The aussie dollar (AUD) and Kiwi dollar (NZD) decline on lockdowns and lower stock prices.

Could this be an A-B-C drop on a daily charts; correction? Let’s discuss the charts using Elliott wave analysis.

Australian dollar has been one of the weakest lately, and it’s probably due to lockdowns that has an impact on their economy. Not only AUD, even NZD got a hit now after New Zealand’s also stepped into lockdown and restrictions due to covid spread. These two currencies will have hard times to attract any buyers if stocks will trade below resistance.

As per Elliott Wave analysis, AUDUSD remains in a strong downtrend within wave 5) which is now eyeing lower prices at 0.71-0.70. Bears are very strong so it would be too soon to look for any bottom formation. Even if we are tracking a fifth wave here, you never know how extended fifth wave can be, so it’s important to be patient and wait on confirmation before turning to the other side of a trend. In our case we need five waves up back into a triangle area which is expected anyhow based on EW guidelines as move out of a triangles are final in a sequence. Keep in mind that on a higher degree chart pair is seen in wave C.

AUDUSD “daily” Elliott Wave Analysis Chart

AUDUSD “4-hour” Elliott Wave Analysis Chart

NZDUSD and S&P 500 Index

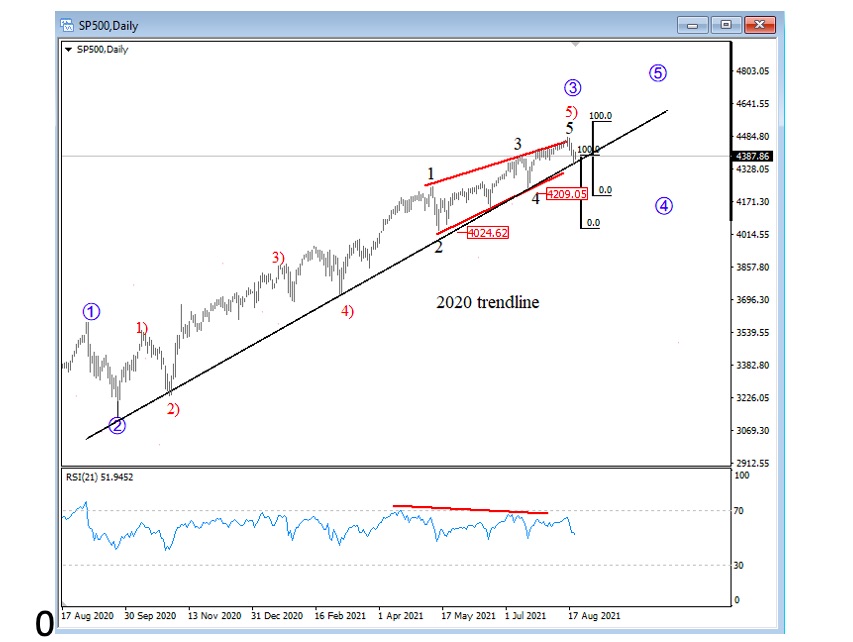

Pair is in corrective downtrend, now eyeing 2020 swing highs at 0.6787 potential support for current wave C) that can be final leg of a corrective set-back. Even lower, but also important support for current trend is at 0.6500, which seem to be far away, but can be valid projection level if SP500 would fall out of a wedge and break the 2020 trendline support

Twitter: @GregaHorvatFX

The authors may have a position in the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.