 39.9k, up 5.2k.

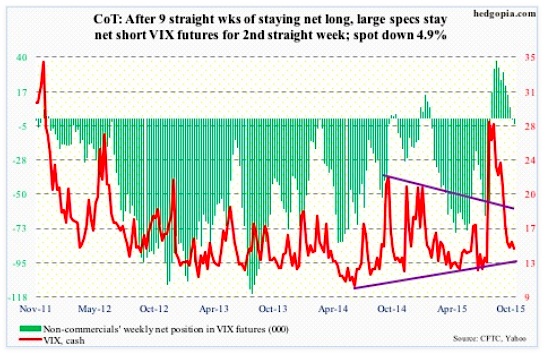

VIX: On Tuesday, the spot Volatility Index (VIX) had a bullish MACD crossover, but is struggling to gain traction. For most of nearly a month now, the VIX hugged its 200-day moving average, which repelled a rally attempt on Thursday, and again on Friday.

If there is any solace for volatility bulls, shorter-term daily averages are flat to slightly rising. The Bollinger band continues to tighten.

November 3 COT Report: Currently net short 3.7k, up 3.5k.

Thanks for reading.

Twitter: @hedgopia

Read more from Paban on his blog.

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.