Tag: currency markets

Is Euro EURUSD Reversing Higher Off At Elliott Wave Support?

Higher US treasury bond yields are causing some reversals in the market, with metals rallying while the US Dollar is lagging. Even better examples...

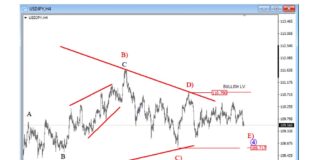

Japanese Yen Currency Pairs Nearing Elliott Wave Support

The US Dollar / Yen currency pair (USDJPY) continues to move sideways. It's trapped in a tight range so we assume that it's a...

US Dollar Index Reversal Sends Bullish Trading Signal

September is here and a new month brings new opportunities and indicators to follow.

Today, I look at the US Dollar Index, which I believe...

Australian Dollar (Aussie) and Kiwi Elliott Wave Analysis

The aussie dollar (AUD) and Kiwi dollar (NZD) decline on lockdowns and lower stock prices.

Could this be an A-B-C drop on a daily charts;...

Australian Dollar Decline A Bearish Sign For Commodities

When the Australian Dollar "moves", so do commodities. And this time the Australian Dollar "aussie" could be sending a bearish message to commodities.

Today's chart...

New Zealand Dollar (Kiwi) Currency Pairs Elliott Wave Analysis

The New Zealand Dollar currency is still navigating its way through some general weakness.

Today we look at Elliott wave analysis on some currency pairs...

$GBPUSD Elliott Wave Analysis Points To Reversal Higher Soon

The British Pound appears ready to strengthen versus the US Dollar soon, if this Elliott wave analysis plays out to forecast.

Following an A-B-C correction,...

Yen ETF (FXY) Nearing Reversal, Currency Set For Further Decline

If the U.S. dollar is poised to regain its upward trend, as we believe, it suggests a bearish trading outlook for the currency pairs...

Euro Currency Triggers Sell Signal On Momentum Reversal

Earlier this week, the U.S. Dollar Index (DXY) turned higher as indicators flashed bullish signals. And by mid-week, the Euro (EURUSD) has triggered sell...

New Zealand Dollar Approaching Bullish Elliott Wave Support

In this article, I look at New Zealand dollar which is in the process of making what appears to be a bullish retracement /...