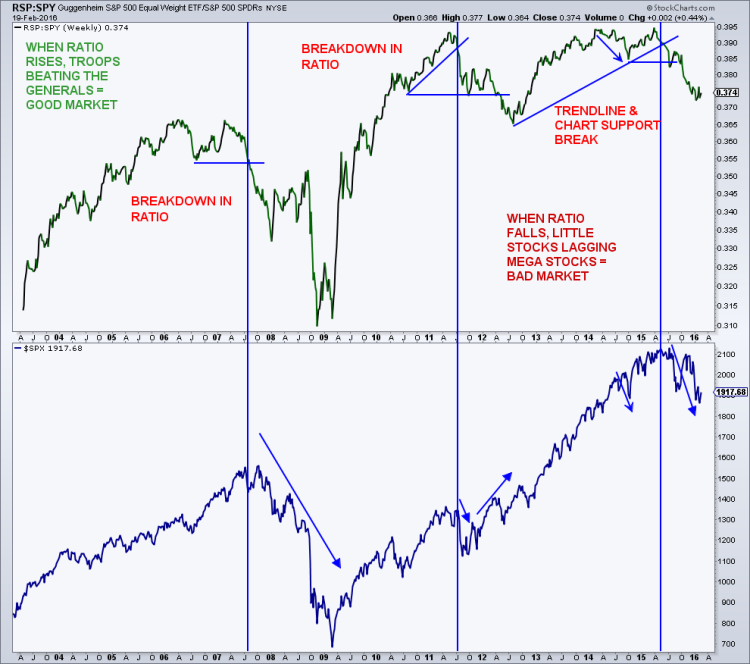

Since April of last year, the equal-weight S&P 500 has underperformed the S&P 500 and was a great leading indicator for the trouble we have seen in the overall market. The generals (mega caps) were moving forward as the troops (smaller stocks) were retreating. Sometimes the workers know more than the bosses. In many bull markets, the smaller stocks (higher beta names) will lead. In the past couple of months, the smaller guys look to be stabilizing, which is a potentially bullish sign. It is also a sign that the mega caps have been beaten down of late much more than the smaller issues. This is something to watch going forward as the past two bull markets (2003-2007 & 2009-2015) were led by the troops and not the generals.

Conclusion: The stock market is in the midst of a strong short- to intermediate-term counter trend rally (i.e. bear market rally) within the confines of a bear market. So, in the next month or two, the risk is likely to the upside. After that, we’ll see if the bear can finally seal the deal.

You can contact me at arbetermark@gmail.com for premium newsletter inquiries. Thanks for reading.

Read more from Mark: “What’s Next After Bulls Make Another Stand“

Twitter: @MarkArbeter

The author has a position in the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.