Tag: gold prices

Will Gold’s 12-Year Cycle Send It Much Higher?

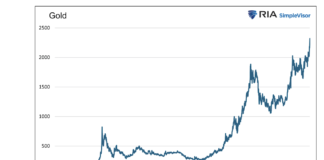

Gold spent the better part of the past 12 years trading in a wide sideways pattern.

This type of price action tends to drive away...

Gold / US Dollar Attempting Historic Bullish Breakout!

I have spent a lot of time discussing the bullish implications of Gold price patterns and the recent Gold breakout attempt.

So why not offer...

Gold, CPI and Inflation: Historical Correlations and Analysis

In the face of higher yields, higher dollar, gold has been rallying since early March-and really since October 2023 after the trough.

Although there have...

Is Gold Warning Us Or Running With The Markets?

Having risen by about 40% since last October, Gold is on a moonshot. Many investment professionals consider gold prices to be a macro barometer,...

Gold Breaking Out of Bullish Inverse Head & Shoulders!

While all the headlines are focused on Bitcoin and the new highs for the major stock market indices, the price of gold is creeping...

Can Gold Rally Further? Ask Silver and Gold Miners

This past week, silver, gold, and gold miners all rallied,

So did oil and sugar.

DBA, the agricultural ETF, made new all-time highs.

The water ETF PHO...

Gold Price Breakout Bullish, But Silver Needs to Play Catch-Up

When the stock market is bullish and in cruise control, we usually see riskier assets performing well. As we often hear, "the market is...

Gold Makes History With Highest Weekly Closing Price!

Precious metals may finally be nearing the rally that gold and silver bulls have been waiting for.

Today, we simply focus on Gold from a...

Bullish Message For Gold Investors… If This Ratio Breaks Out!

Gold prices remain elevated but have yet to record the major breakout that gold bulls are looking for.

Today, we revisit an important Gold ratio that...

Higher Gold Prices Coming For Patient Investors

For today, I am reprinting an interview I did for Kitco News with Neils Christensen, written by Neils.

(Kitco News) - The gold market remains...