Stock Market Considerations For September 7, 2017

The S&P 500 (INDEXSP:.INX) continues to float higher but is subject to strong layered overhead resistance. What happens near 2470 on the futures market could be a tell. Below are futures trading levels for the S&P 500, Nasdaq, and Crude Oil.

Check out today’s economic calendar with a full rundown of releases. And note that the charts below are from our premium service and shared exclusively with See It Market readers.

S&P 500 Futures (ES)

Congested behavior. Earnings will begin shortly as we move into September. Support action holds at 2454 to 2451.5. Resistance action holds near 2470.5 today. The bullets below represent the likely shift of trading momentum at the positive or failed retests at the levels noted.

- Buying pressure intradaywill likely strengthen above a positive retest of 2470.5

- Sellingpressure intraday will likely strengthen with a failed retest of 2454

- Resistance sits near 2469.75 to 2471.5, with 2474.5 and 2478.5 above that.

- Support holds between 2451.5 and 2445.5, with 2439.5 and 2431.5 below that.

NASDAQ Futures (NQ)

Momentum is mixed with lower highs continuing. Range bound behavior between 5930.5 and 5966. The bullets below represent the likely shift of intraday trading momentum at the positive or failed tests at the levels noted.

- Buyingpressure intraday will likely strengthen with a positive retest of 5966

- Sellingpressure intraday will likely strengthen with a failed retest of 5930

- Resistance sits near 5963 to 5965.25, with 5973.25 and 5985.5 above that.

- Support holds between 5930.25 and 5917.5, with 5910 and 5891.5 below that.

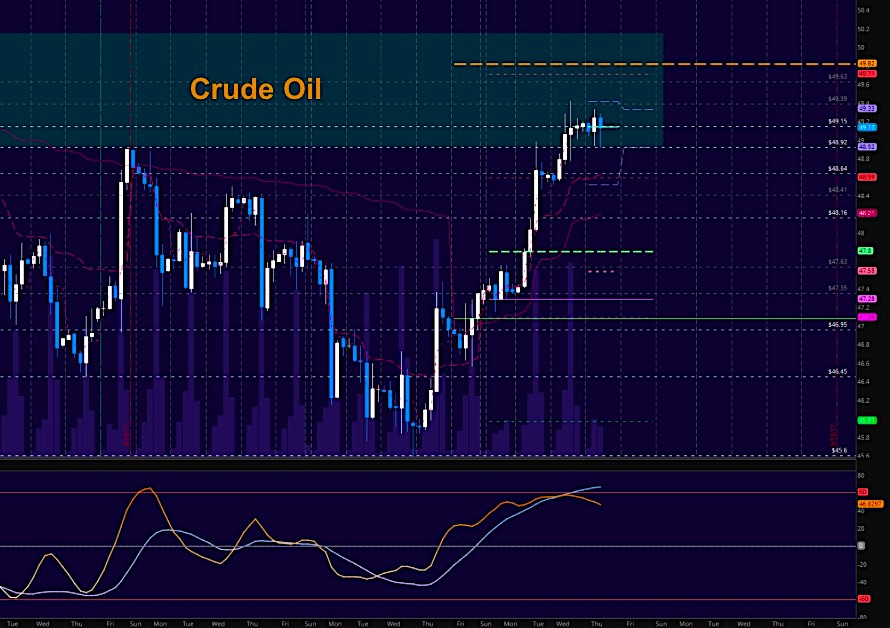

WTI Crude Oil

EIA today due to the holiday schedule. Resistance sits at 49.43 and 49.82. We sit above well above resistance at this time and momentum is mixed. Buyers will have the upper hand as long as we hold 48.4. The bullets below represent the likely shift of trading momentum at the positive or failed tests at the levels noted.

- Buyingpressure intraday will likely strengthen with a positive retest of 49.45

- Sellingpressure intraday will strengthen with a failed retest of 48.4

- Resistance sits near 49.39 to 49.63, with 49.71 and 49.99 above that.

- Support holds between 48.92 to 48.5, with 48.15 and 47.5 below that.

If you’re interested in the live trading room, it is now primarily stock market futures content, though we do track heavily traded stocks and their likely daily trajectories as well – we begin at 9am with a morning report and likely chart movements along with trade setups for the day.

As long as the trader keeps himself aware of support and resistance levels, risk can be very adequately managed to play in either direction as bottom picking remains a behavior pattern that is developing with value buyers and speculative traders.

Twitter: @AnneMarieTrades

The author trades stock market futures every day and may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.