If the U.S. dollar is poised to regain its upward trend, as we believe, it suggests a bearish trading outlook for the currency pairs we follow. This article shows our Elliott wave forecast for the Invesco CurrencyShares Japanese Yen Trust, NYSEARCA: FXY during the next few years.

For traders working on multi-year time frames, traditional currencies can offer very profitable trending moves. Technical traders and especially Elliott wave analysts have an advantage here because we’re able to discover insights by charting both of the currencies in a pair to see how the structures and patterns in one currency play against the other.

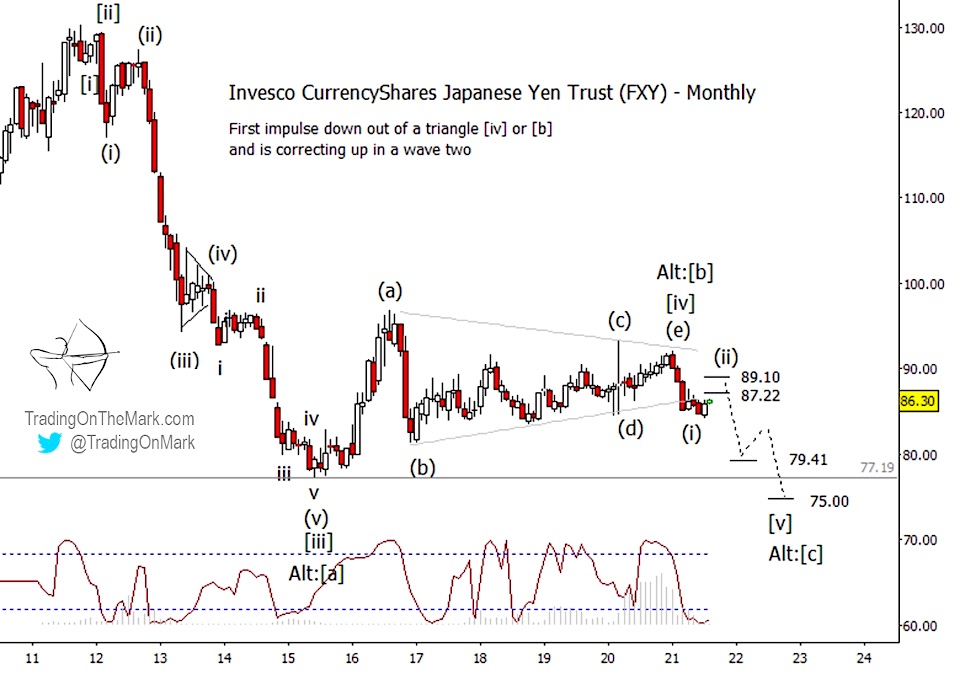

The most prominent “landmark” in the FXY chart during the past decade has been the decline from 2011 into 2015. The forceful, mostly non-overlapping move almost certainly represented an impulsive or five-wave structure, even though there is some ambiguity about whether the impulse started in October 2011 at the high or in February 2012 at the first lower high.

Regardless of how one counts the 2011-2015 decline, price action from 2015 until January 2021 appears to have been the corrective counterpart to the impulse – either wave [b] that follows downward wave [a], or wave [iv] following downward wave [iii]. After the correction, we would expect another downward impulse to test and push slightly beneath the 2015 low. In fact, the next downward impulsive wave [v] or [c] probably has already begun.A preliminary target for the decline awaits near 75.00, although higher resistance at 79.41 and the previous low at 77.19 might produce some bounces. FXY might reach those areas in 2022 or 2023.

Before FXY can test the 79.41 area though, it might first need to put in a small wave (ii) bounce. We have marked some resistance targets to watch at 87.22 and 89.10.

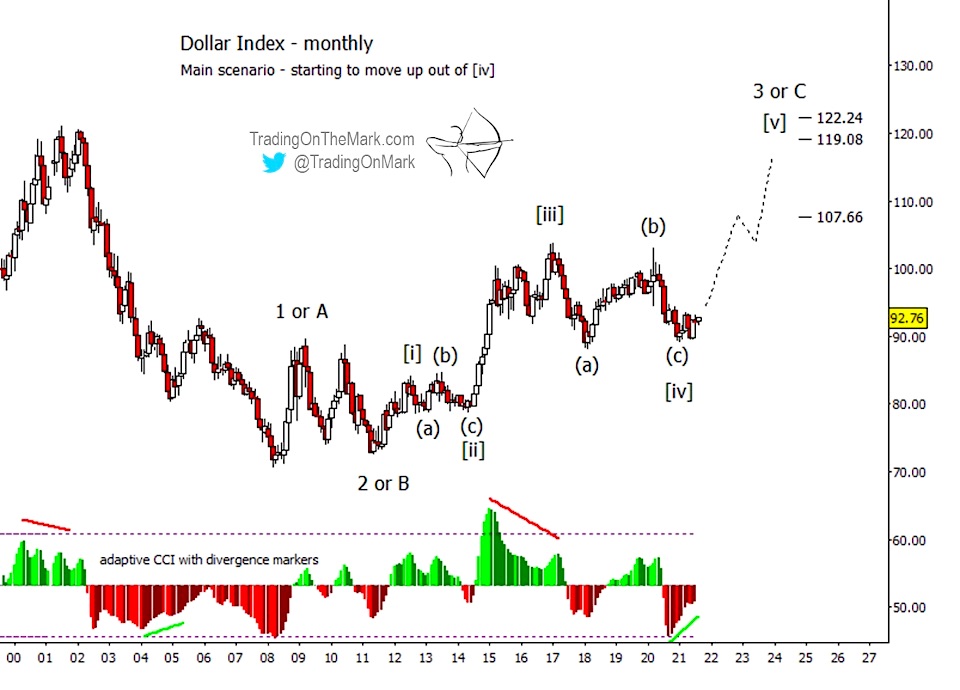

For context, we show the equivalent monthly chart for the U.S. Dollar Index below.

Just as we believe a downward impulsive move has begun in FXY from the January 2021 high, we also believe an upward impulsive move has begun in the Dollar. It may be possible to ride the upward Dollar trend or the corresponding downward moves in other currencies until 2023 or later.

Watch for our next post covering the Euro via its CurrencyShares ETF.

Trading On The Mark provides detailed, nuanced analysis for a wide range of markets including crude oil, the S&P 500, currencies, gold, and treasuries. Sign up for free market updates via our page on Substack and follow us on Twitter for more charts.

Twitter: @TradingOnMark

The authors may have a position in the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.